Archives of “Forex” category

rssDollar a touch softer as the push and pull continues ahead of Jackson Hole

Dollar mildly softer to start the session

The greenback is a little on the backfoot but nothing that stands out all too much once again, as we continue to see more of a push and pull in the past few sessions before getting to Fed chair Powell’s speech at Jackson Hole later in the day.

Overall risk sentiment is holding up modestly but there’s a lack of drive in the market for the time being, awaiting some impetus and catalyst from the Fed later.

The dollar is mildly weaker against the major currencies bloc but narrow ranges are still prevailing for the most part, keeping price action more limited.

EUR/USD buyers are keeping near-term control on a defense of the 100-hour moving average (red line) but there is still a lack of momentum to really get going and test resistance closer to 1.1800 for the time being.

Elsewhere, USD/JPY is sticking close to 110.00 while commodity currencies hold a slight edge against the dollar though nothing that threatens a break from price action that we have seen to kick start proceedings in the early stages of the week.

Japan media says the Australian dollar faces a sell-off risk

Reporting on this piece in Japan’s Nikkei but I’ll add a caveat (the article already does, but I’ll add another).

- The currencies of Australia, South Korea and Brazil — nations reliant on a healthy Chinese economy — are facing sell-offs in the market as fear of an economic slowdown in China spreads.

- “When China sneezes, Australia catches a cold.” So says Tokuhiro Wakabayashi, co-branch manager of State Street Bank and Trust’s Tokyo branch, commenting on the Australian dollar’s sharp depreciation.

Nikkei adds, which is best viewed as a caveat although maybe they didn’t intend it that way:

- The currency touched a roughly nine-month low against the U.S. dollar last week.

- The Australian dollar also recently dipped under 80 yen, marking a year-to-date low.

Yeah … be wary of pieces in mainstream press warning on currency moves ahead. Good of the Nikkei to note AUD is already hitting 9 month lows against the USD … markets tend to take a forward view and the situation on the ground in China (economy losing momentum) and Australia (mounting coronavirus cases recently) has been a hot topic amongst traders for many months already. Not fresh news.

Nikkei piece is here for more (may be gated).

Weekly AUD/USD chart:

US dollar catches a bid to hit session highs versus JPY, EUR and GBP

Dollar bids coming through

It’s tough to find a fundamental underpinning to the latest move in the US dollar. It’s more likely flows or position squaring ahead of Powell.

IF anything, the bond market is dollar negative at the moment as US 10-year yields trail down to 1.299% from 1.310% earlier and that brings rates to flat on the day.

Perhaps that’s some risk aversion creeping in but it’s tough to find much evidence.

The core durable goods orders were a touch soft but that was mostly washed away by revisions to the June data.

In any case, the dollar is at the best levels of the day against the euro, pound and yen after 10-15 pip moves in the past 15 minutes.

