Quieter tones prevail once again so far on the day

That said, risk sentiment is still rather soggy and that may fuel a bit more of a defensive tone as we look towards the start of European trading later.

While FX is keeping in tighter ranges, US futures are down roughly 0.3% with 10-year Treasury yields keeping around 1.33% after the drop yesterday.

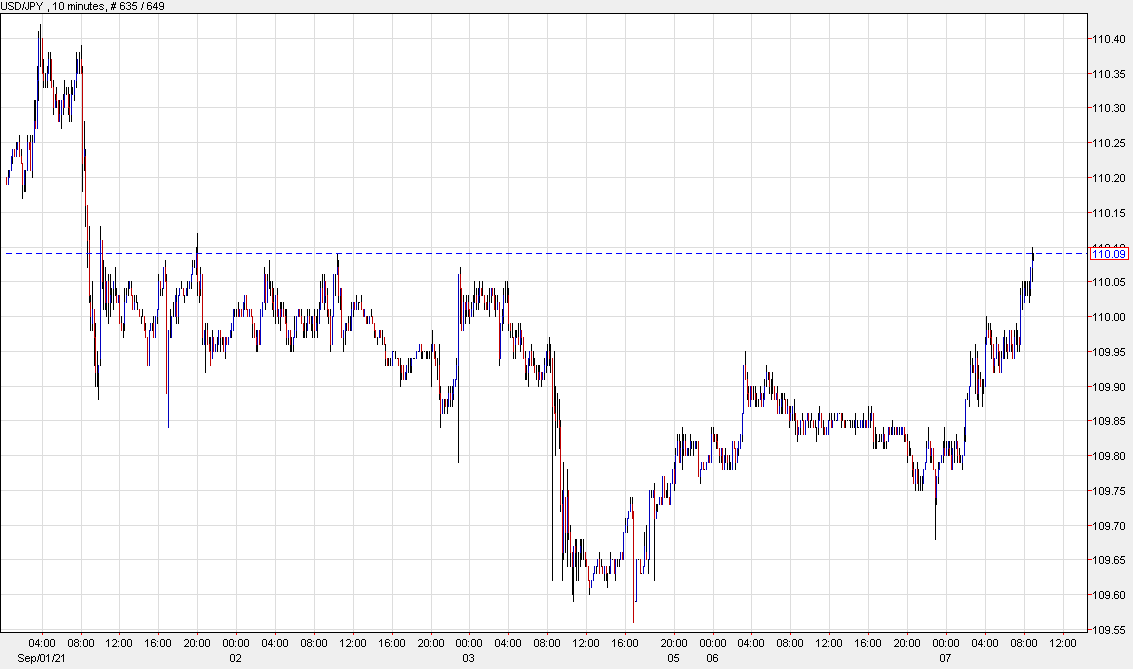

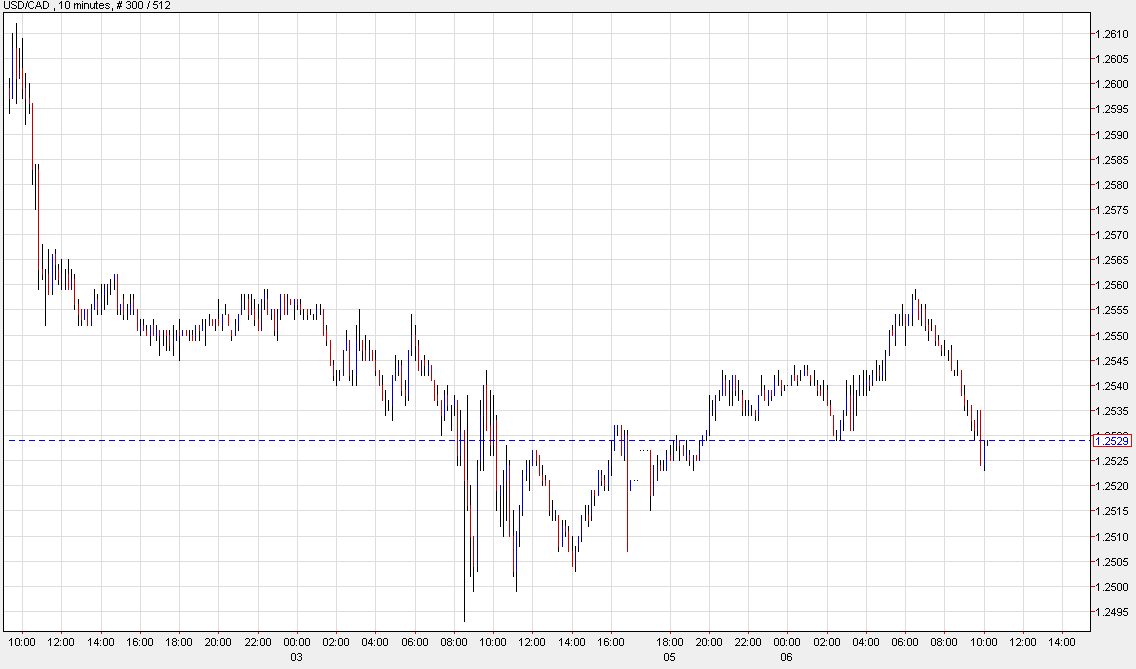

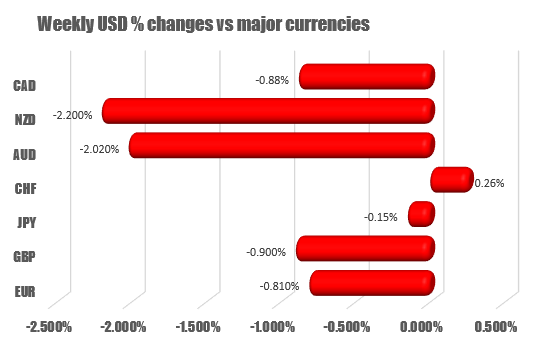

There was quite a bit of push and pull in the dollar overnight and that may yet keep the course as the market sorts itself out on the week. For today though, the ECB policy meeting will be a key risk event to watch for any moves.

EUR/USD is keeping around 1.1815-20 following the drop yesterday, with the 1.1800 level still holding though sellers are maintaining near-term control for now.