Archives of “Forex” category

rssThe US dollar ends the week stronger against most of the other G10 currencies. Fed policy may be dovish, but others are even worse.

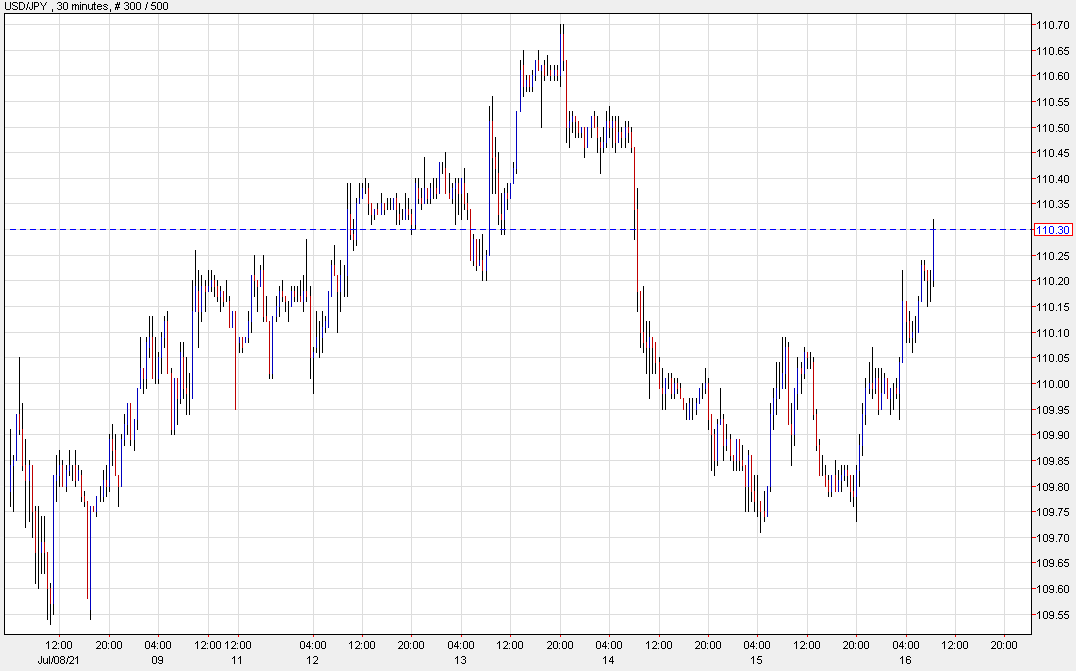

USD/JPY climbs after retail sales

USD/JPY chews into the drop

The market reaction to today’s strong US retail sales numbers was modest but USD/JPY has been a winner as yields tick up, particularly in the belly of the curve.

There’s a double bottom on this chart at 109.75 with a measured target close to 110.50 as the pair attempts to fill in the gap.

USD/JPY keeps on the defensive amid lower yields

USD/JPY down 0.2% at 109.75

With Treasury yields keeping lower on the day, it is seeing the yen hold firmer ground so far in European morning trade as USD/JPY keeps below 110.00.

The low today hit 109.72 and that nears a test of daily support from the 21 June low @ 109.71. That will be a key level to watch ahead of the close before the 50.0 retracement level @ 109.57 comes into play again – as we saw last week.

There hasn’t been a coherent theme in the market in trading this week with equities and bond yields bouncing higher earlier only to see a retreat over the past day or so.

In particular, 10-year yields have come off the high around 1.42% on Tuesday to fall just below 1.32% currently in European morning trade today.

Going back to USD/JPY, as price action continues to tussle around this area, the 100-day moving average (red line) – now seen @ 109.35 – will also draw closer and may play a key technical role in dictating which direction the pair moves next.

Tomorrow’s US retail sales data may be a catalyst for a move so just be wary of that.

BOC tapers, Powell preaches patience

Markets:

- Gold up $19 to $1827

- US 10-year yields down 6.6 bps to 1.349%

- WTI crude down $2.52 to $72.73

- S&P 500 up 5 points to 4374

- NZD leads, USD lags

It was a packed day of news but it didn’t translate into a straight-forward day of trading. No single theme or news item captured the market’s imagination. Early on, Powell’s words boosted the risk trade and weighed on the dollar but that faded later.

In Canadian dollar trading, the market clearly wanted more in terms of tapering or positioning the BOC for earlier rate hikes but it didn’t come. Macklem stressed higher confidence in the recovery and bumped up growth forecasts but the timeline on the output gap closing stayed in H2 and the loonie fell. Sinking oil prices after looser US inventory data also didn’t help.

USD/JPY was weighed down as the bond market came back to life. Yields were persistently pressured, perhaps with the Democrat’s infrastructure plan to be paid for. Powell’s lack of urgency on inflation was another culprit.

