Archives of “Education” category

rssThe stock market is one huge scam.

From ‘Trade Like An O’Neil Disciple’ – Morales/Kacher. Big profits from leaders takes some time.

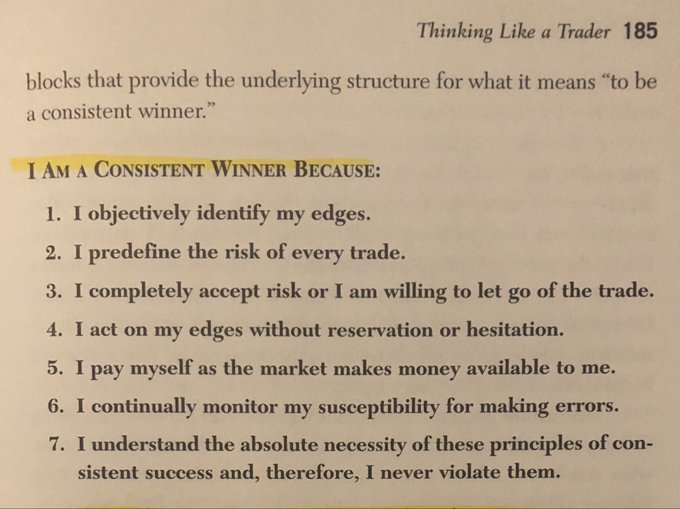

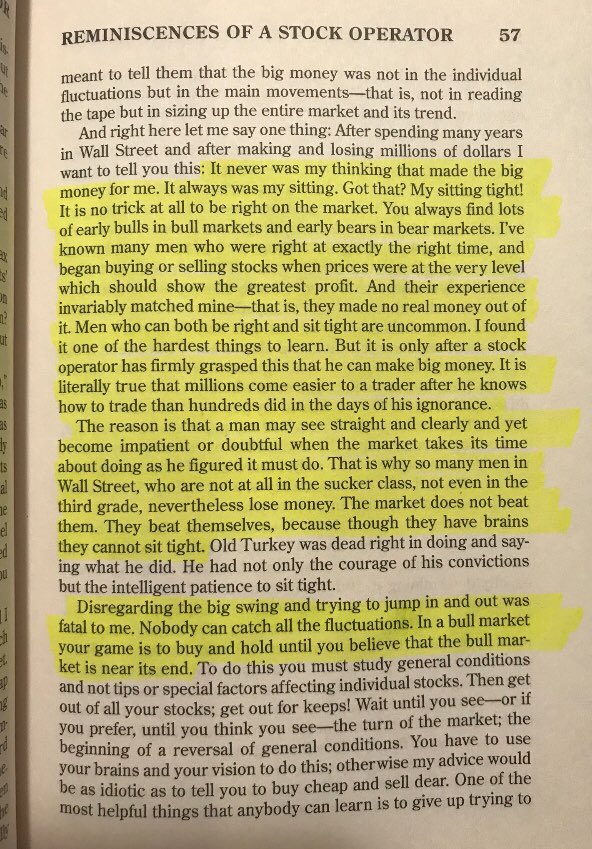

Discipline and Consistency will keep in the markets year after year for a long time. From ‘Trading In The Zone’ – Douglas

2020 left us the fastest bear market in history.

Valuation of electric vehicle companies.

Don’t give up.

A Winning Mindset is Required To Succeed

- A losing trader can do little to transform himself into a winning trader. A losing trader is not going to want to

transform himself. That’s the kind of thing winning traders do. - The winning traders have usually been winning at whatever field they are in for years.

- It is a happy circumstance that when nature gives us true burning desires, she also gives us the means to

satisfy them. Those who want to win and lack skill can get someone with skill to help them. - The “doing” part of trading is simple. You just pick up the phone and place orders. The “being” part is a bit more subtle. It’s like being an athlete. It’s commitment arid mission. To the committed, a world of support appears. All manner of unforeseen assistance materializes to support and propel the committed to meet grand destiny.

- In your recipe for success, don’t forget commitment – and a deep belief in the inevitability of your success.

The Trader and the Trading System Must Meet

- Systems don’t need to be changed. The trick is for a trader to develop a system with which he is compatible.

- My original system was very simple with hard-and-fast rules that didn’t allow for any deviations. I found it

difficult to stay with the system while disregarding my own feelings. I kept jumping on and off—often at just the wrong time. I thought I knew better than the system. - Also, it seemed a waste of my intellect and MIT education to just sit there and not try to figure out the markets.

- Eventually, as I became more confident of trading with the trend, and more able to ignore the news, I became more comfortable with the approach. Also, as I continued to incorporate more “expert trader rules,” my system became more compatible with my trading style.

- As I keep trading and learning, my system (that is the mechanical computer version of what I do) keeps evolving.

- Over time, I have become more mechanical, since (1) I have become more trusting of trend trading, and (2)

my mechanical programs have factored in more and more “tricks of the trade.” I still go through periods of thinking I can outperform my own system, but such excursions are often self-correcting through the process of losing money. - I don’t think traders can follow rules for very long unless they reflect their own trading style. Eventually, a breaking point is reached and the trader has to quit or change, or find a new set of rules he can follow. This seems to be part of the process of evolution and growth of a trader.

- A trading system is an agreement you make between yourself and the markets.

What Trend Trading Is (Ignore Fundamentals)

- Reliance on Fundamentals indicates lack of faith in trend following.

- For Trend Traders, understanding the markets is typically optional, often counter-productive.

- When an up-trend happens, the price is moving up.

- Trend Traders get a signal and pull the trigger without regard to the result of any individual trade.

- Playing for comfort and searching for meanings are both counterproductive to Trend Following.

- Trend Following systems do not speak about entry and exit prices.

- Trend systems do not intend to pick tops or bottoms. They ride sides.

- I don’t implement momentum; I notice it and align my trading with it.

- There is no such thing as THE trend. Some of the shorter indicators are down while some of the longer ones are still up.