Archives of “Education” category

rssTrading should be effortless.

A true piece of wisdom. In my experience when I trade well it is like shooting fish in a barrel. Almost everything works. I don’t need to be overly patient with positions. The money comes in very fast. That’s exactly how trading should be. The exact opposite was the case during the first 2 months of this year. So I did what I had to do. I recognized the situation for what it was and admitted my efforts were not leading my portfolio anywhere. It was like folding when you are dealt a bad hand in poker. So I folded. Now I am waiting for the next hand. If it is a bad one I fold again. If a series of trades start to really go my way I push it hard and increase exposure and trade aggressively.

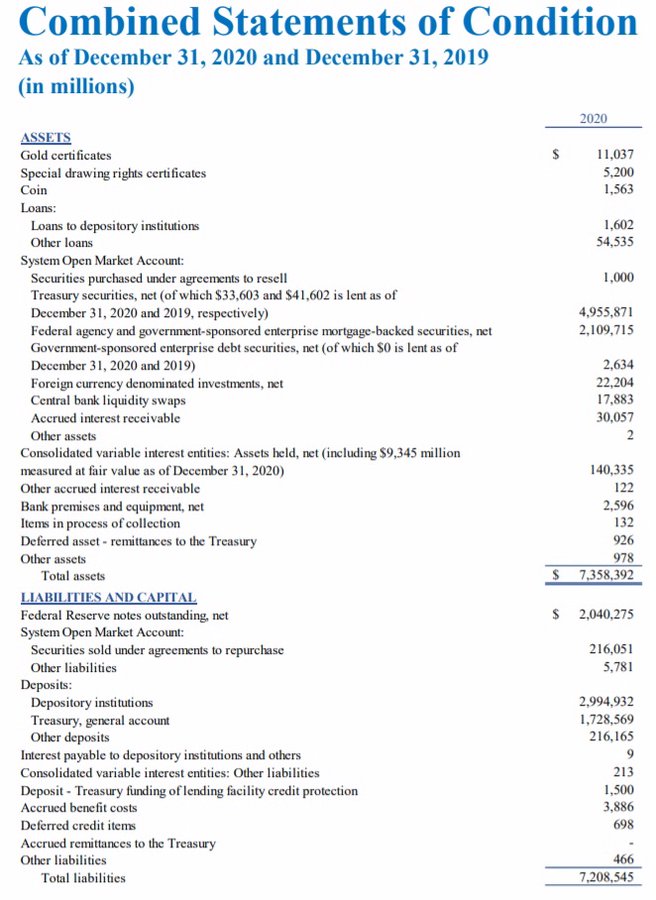

Financial situation of the Federal Reserve at the end of 2020.

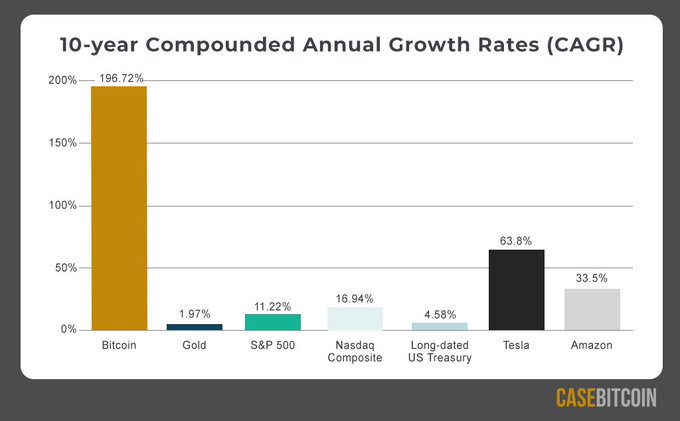

Profitability of various assets in the last 10 years.

This was written in 1908 in ‘The Ticker Magazine’ by Wyckoff. Risk management is the key – same then as today.

Be nimble and flexible to what is actually happening. From 1912 ‘Psychology of the Stock Market’ – Selden

Jason Zweig’s Rules for Investing

1. Take the Global View: Use a spreadsheet to track your total net worth — not day-to-day price fluctuations.

2. Hope for the best, but expect the worst: Brace for disaster via diversification and learning market history. Expect good investments to do poorly from time to time. Don’t allow temporary under-performance or disaster to cause you to panic.

3. Investigate, then invest: Study companies’ financial statement, mutual funds’ prospectus, and advisors’ background. Do your homework!

4. Never say always: Never put more than 10% of your net worth into any one investment.

5. Know what you don’t know: Don’t believe you know everything. Look across different time periods; ask what might make an investment go down.

6. The past is not prologue: Investors buy low sell high! They don’t buy something merely because it is trending higher.

7. Weigh what they say: Ask any forecaster for their complete track record of predictions. Before deploying a strategy, gather objective evidence of its performance.

8. If it sounds too good to be true, it probably is: High Return + Low Risk + Short Time = Fraud.

9. Costs are killers: Trading costs can equal 1%; Mutual fund fees are another 1-2%; If middlemen take 3-5% of your cash, its a huge drag on returns.

10. Eggs go splat: Never put all your eggs in one basket; diversify across U.S., Foreign stocks, bonds and cash. Never fill your 401(k) with employee company stock.

Barbara Tversky’s 9 Laws of Cognition

9 Laws of Cognition

1: There are no benefits without costs (creativity vs learning)

2: Action molds perception

3: Feeling Comes first (before recognition)

4: The mind can override perception (confirmation bias)

5: Cognition mirrors perception

6: Spatial thinking is the foundation of abstract thought

7: The mind fills in misinformation

8: When thought overflows the mind, the mind puts it in the world

9: We organize stuff in the world the way we organize stuff in the mind.

Factfulness Rules of Thumb