AUD/USD runs up above 0.7400 to test its 100-day moving average

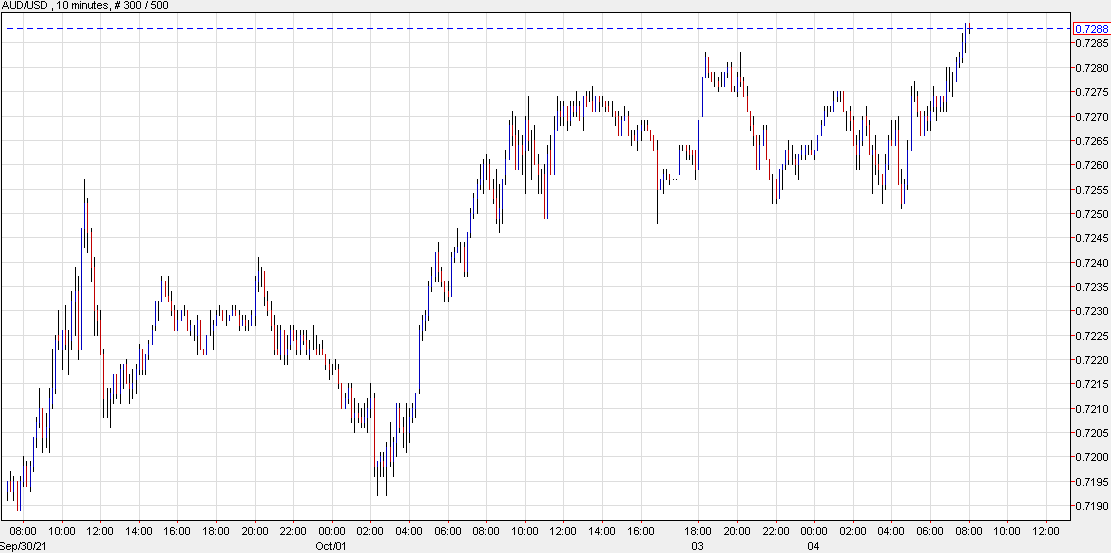

The dollar softness in the past few days is certainly one reason for the push higher but the aussie itself is showing some resilience since dipping below 0.7200 briefly at the end of September trading.

Risk sentiment has been a bit more mixed this week but today’s more optimistic mood won’t hurt the aussie’s charm whatsoever, which I would argue has more to do with rising commodity prices in recent weeks more than anything else.

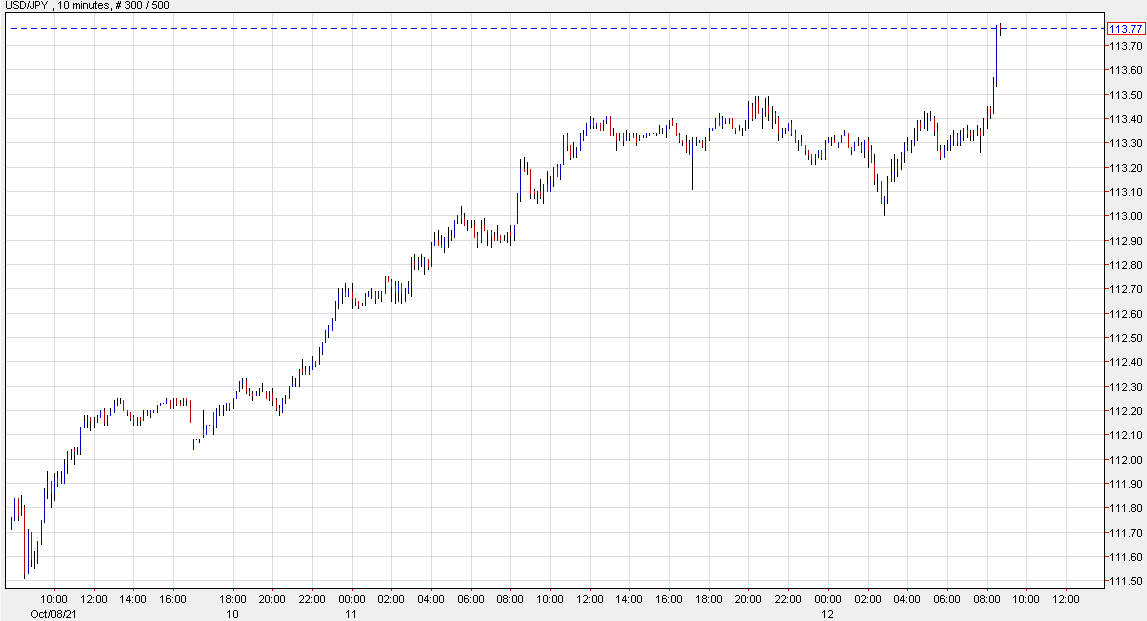

Adding to that is perhaps the technical breakout in AUD/JPY as the pair climbs to its highest since July above 84.00 currently, after having broken above key resistance levels from the September highs close to 82.00 at the start of the week.

So, what’s next for AUD/USD?

The 100-day moving average (red line) @ 0.7413 poses the first immediate resistance for now so buyers will have to try and hold a break above that to keep the upside run going. The September highs @ 0.7469-78 will then be the next key test.

In the big picture, I’m not a big fan of the aussie but the technicals are hard to ignore and considering the climbdown from 0.7700 to nearly 0.7100 since June, there has been a modest downside move played out already for the currency.

The COVID-19 situation is also likely to get better as vaccinations are inching closer towards the 80% rate for NSW and Victoria states. So, that isn’t going to pose an added threat to the outlook although economic conditions are still not the best.

In the bigger picture, I would argue that monetary policy divergence is still a key driver and with the Fed and RBA on two different sides of the spectrum somewhat, a return back towards 0.7800 to 0.8000 is likely out of the picture.

As such, fair value gains may point towards a push towards the 200-day moving average (blue line) at most on a technical break but it shouldn’t be much more than that.

/GettyImages-483658563-fbe002bf7f6d467a94d87cd153ddfa73.jpg)

/GettyImages-483658563-fbe002bf7f6d467a94d87cd153ddfa73.jpg)

/GettyImages-483658563-fbe002bf7f6d467a94d87cd153ddfa73.jpg)

/GettyImages-483658563-fbe002bf7f6d467a94d87cd153ddfa73.jpg)