Archives of “Education” category

rssThe emotions in markets are off-the-charts

Do you feel it?

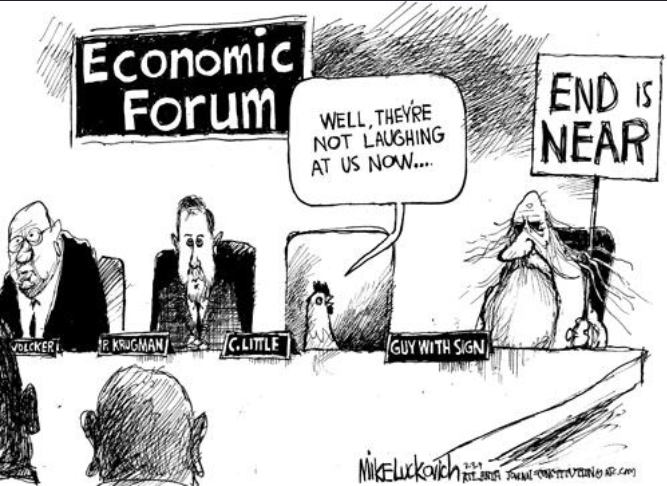

Fear is the strongest emotion but greed isn’t far behind.

What we’re seeing in the markets and in the world right now is extreme emotion. Collectively, I believe that COVID-19 has left everyone an emotional wreck.

We all agree that the fears from the virus have diminished but what has replaced that is a mess. It’s all anecdotal but I’ve come to believe the series of events around the coronavirus has elevated individual and collective emotions — like every day is a full moon.

The fear around the virus has left some kind vacuum and people are trying to fill it.

You see it in people’s lives, in protests, in anger but you’re also seeing it in markets. There has never been a market like this. People are throwing away their hard-earned savings on idiotic gambles on bankrupt companies.

But it’s not just the stupidest of the stupid. The uncertainty in the world is extreme and there’s no reflection of that in risk assets. The transition from fear to greed to euphoria is nonsense.

For everyone trashing Warren Buffett, Apple is his largest holding as of 12/31 and he’s up well over 100% on it

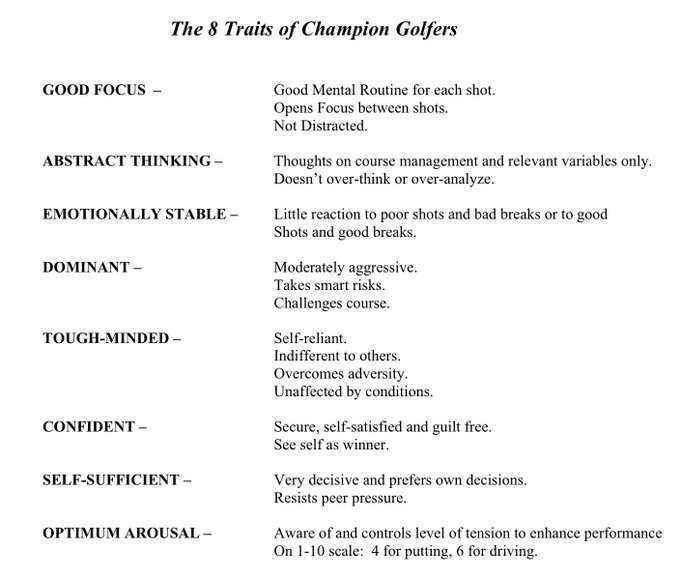

Practice and more practice to reduce mistakes. Traits for success are similar:

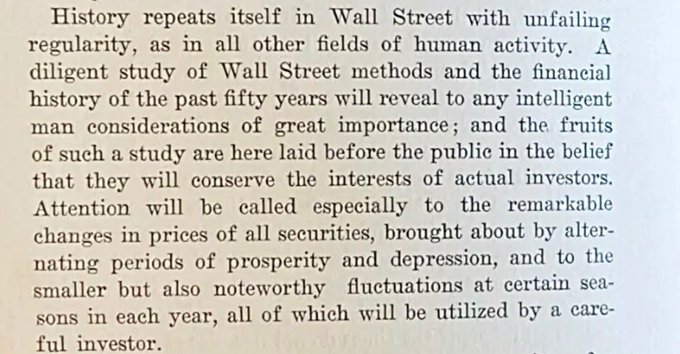

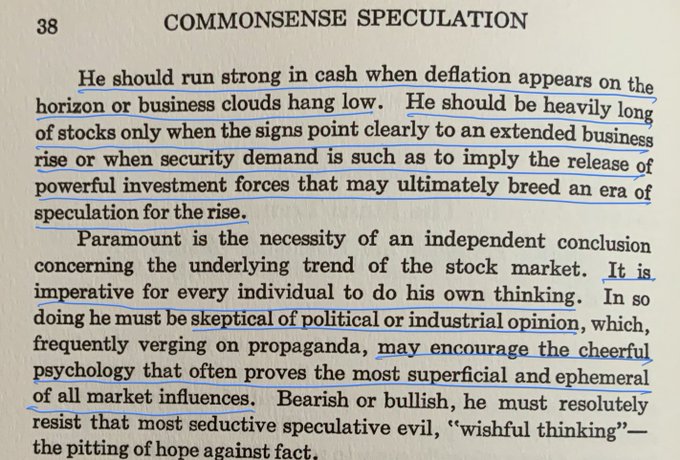

This was written in 1907. How Money is Made in Security Investments – Hall.