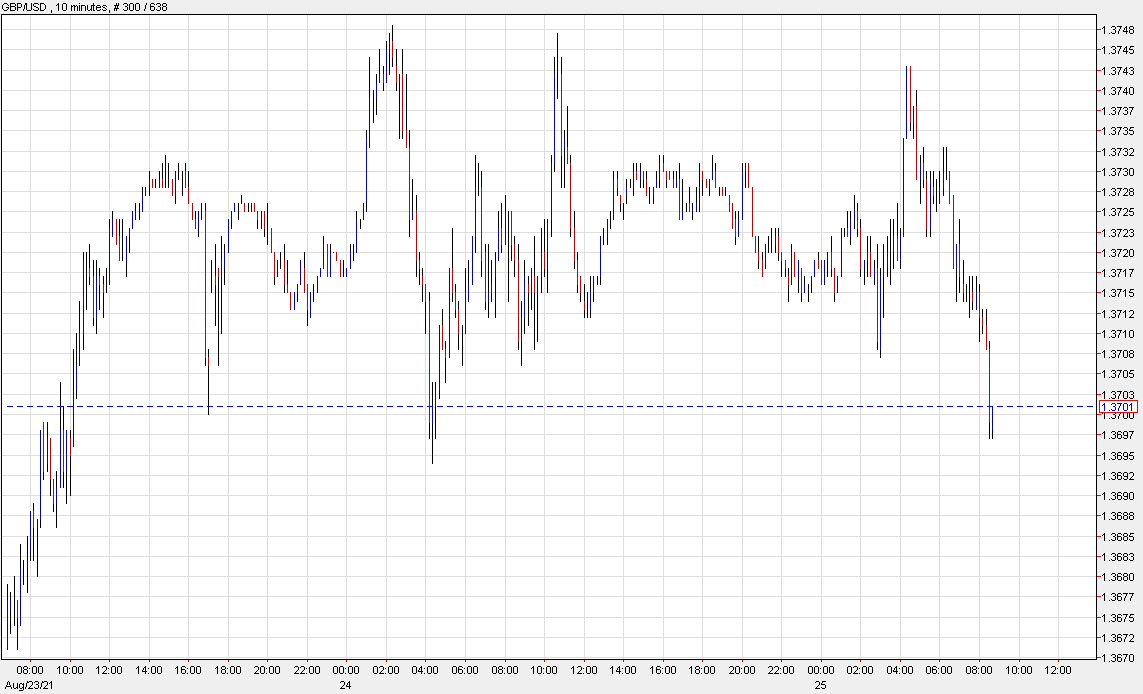

So far, cable is holding yesterday’s low:

US dollar selling picks up. USD/JPY falls to one-week low

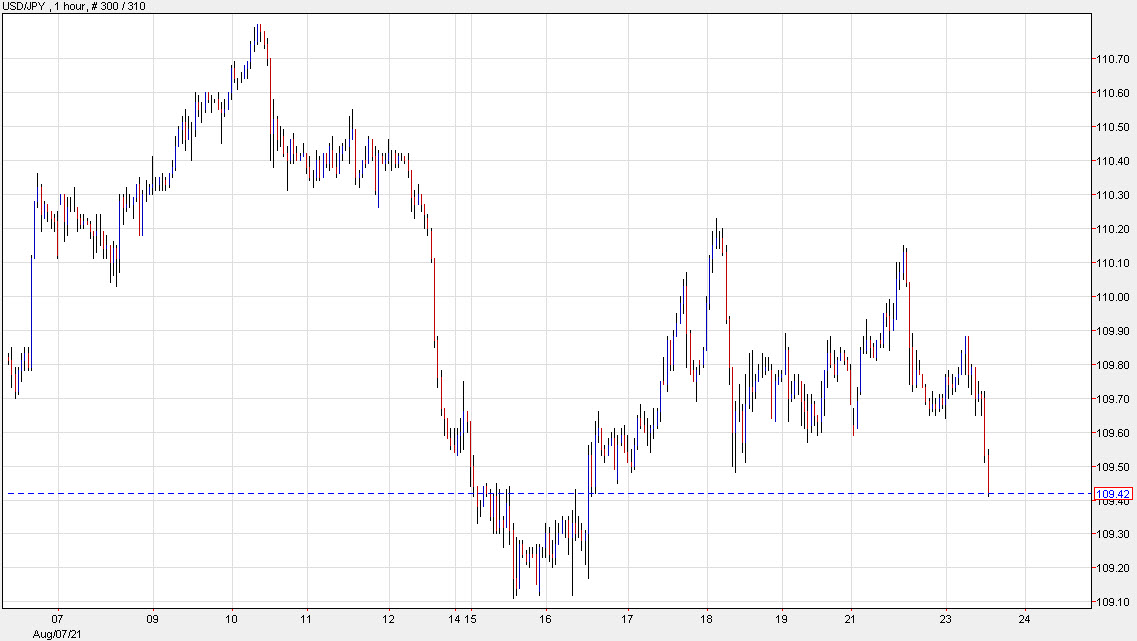

USD/JPY down 20 pips to 109.49

USD/JPY is trading at an one-week low after falling below 109.48 in a round of US dollar selling.

