Archives of “Forex” category

rssEuro edges to a new session low, down 50 pips

EUR/USD at the lows of the day

EUR/USD continues to drift lower as the US dollar holds a big bid to start the month. The pair is down 47 pips to 1.1814, which is just off last week’s low of 1.1807. That will act as support for now.

The fall in sovereign yields isn’t just a US story. German bund yields are down 6 bps to -0.268% and nearing the June low.

The divergence between the inflation talk throughout markets and falling bond yields is stark. It’s tough to bet against the bond market but what makes me pause is that if inflation doesn’t come, then it will simply be a green light for governments to spend more. I don’t see that paradigm changing until there is some real inflation.

US 10-year yields near the June spike low

US 10-year yields could hit the lowest levels since February

Is there a new-quarter repositioning ongoing?

US 10-year yields are nosediving today, falling 6.7 bps to 1.365%, which is just above the short-lived spike lower following the Fed.

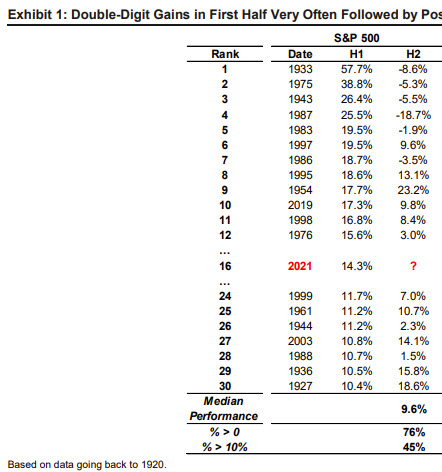

An optimist might think this is money flowing into fixed income at the start of the quarter after a good run in equities to start the year. That might be a mistake with Scotia data showing that a gain of around the 14.3% climb in H1 tends to follow through into H2.

A more pessimistic view — which is hard to ignore — is that the market is losing faith in the Fed’s willingness to run the economy hot and/or the Federal government’s ability to pass infrastructure stimulus and keep spending high.

Another view is that the deflationary dynamics of aging, technology and globalization will overwhelm any policy response.

Those are all big questions but for now the bigger one is whether 1.354% will hold.

Forex Update : #USD #EURO #JPY #GBP #CAD #AUD #MexicanPeso #YUAN #INR – #AnirudhSethi

/GettyImages-483658563-fbe002bf7f6d467a94d87cd153ddfa73.jpg)

