It has been a long and weary year with plenty of twists and turns along the way but here we are, wrapping up the final day of a historic 2020.

Everything that we knew about the year was completely eviscerated in the first three months and this was the year where humanity had to learn to adjust and live with a health crisis, which exacerbated the economic downtrends in recent years.

A new month, year, quarter, and decade dawns upon us so let’s take a look back at the year in FX and some of the hits and misses in trading this year.

The good

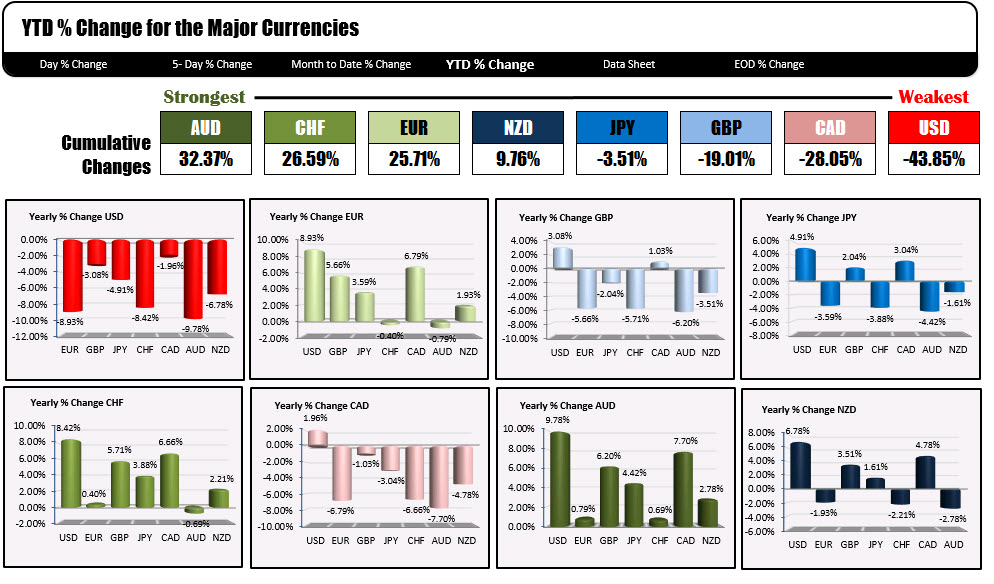

Among the top performers, the Australian dollar is a standout with nearly 10% gains against the dollar this year. The currency pair fell by more than 17% from 9 March to 19 March to the lows for the year, before posting a stunning recovery ever since.

The surge in iron ore prices has also underpinned the currency, which has largely ignored escalating tensions between Australia and China – as the risk rally stays the number one driver in the market to have bolstered commodity currencies this year.

As we look towards the year-end, AUD/USD is now rising past 0.7700 and trading to its highest levels since April 2018. The 0.8000 remains the next key upside target.

Besides the aussie, the euro also deserves a mention in this category as it put on a solid showing with near 10% gains against the dollar itself throughout the year.

The pair had a stunning rise in late February to early March as Treasury yields capitulated and resulted in dollar weakness for the most part, rising from 1.08 to 1.14.

But that all came crashing down as the peak of the virus crisis hit and the pair crumbled to the lows for the year just under 1.07.

Since then, the pair has generally been the go-to trade to short the dollar with the breakout in July towards 1.19 and then the early December break above 1.20 exemplifying the poor dollar performance in the second half of the year especially.

While euro fundamentals aren’t exactly perfect, it is hard to argue against the technical aspect of things with EUR/USD now having much room to roam around 1.20 to 1.25.

Adding to that is other major central banks also cowering and looking towards negative rates, in which the ECB has pretty much reached its limits on that front.

The bad

An easy mention in this category is the British pound. Amid the virus crisis exacerbating economic worries, the Brexit saga didn’t lend much help to the quid throughout the course of the year outside of GBP/USD – which owes to dollar weakness as well.

A double whammy of the virus crisis and Brexit took cable for a nosedive from 1.32 to near 1.14 – a drop of 14% – in the span of roughly two weeks.

But since then, the pair has put up a solid recovery, with the Brexit turmoil during September to October quickly brushed aside as the market bet that a deal will be struck.

Amid thin liquidity this week, cable is attempting a break above its recent highs of 1.3624 as price now trades to its highest levels since May 2018.

It remains to be seen if real money flows will stick with that next week but despite the relief from a Brexit trade deal, UK economic prospects continue to look dim and this will be more clearly reflected against other major currencies outside of the dollar.

The volatility in the currency amid the whole Brexit debacle is also worth mentioning, with price action pretty much dictated by media journalists and Twitter posts during key moments and that made it tough to read into the market at times.

A secondary mention in this category is the Canadian dollar. It wasn’t so much so the loonie’s fault but more so the capitulation in oil prices that proved to be a major drag for the currency – especially in Q1 trading.

Since then, the loonie has put a modest showing but gains aren’t anything that really stands out as the market kept the focus on more key currencies throughout the year.

That said, the descend in USD/CAD from 1.46 to 1.27 is keeping in tune with the dollar slide as of late and the break below 1.30 and the December 2019 low is putting sellers in a good spot as we look towards the new year.

The ugly

Among the major currencies, there’s only one real mention in this category and that is the US dollar. It has been a year where the greenback has turned from being the most sought after during the ‘sell everything, buy dollar’ response back in March, to ‘buy everything, sell dollar’ mode that we are getting into looking towards 2021.

A lot of this owes to the Fed’s response to the virus crisis and the introduction of swap lines helped to ease liquidity pressures on the dollar while the printing press working overtime pretty much gave the green light for risk assets to rally hard.

They pretty much turned the market narrative, leaving investors and traders to put aside the question of “what about the economy?” to stick with “who cares about the economy?”. And that is arguably the key takeaway in the market in trading this year.

Among other mentions in this category is the Turkish lira, Brazilian real, and Argentinian peso. The former had to deal with central bank and political instability, not helped by dwindling FX reserves as well as a rush to the exits in Turkish bonds and stocks.

Meanwhile, the latter two declined by more than 20% against the greenback this year with Brazil arguably having a poor response to the virus crisis while the ARS, well, continues to just be the ARS as tough capital controls continue to spark plenty of demand for the dollar in the black market amid widespread angst about devaluation.

Special mentions

The king of the G10 space this year deserves a mention in this spot. With gains of over 14% against the dollar, the Swedish krona takes the crown, benefitting from a different approach from the Riksbank and the government in dealing with the virus crisis.

There was no draconian lockdown by Sweden when dealing with the health crisis and while that is still up for debate, the Riksbank stayed away from tweaking its benchmark interest rate (0%) while only making minor changes to its lending rate to stimulate the economy.

While not really FX per se, there are two other assets in the market deserve a mention for 2020 as well in my view. The first being silver, which has been among the standout performers this year in the commodities space.

Although iron ore pipped silver in terms of year-to-date gains, the gains in silver this year has been nothing short of stunning with over 48% gains – nearly doubling that of gold throughout the course of the year.

Gold on its own is also set for its biggest jump in almost a decade, so its supposedly “poor cousin” has certainly had a magnificent 2020 all things considered.

:max_bytes(150000):strip_icc()/GettyImages-483658563-fbe002bf7f6d467a94d87cd153ddfa73.jpg)

:max_bytes(150000):strip_icc()/GettyImages-483658563-fbe002bf7f6d467a94d87cd153ddfa73.jpg)