Archives of “Education” category

rssProfit always take of themselves but losses never do”-Nicolas Darvas

Probability of losing trades within a 50-period x Winrate. Save this as a reminder to yourself for future losing streaks.

Will it be easy? Nope! Worth it? Absolutely.

Germany becoming the sick man again? Down pointing backhand index Not a pretty picture for Dax in the last few years. Too little innovation and new technologies, too much regulation.

The Chinese property market, eye-opening chart

6 trading styles you should know

Starting up trading with no experience is not without its difficulties, especially during this challenging time. It takes a lot of time, effort, and knowledge to make it work.

How you fare at trading depends on how you ruminate on trading, what sort of profits/returns you are looking at, and how much risk you are willing to take.

Consequently, you can devise your own strategies and goals, and achieve them to make the most optimal profits.

Traders who want to start their first trading will be glad to learn there are a variety of styles and strategies tailored for certain personalities. Here are a few trading styles you can experiment with based on your personality:

1. Day Trading

This type of trader focuses primarily on starting and completing tasks on the same day. That’s you if you prefer taking one trade a day and closing it before the day ends even if that means staying up until late at night.

Generally, day trading is classified as a short-term trading style due to its nature – the intention of gaining returns from small price movements.

You might be apt for the day trading style if you are persistent. A strong day trader is persistent as they like sticking to a certain style/strategy when it works for them.

Discipline – day traders can manage their plan of how they approach their trading and what they do during market hours. They have a strict schedule to follow every single day without fail.

Also, it is important for day traders to be sharp as day trading is known as the game of minutes. Traders can’t afford to be pensive or apprehensive as they must act quickly when they see the opportunity.

2. Position Trading

A position trader specializes in having a long-term outlook even it means days, months, or years. Thus, it is known as a long-term strategy mainly focused on fundamentals however, technical principles may come in handy as well.

If you lean more on position trading, ensure to comprehend how economic factors can affect markets and thorough technical understanding, is super important in predicting trading plans.

Patience is a virtue for position traders as they won’t make short term profits and you need to be extremely patient to achieve your profit goals. It is best suited for those who have already have a full-time job and not wanting to be worried about price fluctuations every single day. The goal for this trader is to make profits in a long run. That means you enjoy more delayed gratification over instant gratifications. (more…)

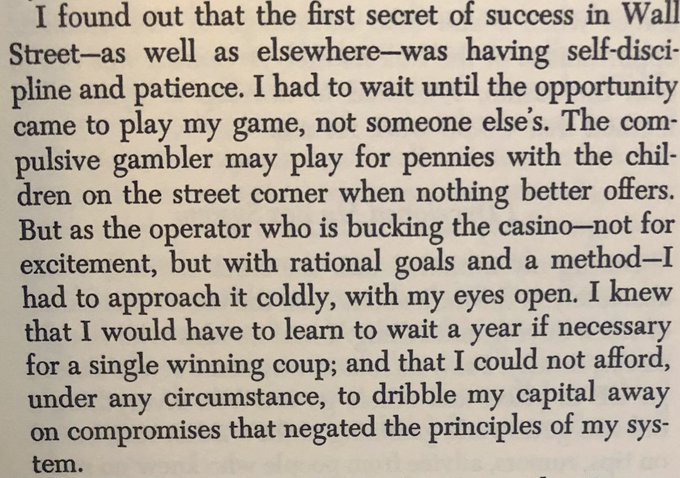

From ‘Trading In The Zone’ – Mark Douglas

Thought For A Day