The dollar is keeping weaker across the board so far today

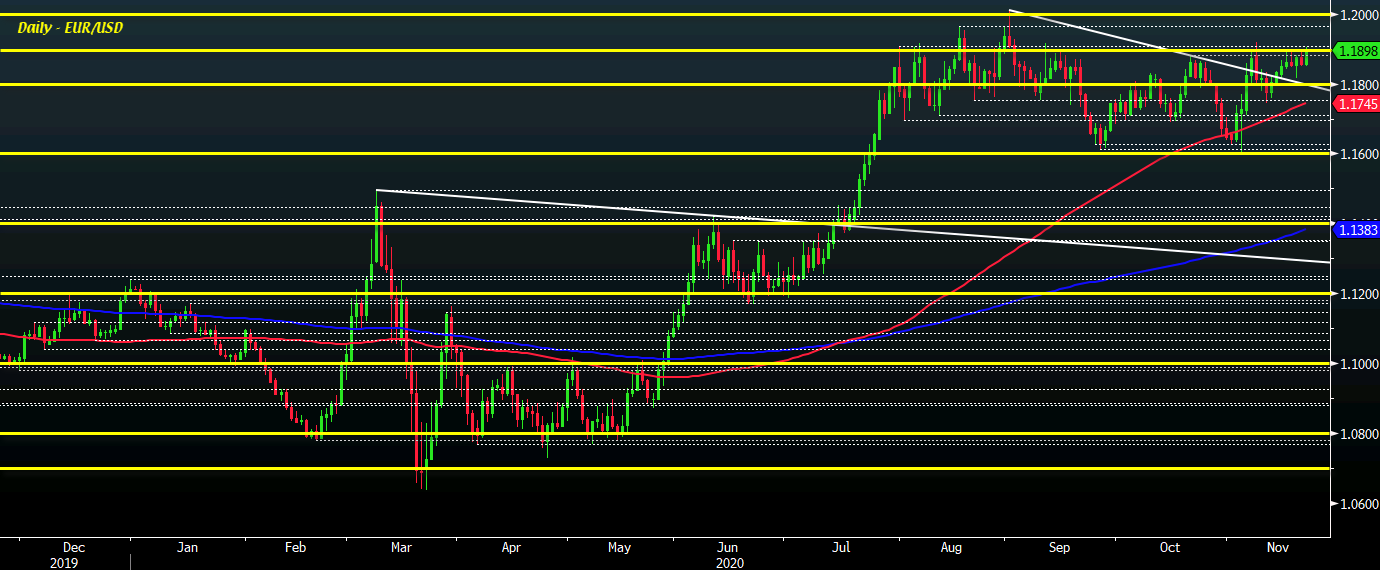

EUR/USD is once again testing the 1.1900 handle, reaching a high of 1.1906, as the dollar is seen weaker so far in European trading today.

Risk remains in a better spot with European equities posting a modest advance of around 0.5% to 0.7% currently while S&P 500 futures are also higher by 0.6%.