To read more enter password and Unlock more engaging content

Dollar now falls to the lowest level of the day vs the EUR

New highs for the EURUSD

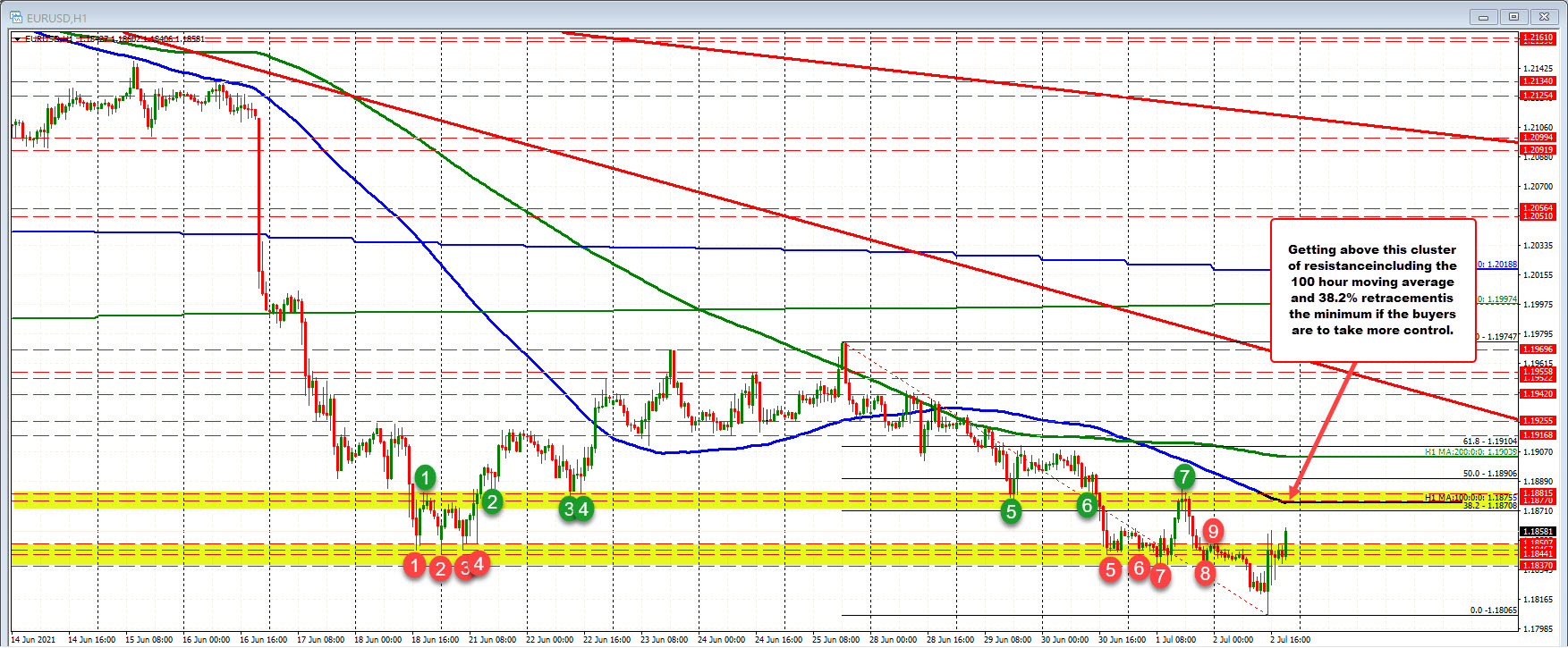

The EUR lagged other currencies in making new lows vs the USD, but the EURUSD has just moved to a new high (new dollar low). The pair traded to a new high of 1.18602, taking out the earlier high at 1.18588.

The next targets comes against the

- 38.2% retracement of the move down from last Friday’s high. That comes in at 1.18708.

- The falling 100 hour moving average is at 1.18755.

- A swing area comes in between 1.1877 and 1.18815 (see green numbered circles and upper yellow area).

If the buyers are to assume more control, getting above those resistance levels are the minimum requirements. Falling short of those levels, and the corrective move higher is a plain-vanilla correction.

A move above that upper cluster of resistance would then look to tackle the 200 hour moving average at 1.19039.

EUR/USD continues to flirt with drop below post-FOMC low

EUR/USD down slightly to 1.1839

The technical picture will be a key consideration going into the payrolls release later today with EUR/USD flirting with a drop below the 18 June low @ 1.1847 as the low today touches 1.1839, with sellers continuing to eye a break towards the 1.1800 level.

The dollar seems to be adamant in holding firmer ground ahead of the jobs report later but keep in mind that there will be large chunks of expiries in EUR/USD from 1.1820 through to 1.1915 and that could keep things more sticky just above 1.1800.

In terms of sentiment, a lot will depend on what the jobs report offers later in the day so while sellers are testing the boundaries for now, it isn’t a given just yet.

Dollar a touch firmer as the session gets underway

The bid in the greenback this week has been unrelenting

The dollar is stretching gains across the board now as the narrow ranges are starting to expand in early European morning trade.

EUR/USD is down to 1.1827 with sellers eyeing 1.1800 next while GBP/USD has eased to 1.3745 as the drop below 1.3800 gathers further momentum for now.

Elsewhere, AUD/USD is tracking to fresh lows since December last year with support at 0.7462 starting to give way to a potential drop towards 0.7400 next:

USD/JPY makes a new high (compared with US trade) – highest since March of 2020

- Global growth is bouncing back.

- The Federal Reserve is inching closer to less loose policy.

- The BOJ inflation target is … nowhere in sight.

Who would want to buy a safe haven, yen especially?

AUDUSD trades to a new 2021 low

AUDUSD traded lowest level since December 2020

The AUDUSD is traded to a new session low and in the process is trading to a new low for 2021 and new low going back to December 21, 2020.

The price has cracked through the June 18/June 21 lows down to 0.7476. That level is now a close intraday risk level for sellers. Stay below keeps the sellers firmly in control intraday.

Looking at the daily chart below, the deeds 21 low comes in at 0.7461. Move below that level and traders would be targeting down toward the 0.7400 level and the 61.8% retracement of the move up from the November 2020 low at 0.73784.

EURUSD, USDJPY, and USDCHF trade to new extremes for the day

USD moves higher vs those pairs

The USD has moved to new session highs vs the EUR, JPY and CHF.

EURUSD: The EURUSD finally showed some additional downside momentum and has increased the day’s trading range in the process, the range is up to a more respectable 53 pips (was only 26 pips at the start of the NY session). The average over the last 22 trading days (about a month of trading), is 65 pips. The low has reached 1.18552 so far. The swing lows from June 18 to June 21 come between 1.18452 to 1.18507.