Archives of “Forex” category

rssCFTC commitments of traders: USD shorts increase led by CAD longs

Weekly forex futures positioning data from the CFTC for the week ending May 11, 2021.

- EUR long 94K vs 85K long last week. Longs increased by 9K

- GBP long 28K vs 20K long last week. Longs increased by 8K

- JPY short 42K vs 41K short last week. Shorts increased by 1K

- CHF short 3K vs 0K short last week. Shorts increased by 3K

- AUD long 2K vs 1K long last week. Longs increased by 1K

- NZD long 9K vs 9K long last week. Longs unchanged

- CAD long 39K vs 26K long last week. Longs increased by 13K

Highlights:

- CAD longs continue to get larger and is now the 3rd largest position

- EUR longs have moved higher for 2 consecutive week

- CHF went from square to modestly short (by 3K)

- GBP longs increased

- A net change of +27K in currencies or -27K USD

US dollar continues higher as risk assets wilt on inflation fears

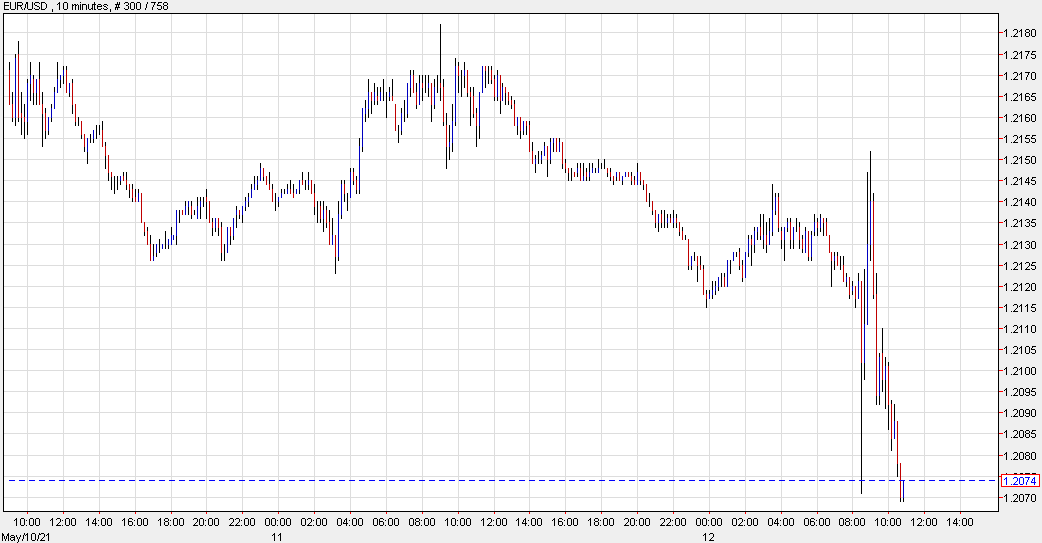

EUR/USD falls to the lows of the day

The US dollar is near the best levels of the day as it resolves higher on falling US equities and rising Treasury yields.

Today’s CPI report was a shocker and it puts the potential for a premature taper back on the table. Initially the dollar strengthened and then it reversed lower. Now it’s climbing again and at the best levels of the day against most counterparts. Some of that is risk aversion with the Nasdaq nearly 2% lower and S&P 500 down 50 points to 4101.

The transitory inflation debate is the main event in markets for the rest of the year. The period before now was pre-game hype. Everyone expected inflation to come out swinging but it landed an absolute haymaker in the 1st round.

DOLLAR: if you’ve had the Dollar right, you’ve had both Commodities & Inflation right

United States CIRCULATED CURRENCY & CRYPTO

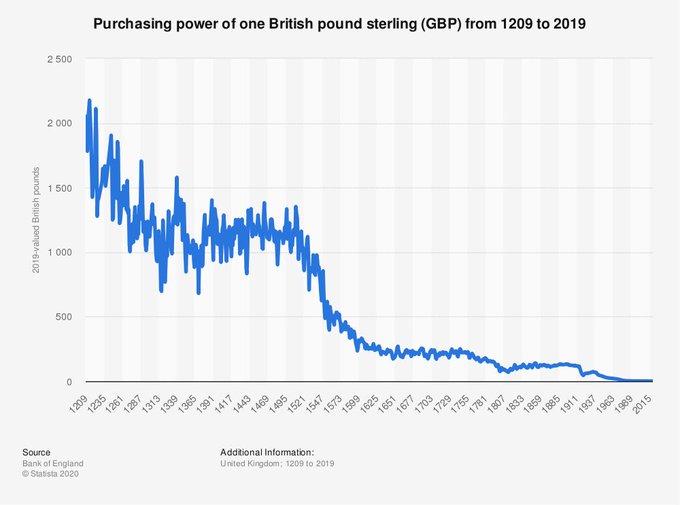

Purchasing power of 1 pound sterling.

