Archives of “Education” category

rss15 Points for Traders

- What everyone else knows is not worth knowing. Knowledge is useless without application. There are many, many miles between doing and knowing.

- Stocks are always way overvalued in a bull market and way undervalued in a bear market. I would argue there is no such thing as value only prices, price is function of supply of buyer and sellers.

- The best stocks will always seem overpriced to the majority of investors. Not sure what constitutes best.

- Expectation, not the news itself, is what moves the market. Density of buyers and sellers move the market but expectation and news can affect that.

- Three basis elements should be considered when evaluating a stock – 1) quality (fundamentals, liquidity, management), 2) price, and 3) trend (the most important). I will take his word for it.

- Stocks act like human beings and go through the same stages and phases as people do, including infancy, growth, maturity, and decline. The key in trading is to be able to recognize which stage the stock is in and to take advantage of that opportunity. In futures markets, what changes is the participants, their objective, and how aggressively they pursue that objective.

- Pyramid your buys – start with an initial position and then add to it only if the trade moves in your favor. A loser does not always mean you got a bad price, that is an important distinction.

- The more experienced and successful you become, the less you should diversify. Stock specific.

- Traders must always resist the urge and temptation to change their strategies for each and every different market cycle. The process is a bajillion times more important than the strategy.

- To succeed in trading you must 1) aim high, 2) control the risks, 3) be unafraid to keep uninvested reserves and 4) be patient. One of the most important things I have learned from my mentor is about risk. People mess up risk too often.

- Successful traders are intelligent, they understand human psychology, they practice pure objectivity, and they have natural quickness. Trading is a cooking not baking. Quickness comes with having a plan.

- You must always trade with the actions of the market and not simply by how you might think the market should trade. Do not risk too much trading that way and understand the psychological risks of trading that way. As far as not using your experience, I am not sure.

- Knowledge through experience is one trait that separates successful stock market speculators from everyone else. Experience is important but can also be a detriment.

- The stock market is more an art than a science and far more complex than most people understand. Complexity of the market is irrelevant to the success as a trader. The process is a science.

- Always sell when you start patting yourself on the back for being smarter than the market. Agree, get out when you have time think about being smarter than the market or anything.

An Eye Test For Traders

Your win-rate expectancy sets the probability for your longest losing streak:

From heaven to hell.

Liquidity of the futures contract on the S&P 500.

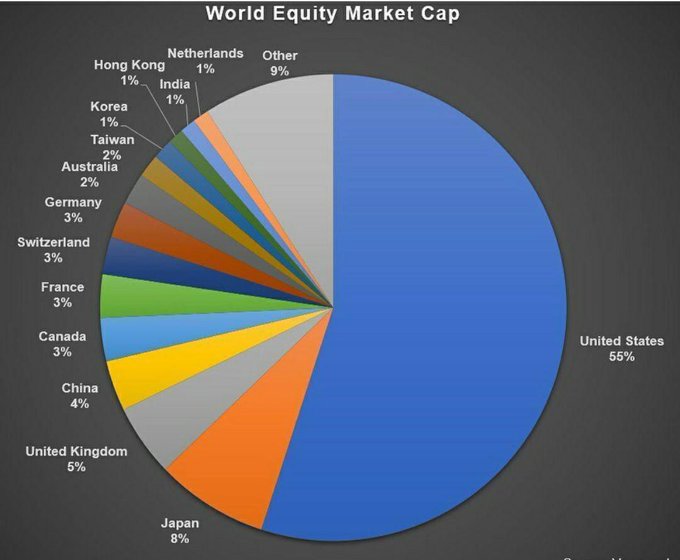

Capitalization of the stock markets worldwide.

Be a Dedicated Trader

- Dedication will show itself as a consistent commitment to understanding the markets and awareness of just how we are affected by it every day.

- The dedicated trader uses a journal to chronicle the market and her actions through the day.

- The trader examines the market in different ways and makes the decision to learn something new every day that makes her a better person and a better trader.

- The dedicated trader studies after hours. She will review trades, scrutinize charts, and work to discover what she had missed during the work day.

Psychological Risk Management

- If you’re out of balance, you’re going to make bad decisions, and trading the market is a decision game

- If you’re overtrading, you’re out of balance

- If you’re overcommited, you’re out of balance.

- If your dollar risk is too high, you’re out of balance.

- If you’re hung over, you’re out of balance.

- If you’re sick, you’re out of balance.

- If you need the money, you’re out of balance.

- If you make too much money, you’re out of balance.

- You’ve got to take time off. You can’t trade every day.

- Pay more attention when you account size gets bigger

- I’ve noticed over the years that when my account has been small for whatever reason, I have been really careful with it. I watch it like a hawk. When my account gets rich, I tend to fall into a habit of neglect. I’m making money. I have profits, and I’m more comfortable. I don’t keep as close an eye on it. That’s very foolish.

- Take profits out of your account

- You should spend some profits rather than letting the money stay in your account indefinitely. That’s been important to me over the years. I withdraw money from time to time and take a vacation or buy a new car. From a behaviorist’s standpoint, it gives a sense of reward. It provides conscious and subconscious motivation.

MANAGE RISK

Position Size Limits

- Trade risk limit

- Never risk more than 2%-5% of your equity on any individual trade.

- Simultaneous open positions risk limit

- The risk on all the open positions together should never exceed 10% of the account.

- The total risk exposure (to their stops) for all positions should never be more than 50% of your total capital.

- Consider correlated markets a single position

- For applying the 2-5% risk per position, consider all the correlated markets as a single position.

- Gradually build up positions

- You need to take a decent-sized (up to 1/3 of equity) position to capitalize on markets that are moving for you. Take a small position initially, and if it starts working, build up to a full weighting.

- Margin limit

- Total initial margin requirements for the contract size you trade should be no more than 15-50% of your account size. 20-30% to be more conservative. 40-50% to be more aggressive.