US dollar moves higher after Fed minutes

The USD has broken to new highs after the Fed minutes suggested might be time to think about tapering.

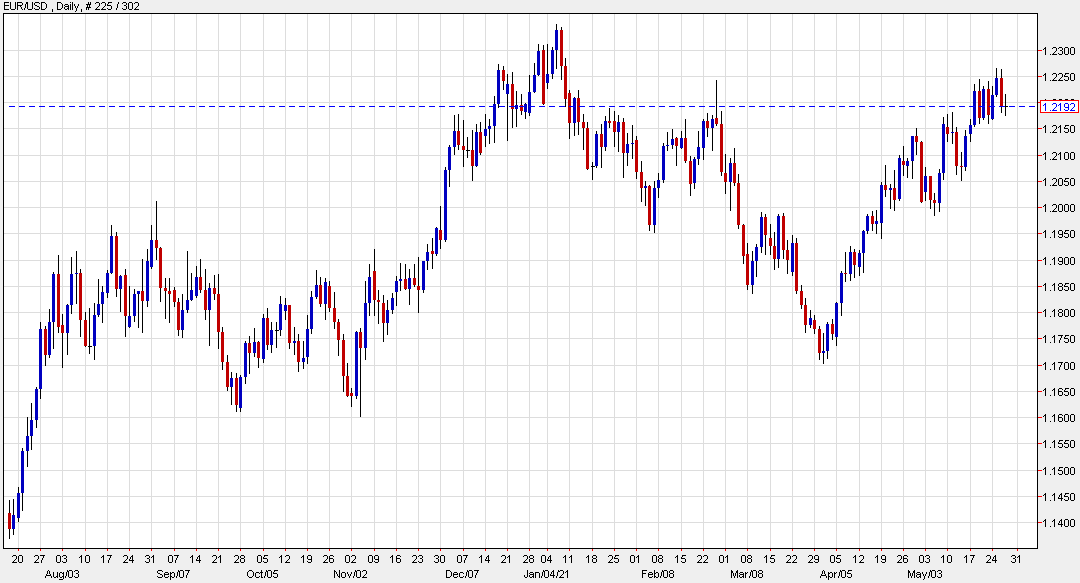

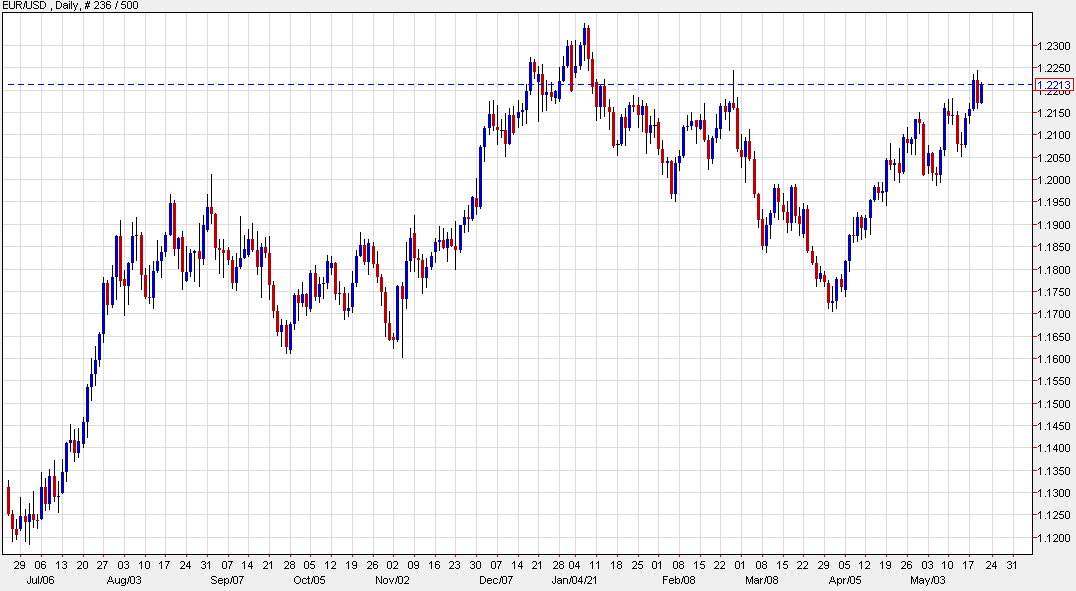

EURUSD: The EURUSD has moved to an through (at least temporarily), the swing highs from May 10 and May 11 between 1.2175 and 1.2181. THe pair has fallen short of the 38.2% retracement of the move up from last week’s low at 1.21707 and the 100 hour moving average of 1.21605. Getting below each of those would increase the bearish bias. The 200 hour moving average comes in at 1.2145 currently. That would also be a level that if broken would increase the bearish bias.