Spotting Bottoms

- Fake rallies

- At some point on the way down, the indices will attempt to rebound or rally. Bear markets normally come in 2 or 3 waves, interrupted by several attempted false rallies that usually fizzle out after 1, 2, or 3 weeks and occasionally 5 to 6 weeks or more [my note: created by both bargain hunters as well as big players going for the short squeeze].

- Counting rallies and follow-throughs

- 1st day of an attempted rally is when the index closes up from the prior day (doesn’t matter if the intraday low is lower than the prior day).

- If the intraday low of the 1st day of the attempted rally is undercut in the subsequent days, then the rally fails and the count is resetted back to zero.

- As long as the days after the 1st day of the attempted rally stay above the initial intraday low of the 1st rally day, you are still in the rally process.

- Look for a “follow-through day” in the 4th to 7th days (inclusive) of the attempted rally. A “follow-through day” is when the index closes up 1% or more with a jump in volume from the day before. Market is then in a new uptrend.

- “Follow-throughs” after the 10th day indicate the turn may be acceptable, but somewhat weaker.

- An initial “follow-through” can occur on any one of the indices and is usually followed a few days later on another index.

- False signals

- About 20% of the time they [the follow-through method] can give a false buy signal, which is fairly easy to recognize after a few days, because the market will usually promptly and noticeably fail on large volume.

- Most true “follow-throughs” will usually show strong positive action on good volume either the day after the “follow-through” or several days later. Convincing power and strength is what you want to observe.

Why not buy at the bottom of the cup? The Risk is Higher

- The objective is not to buy at the cheapest price when the probability of the stock having a huge move may be only so-so.

- The objective is to buy at exactly the right time — the time when the chances are greatest that the stock will succeed and move up significantly.

- I found through our detailed historical studies that a stock purchased at this correct “pivot point,” if all the other fundamental and technical factors of stock selection are in place, will simply not go down 8% (your protective sell rule), and has the greatest chance of moving substantially higher. So ironically, if done correctly, this is your point of least risk.

- On the day the stock breaks out, its trading volume should increase at least 50% above its average daily trading volume.

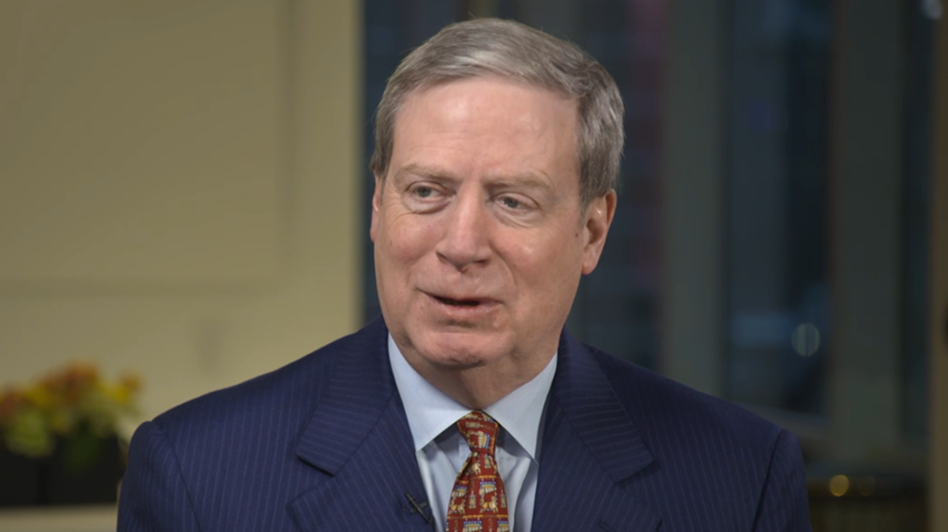

Druckenmiller: I’ve made 3% in the 40% rally from the bottom

What the legendary investor sees next

Stanley Druckenmiller is arguably the greatest macro investor of all time. His record of 30 years straight of 30% returns is nothing short of legendary.

Yet Druckenmiller has never seen a market like this.

“I was up 2% the day of the bottom, and I’ve made all of 3% in the 40% rally,” he told CNBC today. “I missed a great opportunity here. It won’t be the last time.”

His humility and patience are a great lesson but his comments are a reminder of how difficult this rally is to believe in, and how much money might still be on the sidelines.

“I had long-term concerns for the last few years that because of easy money, too much debt was being built up in the corporate sector,” Druckenmiller said. “When Covid hit, I was pretty much of the view that there was a good chance that the credit bubble had finally burst and the unwinding of that leverage would take years.”

In May, Druckenmiller said the risk-reward in equities was the worst he had ever seen and he still says he has the least growth in his portfolio over the past 6-7 years.

One thing he says he underestimated is how far the Fed would go and said there could now be a ‘breadth thrust’ that carries equities higher.

With that, S&P 500 futures just crossed into positive territory year-to-date.