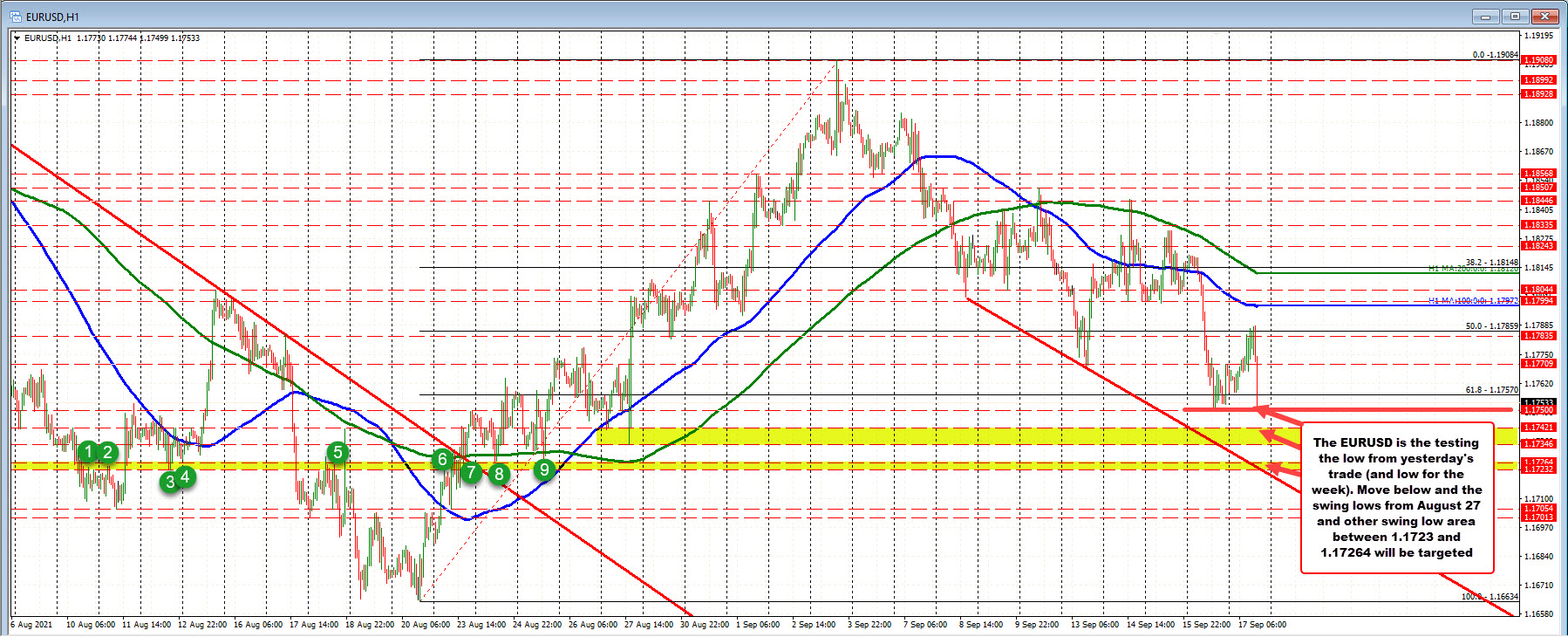

EUR/USD down 40 pips on the day to 1.1775

The dollar isn’t overwhelmingly strong in European trading but there is an evident push lower in EUR/USD over the past few hours as the pair slides from 1.1810 to 1.1775 and is marked down by 40 pips on the day now.

There isn’t any major catalyst for the move but this ties to more of a push and pull as seen in recent days as sellers now keep near-term control of the pair.

Price action is keeping below both key hourly moving averages so the near-term bias favours sellers but there is support from the Monday low @ 1.1770.

But a daily break below that and the 50.0 retracement level @ 1.1786 sets the stage for an added drop perhaps towards 1.1700 next. Besides a couple of technical considerations as pointed out above, there isn’t much else for traders to work with.

The dollar continues to look more choppy overall but standing its ground in light of any short-term weakness as the Fed’s taper narrative continues to offer some tailwind for the currency going into next week’s FOMC meeting.

I mean we already saw that sort of conviction already after the US CPI report, in which the drag on the dollar was a rather brief one by all accounts.

/GettyImages-483658563-fbe002bf7f6d467a94d87cd153ddfa73.jpg)