To read more enter password and Unlock more engaging content

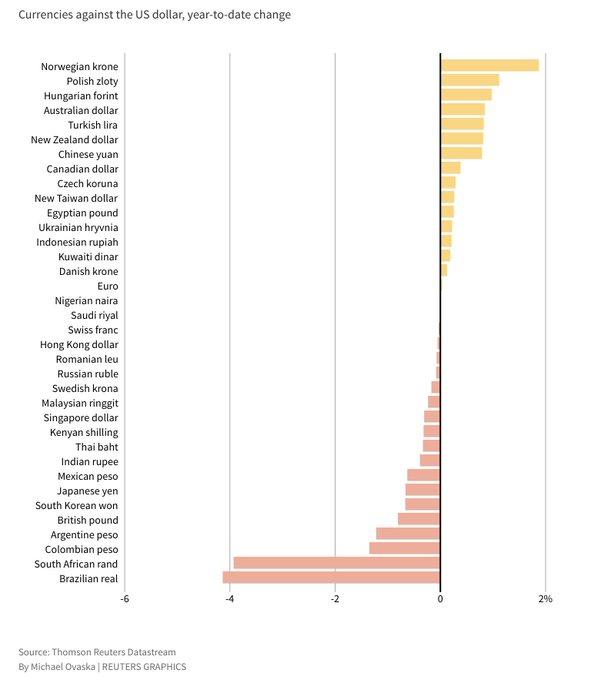

Image source: PixaHive2020 has been a highly volatile year for the major international currencies, as international trade and supply chain disruptions combined with mixed investor sentiment led to extensive fluctuations.As an aftermath of the pandemic, the world’s reserve currency the U.S. dollar (USD), has declined steeply throughout the past year, making it the worst-performing currency among the G10 currencies.This is reflected in the US Dollar Index’s 7.53% decline over the past year. The Indian Rupee (INR) did not fare any better, as it was the worst-performing currency in the Asian subcontinent over the past year.

Image source: PixaHive2020 has been a highly volatile year for the major international currencies, as international trade and supply chain disruptions combined with mixed investor sentiment led to extensive fluctuations.As an aftermath of the pandemic, the world’s reserve currency the U.S. dollar (USD), has declined steeply throughout the past year, making it the worst-performing currency among the G10 currencies.This is reflected in the US Dollar Index’s 7.53% decline over the past year. The Indian Rupee (INR) did not fare any better, as it was the worst-performing currency in the Asian subcontinent over the past year.