The antipodeans managed to hold onto earlier bids after the RBNZ taper surprise. Aside from oil, commodities were solid.

The euro staged somewhat of a recovery after yesterday’s rout. That’s the name of the game at the moment with few lasting trends as we sort through the summer doldrums.

Cable down to session lows as the dollar holds firmer on the day

GBP/USD down 50 pips to 1.3849 currently

The pair had a great showing on Friday, erasing the week’s losses altogether in a push to the week’s high of 1.3900 at the time. The opening levels today stuck there but there has been a steady retreat since – more so as European traders entered.

The technical picture shows a rejection of 1.3900 and the 61.8 retracement level @ 1.3898, but it also comes as the dollar is holding firmer across the board, extending gains. USD/CAD is up 0.5% to 1.2505 now while NZD/USD has dropped 0.6% to 0.6950.

Going back to cable, there isn’t much support until the confluence of the key hourly moving averages @ 1.3815-16 and then the 1.3731-50 region thereafter.

Or perhaps this is the pound suffering a bit of a post-Euros hangover after the penalty shootout defeat to Italy yesterday. ¯\_(ツ)_/¯

PBOC sets USD/ CNY reference rate for today at 6.4785 (vs. Friday at 6.4755)

The People’s Bank of China set the onshore yuan (CNY) reference rate for the trading session ahead.

- USD/CNY is permitted to trade plus or minus 2% from this daily reference rate.

- CNH is the offshore yuan. USD/CNH has no restrictions on its trading range.

- The previous close was 6.4791

- Reuters surveyed estimate was 6.4739 (A rate that’s significantly stronger or weaker than expected is typically considered a signal from the PBOC).

PBOC injects 10bn yuan via 7-day reverse repos

- 10bn RRs mature today

- thus a net natural day for open market operations

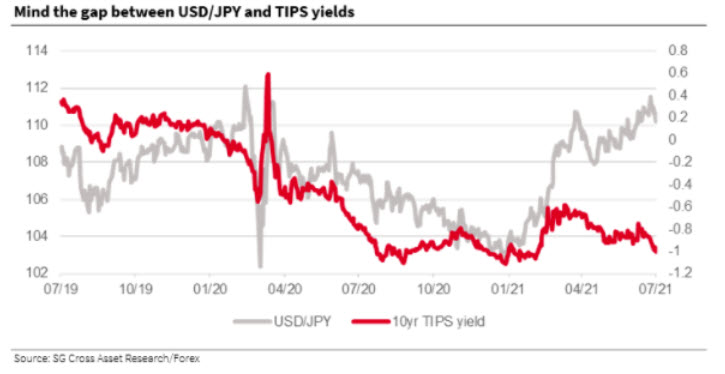

It’s unlikely that USD/JPY move lower is a false dawn – SocGen

USD/JPY down 84 pips to 109.81 today

Societe Generale Research discusses the ongoing move lower in USD/JPY.

“The yen is, after a period of ignoring the fall in US real yields, coming home to them with a bang. The chart shows 10yr TIPS and USD/JPY, which has been very hard to understand since mid-April. Q3 is starting on a much sounder footing. The caveat is that the fall in longer-dated US yields at the start of April saw USD/JPY fall from 111 to 107.50, before the largely unintelligible rally back to 111.60,’ SocGen notes.

“This could be a false dawn especially if TIPS yields turn higher and market volatility leaches away again. But that’s unlikely with Covid concerns, more volatile oil prices, a debate about growth peaking, and with central bank policies diverging,” SocGen adds.

8 reasons to stay bullish targeting 112.20 ahead of 114 – BofA

Bank of America on USD/JPY

Bank of America Global Research outlines 8 reasons for maintaining a bullish bias on USD/JPY into year-end.

“1. JPY’s cyclical bottom has depreciated over time

2. Economic recovery is negative for JPY

3. Commodity bull market

4. Inflation = higher US real yield vs lower JP real yield

5. JPY’s weakness hasn’t been excessive vs other markets

6. Outward FDI could accelerate in 2H21

7. Positioning is not stretched JPY short positioning is not stretched.

8. Chart technical is bearish JPY,” BofA note.

“We estimate USD/JPY’s upside targets at 112.20, the 114s and possibly 115.86. Late-2016/early-2017 highs in the 118s can’t be ruled out,” BofA adds.

For bank trade ideas, check out eFX Plus.

Euro nears 1.1800 as it trades at the lowest since April 6

UR/USD slips to the downside

There is some chatter about stops in EUR/USD below 1.1800. We’ve just edged below the recent lows and this could get ugly fast without any support until the March/April lows.