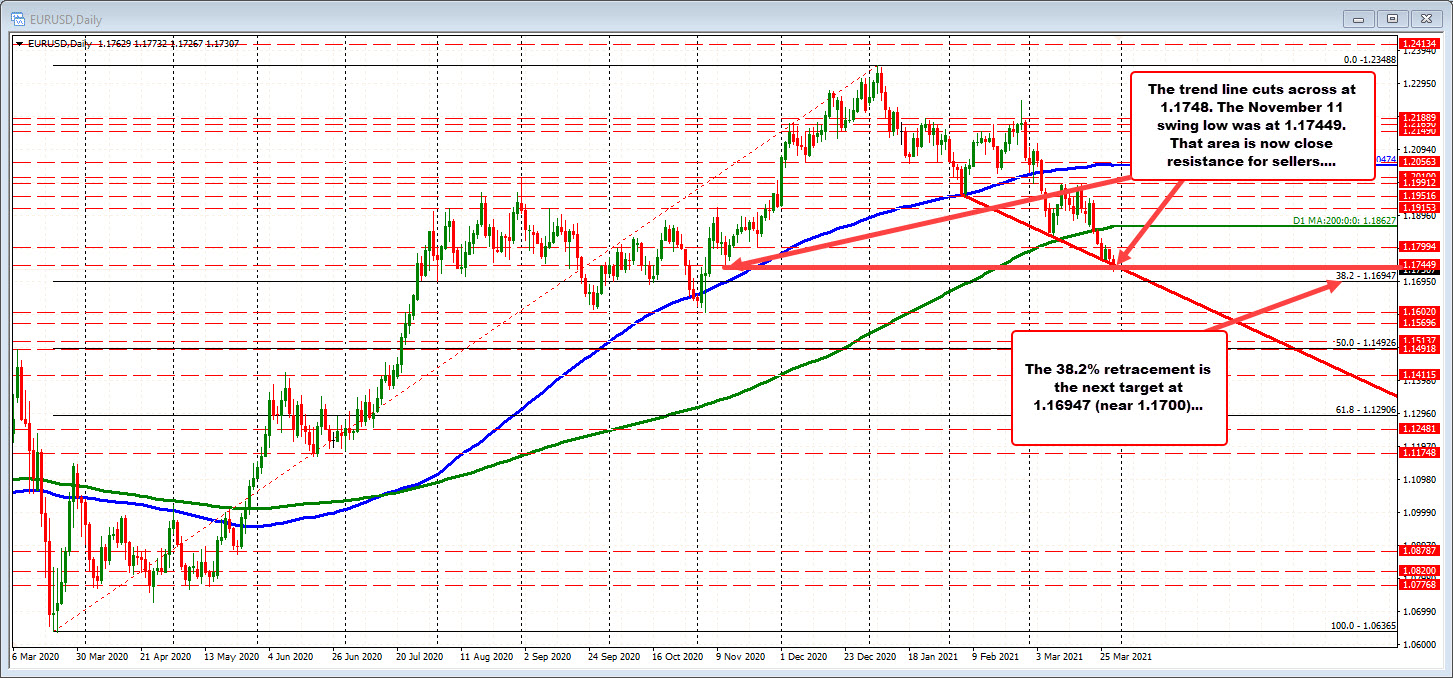

Falls below daily trend line.

The EURUSD has continued its move lower after a choppy but lower session on Monday. The pair is working on its 5 day down in 6 and in the process, has moved to a new low for the month and trades at the lowest level since November 4, 2020.

Looking at the daily chart above, the pair cracked below a lower trend line cutting across at 1.1748 today. That is near the swing low from November 11 at 1.17449. That area is now close risk for sellers looking for more downside. Stay below the break, keeps the sellers in control. The next target on the daily is the 38.2% of teh move up from the March 2020 low which comes in at 1.16947 (around the 1.1700 level). The currently price is at 1.1730 – just off the low for the day at 1.1728.

