GBP/USD sellers set their sights on the July lows

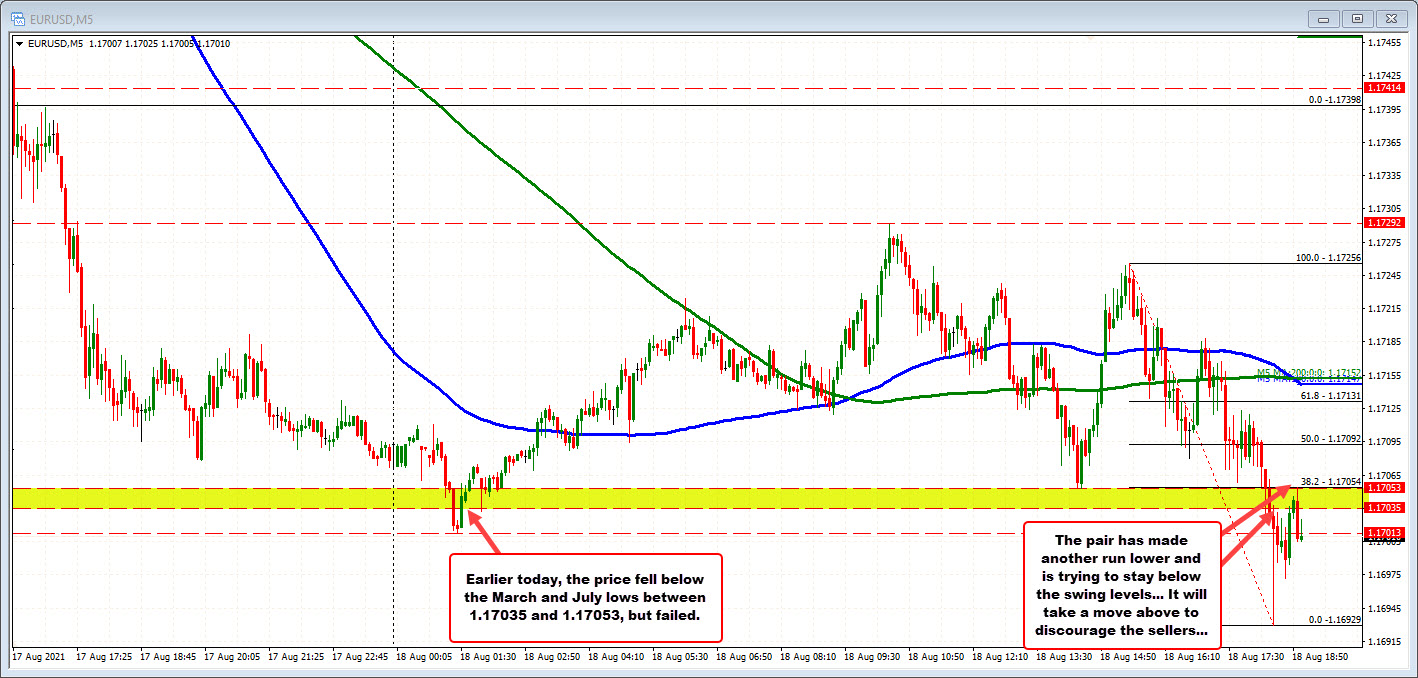

It hasn’t been a good week for commodity currencies amid the hit to risk but the pound itself is also not faring too well, with cable experiencing a sharp drop yesterday by over 100 pips. And that downside momentum is continuing to today.

The drop in cable price action below the 200-day moving average (blue line) signified a break favouring sellers and now they are riding that wave towards the 1.3600 mark.

Buyers managed to hold daily closes above that level in July and it will be a key area to watch as the downside momentum extends. The July lows @ 1.3572-91 adds to the line of defense but a break below that could open up a slippery slope in cable.

The case for the pound is that all the good news is essentially already priced in for the currency. The BOE will look towards ending asset purchases by year-end and while a taper may follow next month, it is hardly significant considering the timeline.

As such, any such announcement by the central bank will be one more for the optics.

Adding to that is the UK economy looking like it has peaked on reopening demand going into the summer as economic conditions starts to wind down.

Inflation is still on the high side but it seems like the BOE is more than content to stick with the ‘transitory’ narrative, at least for as long as they can get away with it.

Meanwhile, the case for the dollar is rather interesting as the latest wave of strength owes much to a technical push in my view. The more sour risk tones in the market is also helping amid a flight to safety this week.

That said, the dollar may face some risk going into Jackson Hole where I would expect Powell & co. to stick with a similar narrative on tapering as we heard in July i.e. nothing hawkish and nothing to suggest an imminent announce in September or November.

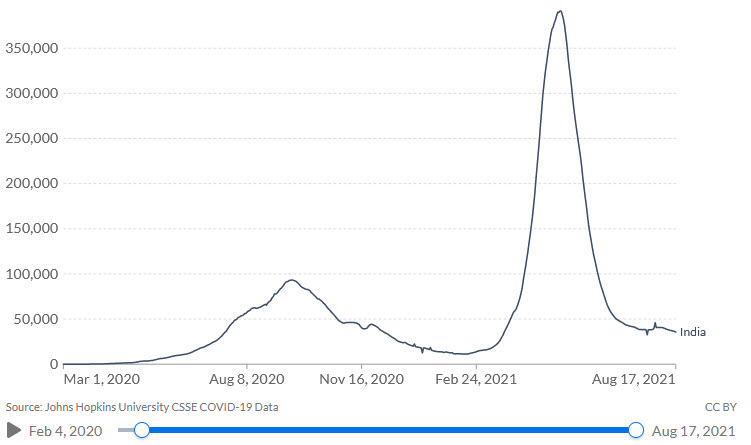

Also, just be mindful in case the Fed does highlight growing risks on the delta variant as part of their outlook. That could keep the market more on edge going into September.

/GettyImages-483658563-fbe002bf7f6d467a94d87cd153ddfa73.jpg)