CFTC commitments of traders: The loonie longs increased by 10K in the current week

Weekly forex futures positioning data from the CFTC for the week ending May 4, 2021

- EUR long 85K vs 81K long last week. Longs increased by 4K

- GBP long 20K vs 29K long last week. Longs trimmed by 9K

- JPY short 41K vs 49K short last week. Shorts trimmed by 8K

- CHF square vs 1K short last week. Shorts decreased by 1K

- AUD long 1K vs 1K short last week. Longs increased by 2K

- NZD long 9K vs 7K long last week. Longs increased by 2K

- CAD long 26K vs 16K long last week. Longs increased by 10K

Highlights:

- The CAD longs increased by 10K as the loonie moves to new highs going back to 2017.

- The largest position remains the largest of the positions.

- The JPY is the largest and only short but it’s position was trimmed by 8K this week.

- The CHF and AUD are near square.

CNH – offshore yuan at its strongest since late February

There is no stopping the yuan, the PBOC set the reference rate for onshore (CNY) stronger again today.

CNH is gaining further during Friday trade hitting his (ie lows for USD/CNH) not seen since late Feb. USD softness is one factor, the Fed continues to insist it will not be tightening for a good while to come (despite some concerns raised in its stability report out earlier in this season)

USD/CNH:

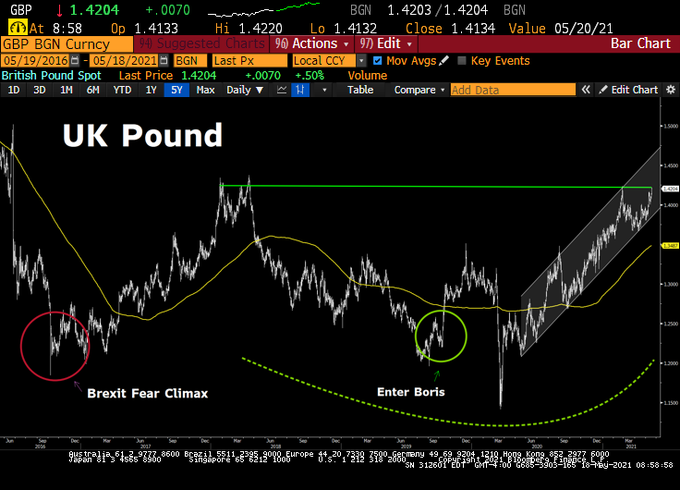

Sterling faces a double combo of risks today

The BOE and UK local elections are the two event risks to watch

The BOE could make an announcement to taper QE purchases later in the day, though there is some expectation that they may put that off until June or perhaps even August. That said, they could still tee that up with a more hawkish tone this time around.

Meanwhile, the area to watch in the UK local elections is in Scotland and whether Nicola Sturgeon’s SNP will be able to garner a majority to potentially push forward with the agenda of a second Scottish independence referendum.

The main risk for the pound is if the BOE turns out more dovish than expected and fails to tick the boxes in terms of setting up expectations of a taper to follow and the SNP winning a majority in the local elections.

That said, I would expect dips to be bought with worries on the Scottish independence referendum likely to be phased out over time while the market continues to keep a firm focus on the more structural undertones in the pound.

The BOE may put off any taper or tightening talk this month but will inevitably have to address that by August at the latest as the economy reopens in a more meaningful way.

AUD took a hit lower on China suspending its Strategic economic dialogue with Australia

Australia has been calling out China on its human rights abuses.

China has taken a petty revenge today with:

- China’s state planner will suspend China-Australia economic dialogue

The Australian dollar took an immediate hit lower, China is a huge export destination for Australia’s iron ore:

As a bit of an explanation, the Strategic economic dialogue with China is aimed at strengthening Australia’s economic and trade relationship with Chin:

- growing trade and investment with China

- opportunities for Australian and Chinese businesses to cooperate

- further increasing trade and investment with China will drive economic growth in both countires

China’s NDRC (the CCP state planner) has thrown this away for political recrimination reasons.