There were some minor stops below the Aug 18 low of 109.48.

There’s no clear catalyst for the latest move lower in the dollar and the Treasury market along with equities are largely steady.

Even in all the churn of the past week, USD/JPY has been remarkably flat. The pair traded inside of a 100-pip range as risk aversion and shifting tapering expectations battled to a standstill.

Along with USD/JPY weakness, there is some EUR/USD strength going through at the moment but otherwise the dollar isn’t getting much of a lift.

EURUSD trades to new highs in early North American trading

There is only in a 24 pip trading range

The good news for the buyers is that the EURUSD is trading to a new session high in early North American trading. Also positive in a negative way sort of, is that the range is extended to 26 pips. That is well below the 51 pips average over the last 22 trading days. So although the price activity is very limited, there is room to roam.

Looking at the hourly chart, the next upside target comes between 1.1754 to 1.17594 area (see higher yellow area in the chart above). Within that range sits the 38.2% retracement of the move down from the July 30 high. That is a minimum hurdle to get to and through if the buyers are to start to take back more control. Be aware.

Earlier today, the price corrected lower and dipped back below the 200 hour moving average at 1.17297. However the price did stay above a swing area between 1.1723 and 1.17248. A move back below the 200 hour moving average would not be good for the buyers looking for more corrective upside price action.

Buyers are making play above the 200 hour moving average, but there is still work to do with overhead resistance target in the way.