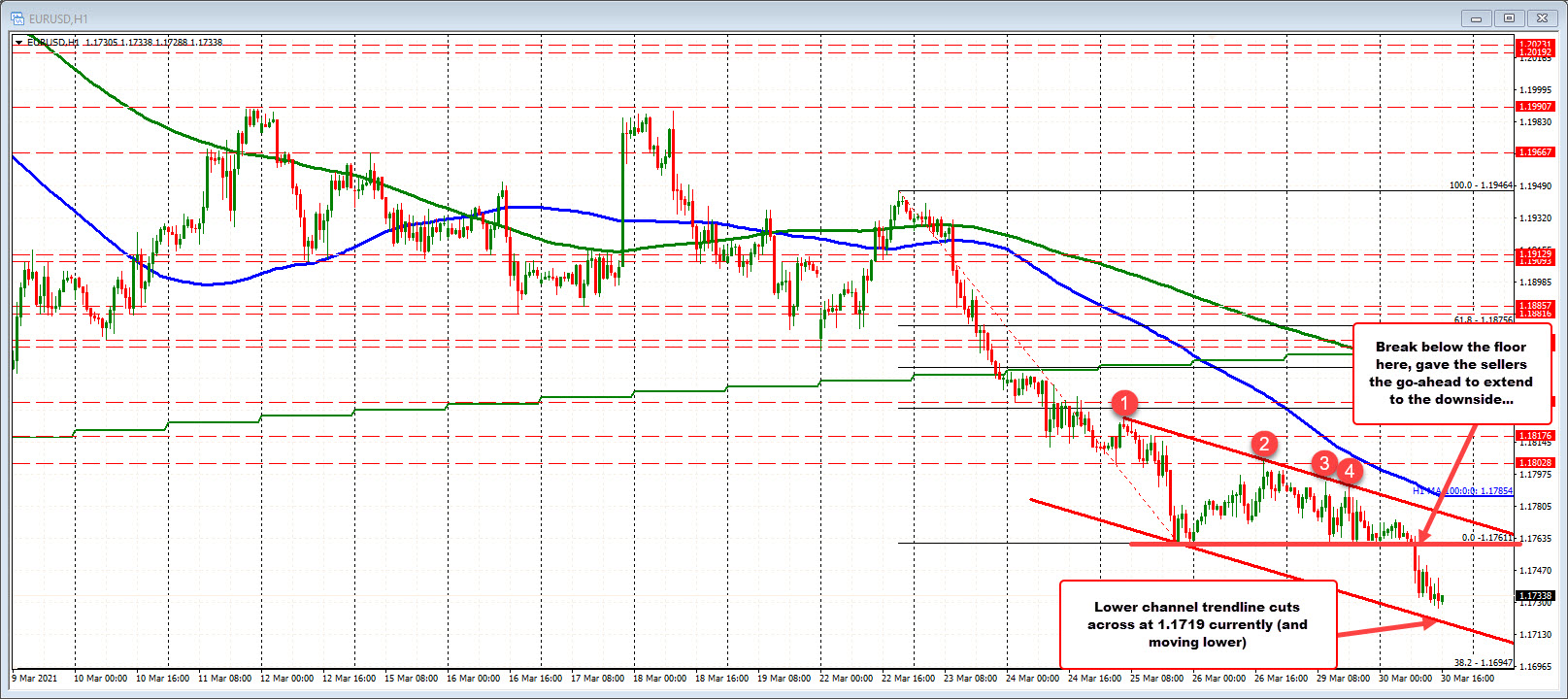

Drilling to the hourly chart below, the pair stalled the rallies yesterday near a topside trendline. The parallel channel trendline on the downside target 1.1719 currently (and moving lower). A move below would have traders targeting the 1.16947 retracement on the daily (with 1.1700 a natural support target as well).

In addition to the resistance on the daily chart at 1.1745-48 area, the EURUSD fell below a floor on the hourly at 1.1761 area. That too will be eyed now as resistance (and a bias level) that would keep the sellers in control.

:max_bytes(150000):strip_icc()/GettyImages-483658563-fbe002bf7f6d467a94d87cd153ddfa73.jpg)

:max_bytes(150000):strip_icc()/GettyImages-483658563-fbe002bf7f6d467a94d87cd153ddfa73.jpg)

A world focused on US recovery:Rising US 10 year yields – rising dollar

Falling US 10 year yields – falling dollar

A world focused on US recovery:Rising US 10 year yields – rising dollar

Falling US 10 year yields – falling dollar Hope this helps to see what is driving the USD and when.

Hope this helps to see what is driving the USD and when.