Archives of “Education” category

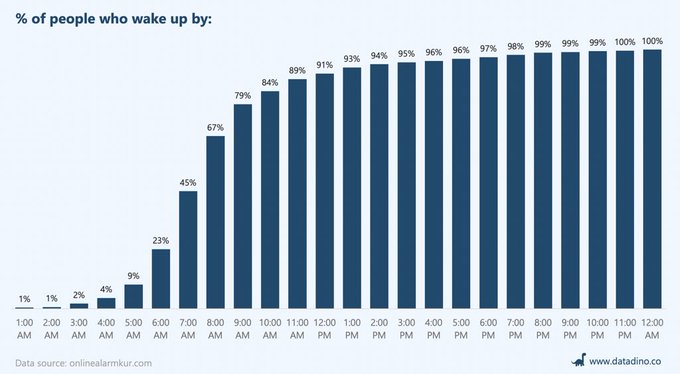

rss“Early to bed and early to rise, makes a man healthy, wealthy, and wise” – Benjamin Franklin

Major European indices close higher

Euro Stoxx index closes at another record high

Themajor European indices are all closing hiigher on the day. The France’s CAC moves closer to its 2000 all-time high. The Euro Stoxx index closes at a another record high.

The closing levels are showing:

- German DAX, +0.16%

- France’s CAC, +0.1%

- UK’s FTSE 100, +0.4%

- Spain’s Ibex, +0.4%

- Italy’s FTSE MIB, +0.25%

- Euro Stoxx 50, +0.31%

In other markets as European/London traders look to exit shows:

- Spot gold, plus $1.87 or 0.12% at $1731.68.

- Spot silver down one cent or -0.05% at $23.43

- WTI crude oil futures are up $1.55 or 2.31% at $68.38

- Bitcoin is down $1100 and $45,175

From ‘The Sophisticated Investor’ – Burton Crane 1959

One of my favorite Nicolas Darvas passages. From ‘You Can Still Make It In The Market’ – 1977

From ‘Bernard Baruch – Adventures of a Wall Street Legend’ – James Grant 1997

Schabacker from 1930 ‘Stock Market Theory and Practice’

S&P and NASDAQ post record closes

Russell 2000 index rises by 1.81%.

The S&P and NASDAQ index both closed at record levels with a late day surge that has the indices going out near the highs for the day.

The Dow and the Russell 2000 index also had strong days, with the small-cap index outpacing the larger cap indices with a surge higher of 1.81%.

Highlight sectors included:

- energy +1.29%

- financials +1.25%

- utilities +1.11%

- discretionary +0.92%

- industrials +0.49%

- technology +0.54%

Lagging today were:

- healthcare -0.38%

- materials -0.14%

The final numbers are showing:

- S&P index rose 26.43 points or 0.60% at 4429.09. The intraday high reached a new record at 4430.30

- Dow industrial average rose 270.92 points or 0.78% at 35063.59

- NASDAQ index rose 114.58 points or 0.78% at 14895.12. Its intraday high reached 14896.50. That is the new all-time record high.

- Russell 2000, +39.67 points or 1.81% at 2235.99

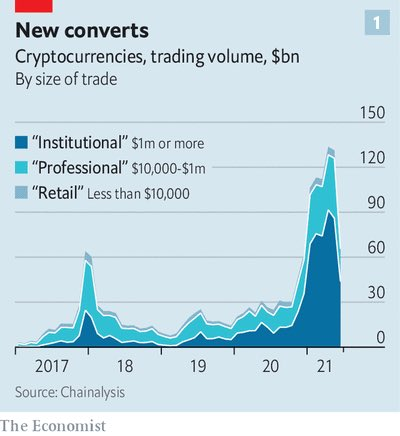

Who is trading #bitcoin? Not retail.

Trailing P/E ratio: It can guide you but it can’t predict the future

What is the trailing P/E ratio

Let us talk about the trailing P/E ratio.

Have you encountered the term price-to-earnings? It is a significant factor when it comes to knowing the value of stocks and companies. It is also known as the P/E ratio, and it may be forward or trailing. A forward P/E ratio maximizes the use of projected future earnings for the calculation. On the other hand, a trailing P/E ratio is the valuation multiple that focuses on the past year’s earnings.

Tell me more about the trailing P/E ratio.

When we read articles about companies and stocks, we often encounter the term P/E ratio. But do you know what it means? It means the price-to-earnings ratio, and it is usually the trailing one unless otherwise stated that it’s the forward. We calculate it by taking the share price and dividing it by the EPS of the most recent fiscal year. We see that we need the EPS of the most recent fiscal year in the formula. We can access it from the annual report’s income statement.

Here is the formula:

Trailing P/E ratio = Current share price/ EPS of the last 12 months

Why use a P/E ratio?

This ratio is beneficial, especially for analysts, because it is a similar valuation to relative earnings. Analysts can use this when they look for bargains that are related to the market. Some use this to know whether a stock is more expensive than another. Some companies have a high P/E, which they deserve because they have better economic moats than others. And when we say economic moats, we refer to the advantage that one company has to protect their profitability and ace the competition, which the others do not have. Unfortunately, this is not always the case. Sometimes, some company share prices are nothing special. They are just overpriced.

On the other hand, some companies have low P/E ratio are experiencing challenges financially. Others have it low because they are offering a great bargain. Now, if you are asking why use a P/E ratio, you know that it helps entities like analysts have an accurate idea about the value of a stock or a company.

Why not use a P/E ratio?

If there are reasons to use the P/E ratio, there are also reasons why we should hesitate. It has its fair share of flaws. We know that while earnings are constant, stock prices are constantly moving. This is why we have a trailing P/E ratio. It only uses the most recent four quarters instead of the earnings generated from the latter of the last fiscal year.

Trailing P/E and forward P/E

Entities use the forward P/E to evaluate a company because it shows the subsequent projected earnings for 12 months. This ratio is focused on a future earnings estimate. Hence, miscalculation and an analyst bias are always a possibility.

On the other hand, the trailing P/E is more focused on the past performance of a company that is subjected to an acquisition. It gives an acquirer an idea about how it did in the past and how it can do in the future. We usually get a company valuation based on its latest ratio. Some acquirers will always look for a way to buy a company for a cheaper amount, including an earn-out provision. They give an option that they will provide an additional payout if their goal earnings are achieved.

Should I use a trailing P/E ratio?

Many people can say that this measure is reliable because it is backed up by actual performance and not the expected future performance that did not happen. However, know that a company’s past performance can guide you but can’t predict the future. The future, stocks, and the market will always surprise us.