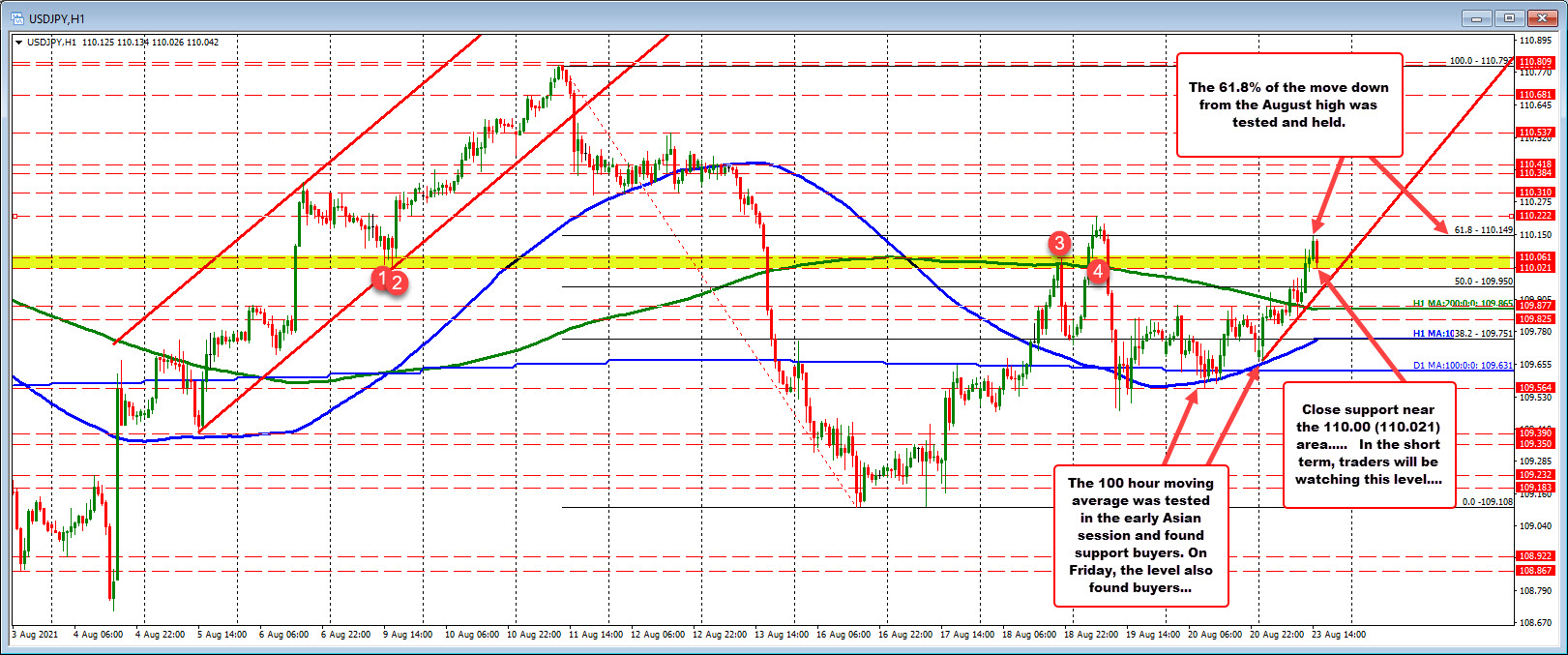

USDJPY above 110.00. Can it stay above?

Held resistance against the 61.8% retracement/ahead of the high from last week

The USDJPY has seen a move higher today help by better risk on sentiment.

Recall from Friday, the price came down and tested its 100 hour moving average (lower blue line) and found support buyers. Today in the early Asian session, the price retested that moving average line and found buyers once again. That set traders up for a move higher.

When the price started to extend and stay above the 200 hour moving average (green line), buyers made another push to the upside that saw a swing area between 110.02 and 110.06 and a test of the 61.8% retracement of the move down from the August 11 high at 110.149.

Last week, the price did extend above that retracement level but could not sustain momentum.

We are seeing a rotation back down toward the 110.00 level (and near the lower end of the swing area – see red numbered circles). In the short term if that area can hold support, the buyers remain in control. We should see a retest and potential break toward the high from last week at 110.222.

Move below the 110.00 level and the rising trendline near 109.91 and the 200 hour moving average at 109.865 would be the next targets. Will below the 200 hour moving average and the buyers will be disappointed with the move, and tilt back to the upside today.

Dollar slips further on the session, risk currencies stay in the lead

The greenback falls to fresh lows on the day in European trading

Of note, commodity currencies are capitalising on the sentiment to start the new week as the market stays focused on the fact that the Jackson Hole symposium isn’t likely to bring any changes to the Fed’s taper narrative.

USD/CAD is meeting fresh lows at 1.2735 currently, nearing a test of its 100-hour moving average (red line) at 1.2730. That will be a key level to watch as a break below will shift the near-term bias to being more neutral and discard some of last week’s momentum.

Elsewhere, AUD/USD is up 0.6% to near 0.7180 while NZD/USD is up 0.5% to 0.6860 despite New Zealand announcing a lockdown extension until 27 August.

The dollar is also seen lower against the euro and pound, though keeping higher against the yen as USD/JPY is up to 110.00 as 10-year Treasury yields climb up 2 bps to 1.28% amid a retreat in safety bets from last week.

In the equities space, European indices are holding decent gains while US futures are still up around 0.3%, so that’s a modest showing so far on the session for risk.

An Update : #USDOLLARINDEX #USD #EURO #JPY #AUD #YUAN #CAD #GBP #INR -#AnirudhSethi

/GettyImages-483658563-fbe002bf7f6d467a94d87cd153ddfa73.jpg)