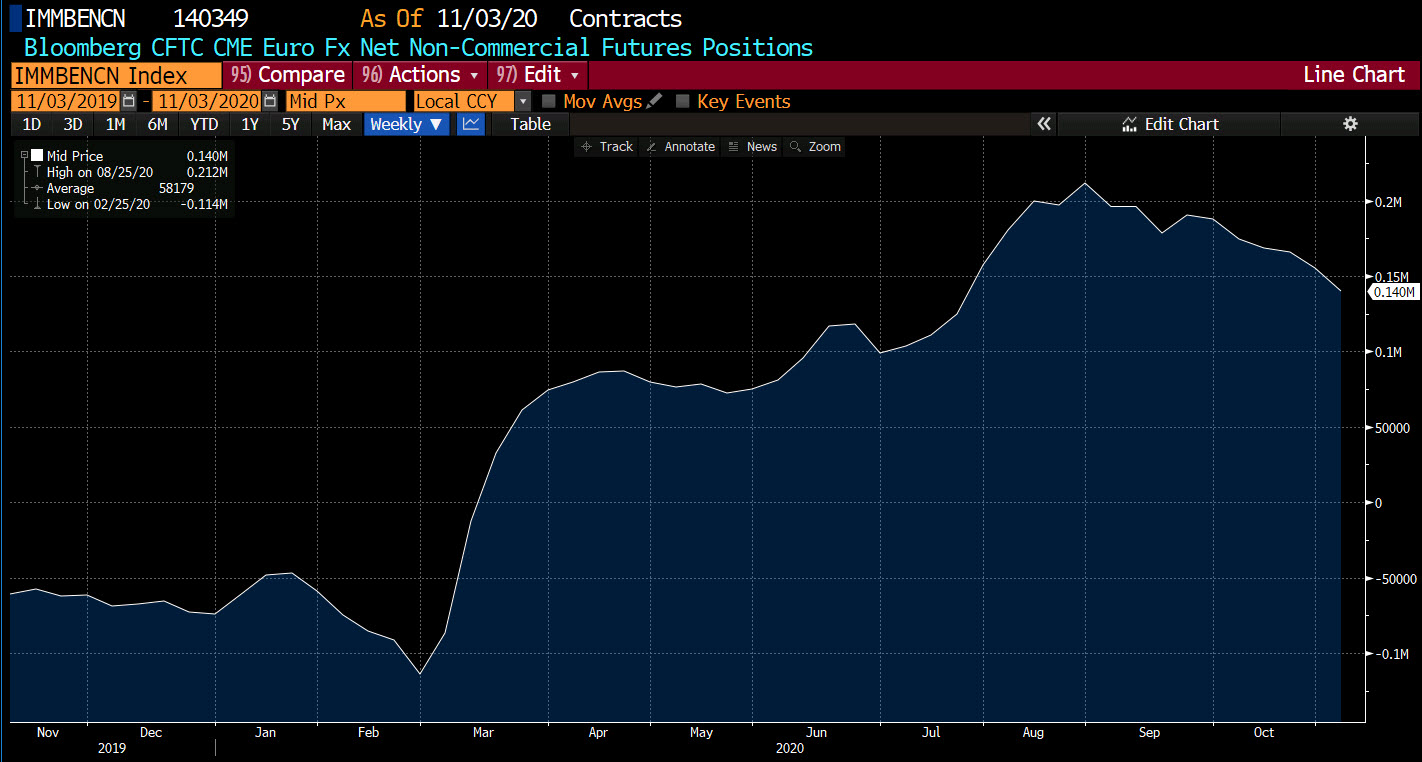

But the movement out of the dollar looks more flow-based than any reaction to risk, with the greenback sitting as the weakest performer among the major currencies.

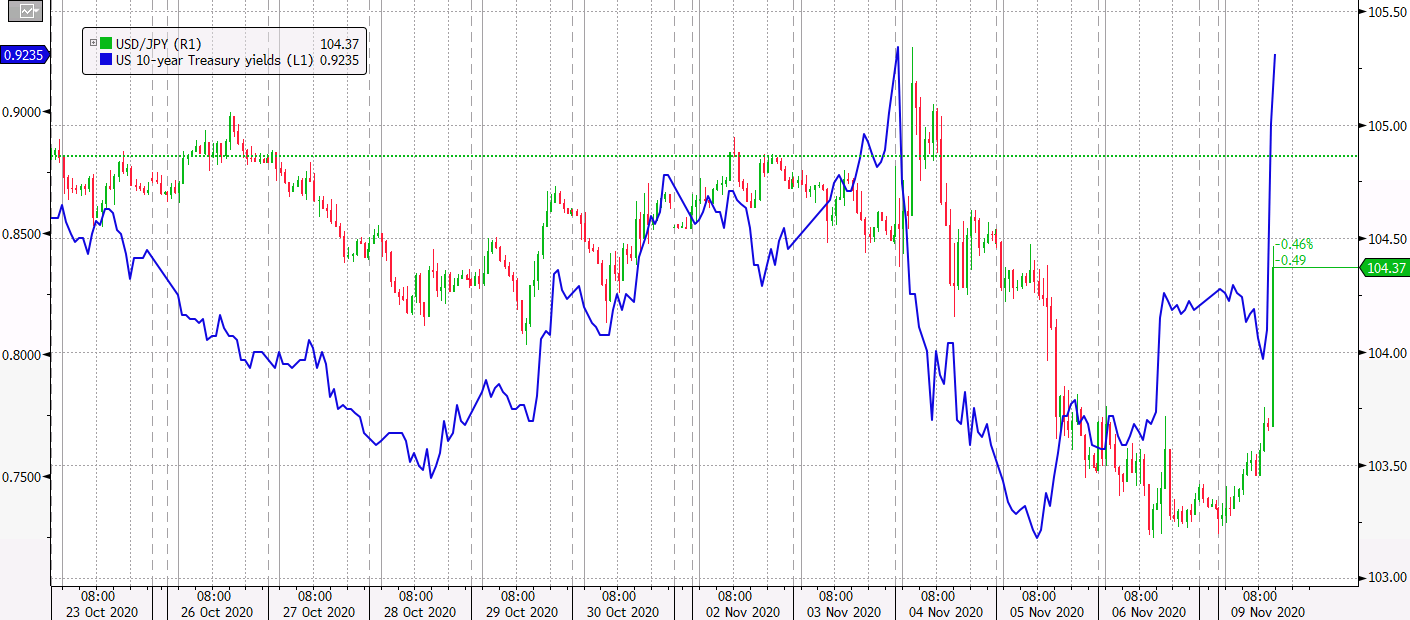

Even with 10-year Treasury yields up 2.5 bps to 0.849%, USD/JPY is down to 103.70.

Looking back to EUR/USD, buyers will have a key test ahead of the close today in trying to keep above the 1.1900 handle. The 9 November pop on the vaccine news saw the high touch 1.1920 and a push above that will start to bring 1.2000 back into the picture again.

Otherwise, a failure to hold another break above 1.1900 may lead to some exhaustion as the pair continues to consolidate just below that.

Elsewhere, AUD/USD is still settling around 0.7320-30 levels with short-term resistance at 0.7340 still holding. GBP/USD is off earlier highs of 1.3380 to sit around 1.3350-60 levels while NZD/USD is still flirting with a retest of the December 2018 high of 0.6969.