Archives of “Education” category

rssDo the right thing.

Failures become lessons if you learn.

JOHN KENNETH GALBRAITH ON STOCK MARKET MEMORY LOSS

Where else but in the markets can short term memory loss be both beneficial and profitable?

John Kenneth Galbraith, an economist, says the financial markets are characterized by…

“…extreme brevity of the financial memory. In consequence, financial disaster is quickly forgotten. In further consequence, when the same or closely similar circumstances occur again, SOMETIMES IN A FEW YEARS, they are hailed by a new, often youthful, and always extremely self-confident generation as a brilliantly innovative discovery in the financial and larger economic world. There can be few fields of human endeavor in which history counts for so little as in the world of finance.” [emphasis mine].

UK July flash services PMI 57.8 vs 62.0 expected

Latest data released by Markit/CIPS – 23 July 2021

- Prior 62.4

- Manufacturing PMI 60.4 vs 62.5 expected

- Prior 63.9

- Composite PMI 57.7

- Prior 62.2

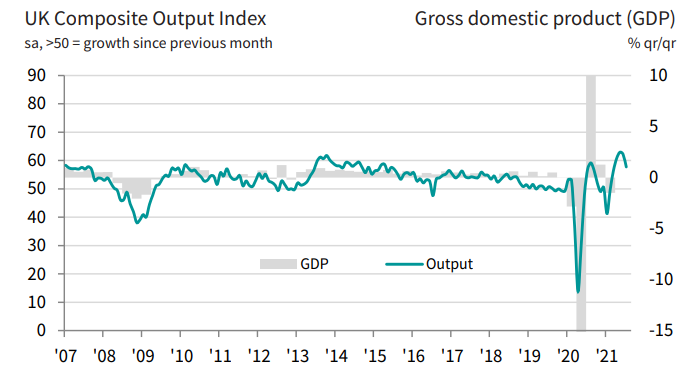

UK business activity miss on expectations and decline quite considerably from June as firms widely report that staff and raw materials shortages dampened conditions, hindering the recovery pace after the reopening in April.

This is certainly a spot to watch now for the UK and will likely dampen any hopes of a more hawkish tilt by the BOE as we look towards the August meeting.

Markit notes that:

“July saw the UK economy’s recent growth spurt stifled by the rising wave of virus infections, which subdued customer demand, disrupted supply chains and caused widespread staff shortages, and also cast a darkening shadow over the outlook.

“Although business activity continued to grow, aided by the easing of lockdown restrictions to the lowest since the pandemic began, the rate of expansion slowed sharply to the weakest since March.

“Transport, hospitality and other consumer-facing services companies were the hardest hit, though manufacturing also saw growth weaken markedly during the month.

“Although the July flash survey only covered three days of the full easing of covid restrictions, any imminent re-acceleration of growth in August looks unlikely due to a steep slowing in overall new order growth recorded during July.

“Concerns over the Delta variant have meanwhile overshadowed the passing of “freedom day”, and were a key factor alongside Brexit and rising costs behind a sharp slide in business expectations for the year ahead, which slumped to the lowest since last October.

“The PMI indicates that GDP growth will likely have slowed in the third quarter, after having rebounded sharply in the second quarter.

“Firms’ costs rose at a rate unprecedented in over 20 years of survey history as supply shortages pushed up the price of goods, suppliers of services hiked prices and employee pay continued to rise.”

Mark Zuckerberg and Kevin Systrom on Instagram acquisition March 19, 2012

Bill Gates on iTunes Music Store April 30, 2003

Jim Allchin to Bill Gates: “I would buy a Mac today if I was not working at Microsoft” January 7, 2004

Jim Allchin to Bill Gates: “I would buy a Mac today if I was not working at Microsoft” January 7, 2004

Thought For A Day

There’s two ways we learn things, the easy way, and the hard way.

If we learn things the hard way the FIRST time we climb up off of the pavement — that is the definition of a windfall.

Learning things the easy way is to accept facts like an obedient database. The only payoff to learning things the easy way happens when our perspective on the matter at hand altered such that we see it in its proper light and thus actually understand it, rather than merely as data.

To convey ideas to other human beings, we must amend their perspective, their point of reference on the matter, to see it anew from an entry point that they will understand it. To spare them the inevitable beatings of otherwise learning it the hard way is such a gift.