To read more enter password and Unlock more engaging content

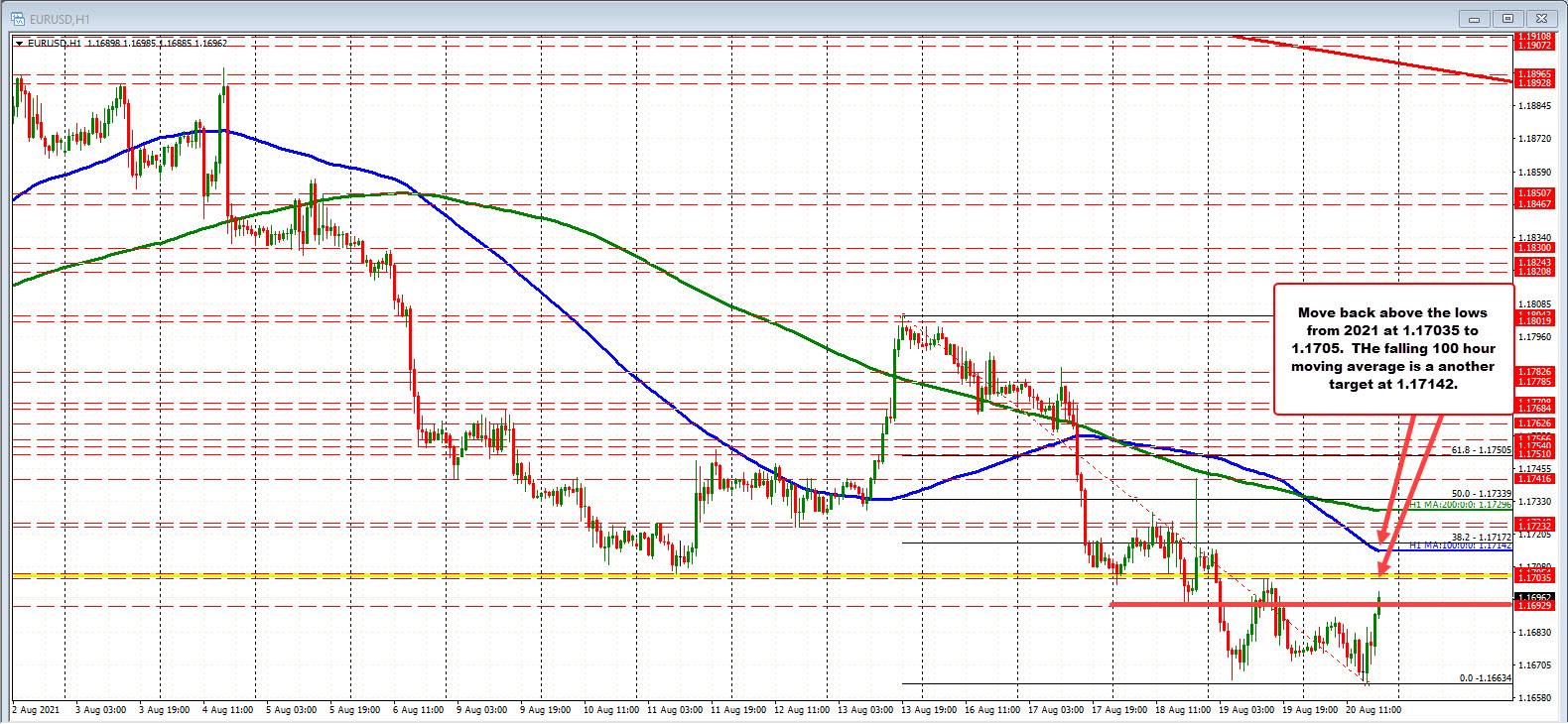

New highs for the EURUSD. Looks toward the old 2021 lows now

Old lows between 1.17035 to 1.07053

The EURUSD is trading to a new session high and in the process has moved above the low from Wednesday’s trade at 1.16929.

The next key target comes in at the old 2021 lows between 1.17035 and 1.17053. The price started to dipped below those levels on Wednesday. Yesterday the intraday corrective high stalled right near those levels. Bearish. A move back above that area would then have to contend with the falling 100 hour moving average at 1.17142.

PS. The low today stalled near the low from yesterday creating a double bottom near 1.1664