GBPUSD. The GBPUSD as just broken below its 100 hour moving average of 1.41254 and looks to test its 200 hour moving average 1.41051. The low price just reached 1.41076 and trades between the moving averages (currently at 1.4117).

USDJPY: THe USDJPY his moving above its 200 hour moving average of 109.074 and its 100 hour moving average of 109.182 . The current price trades at 109.253 . Stay above each of those moving averages keeps the bias more in the bullish direction.

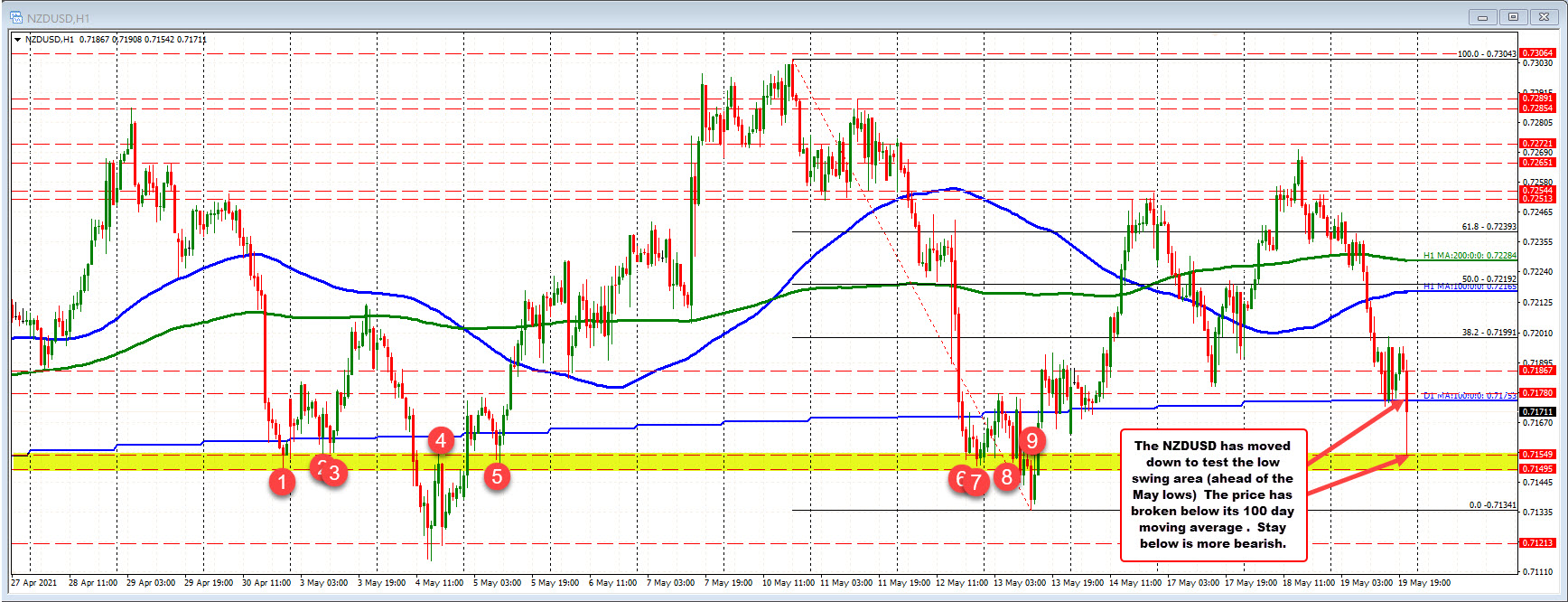

NZDUSD: The NZDUSD has moved below its 100 day moving average at 0.71753 and traded to a low price of 0.7154. Stay below the 100 day moving average keeps appears more control. ON the downside, the 0.71495 to 0.71549 is a swing low support area (see yellow area and red numbered circles in the chart below).