Archives of “Education” category

rssEquity Markets vs Crypto

W. D. GANN’S 24 TIMELESS STOCK TRADING RULES

Here are the 24 rules:

1. Amount of capital to use: Divide your capital into 10 equal parts and never risk more than one-tenth of your capital on any one trade.

2. Use stop loss orders. Always protect a trade.

3. Never overtrade. This would be violating your capital rules.

4. Never let a profit run into a loss. After you once have a profit raise your stop loss order so that you will have no loss of capital.

5. Do not buck the trend. Never buy or sell if you are not sure of the trend according to your charts and rules.

6. When in doubt, get out and don’t get in when in doubt.

7. Trade only in active markets. Keep out of slow, dead ones.

8. Equal distribution of risk. Trade in two or three different commodities if possible. Avoid tying up all your capital in any one commodity.

9. Never limit your orders or fix a buying or selling price.

10. Don’t close your trades without a good reason. Follow up with a stop loss order to protect your profits.

11. Accumulate a surplus. After you have made a series of successful trades, put some money into a surplus account to be used only in emergency or in times of panic.

12. Never buy or sell just to get a scalping profit.

13. Never average a loss. This is one of the worst mistakes a trader can make.

14. Never get out of the market just because you have lost patience or get into the market because you are anxious from waiting.

15. Avoid taking small profits and big losses.

16. Never cancel a stop loss order after you have placed it at the time you make a trade.

17. Avoid getting in and out of the market too often.

18. Be just as willing to sell short as you are to buy. Let your object be to keep with the trend and make money.

19. Never buy just because the price of a commodity is low or sell short just because the price is high.

20. Be careful about pyramiding at the wrong time. Wait until the commodity is very active and has crossed resistance levels before buying more, and until it has broken out of the zone of distribution before selling more.

21. Select the commodities that show strong uptrend to pyramid on the buying side and the ones that show definite downtrend to sell short.

22. Never hedge. If you are long one commodity and it starts to go down, do not sell another commodity short to hedge it. Get out at the market: Take your loss and wait for another opportunity.

23. Never change your position in the market without a good reason. When you make a trade, let it be for some good reason, or according to some definite rule; then do not get out without a definite indication of a change in trend.

24. Avoid increasing your trading after a long period of success or a period of profitable trades.

Every failure..

March 16 does not bring good memories.

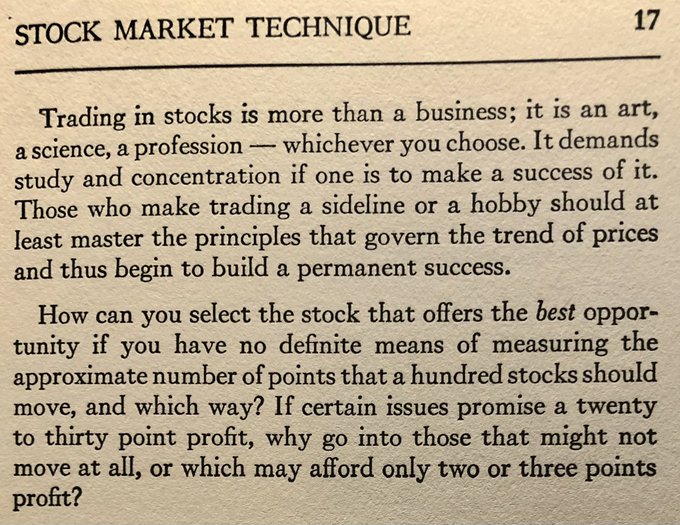

Follow the current trend and the leaders of that current trend. From ‘Stock Market Technique Vol 1’ – Wyckoff 1933

‘I can calculate the movement of the stars, but not the madness of men.’ Sir Isaac Newton

“In the stock market, the most important organ is the stomach. It’s not the brain.” Peter Lynch

The Pitfalls of Speculation by Thomas Gibson, 1906.

The question at once asks itself: “How may the top of the market be discerned, and the dangers of the eleventh hour be avoided?” The answer is more or less complex.

It is, of course, necessary above all things to revert to the estimated and fixed value of the stocks traded in and to find out how much above this normal point the securities are selling. This done, common sense, plus prudence, and minus piggishness, may determine the question and dictate the time for liquidation. This action, however, once decided upon must be adhered to with great rigidity, for thousands of traders who thus take time by the forelock have been dissatisfied afterwards by seeing a still greater advance in which they had no interests, and through greed and impatience have re-entered the lists at a most inopportune time.

The trader who realizes his profits, and sees a further advance following his own withdrawal from the market, may console himself with the fact that he has made and secured a profit; that trying to guess the exact extreme of a cycle is hazardous, and that the advance which followed his withdrawal is unsound, being founded on speculation rather than valuation.

But this is a digression from the technical phase of the matter. So far as it is possible to judge the culmination of the speculative campaign by extraneous appearances, it may be said that a long period of backing and filling, a swinging back and forth of prices at the approximate high level marks the beginning of the end. (more…)

Some things never change.

Accepting losses is the most important single investment device to insure safety of capital. It is also the action that most people know the least about and that they are least liable to execute. I’ve been studying investments, giving investment advice and actually investing since 1921. I haven’t found the real key yet and don’t ever expect to, as no one has found it before me, but I have learned a great many things. The most important single thing I learned is that accepting losses promptly is the first key to success.