Archives of “Education” category

rssTRADE WHAT IS NOT WHAT YOU THINK SHOULD BE

Trade what is… for in doing so your trading is based on fact, substance and reality. It provides clarity, confidence, manageability, and useful feedback for consistent success where appreciation for winning, and respect for losing, keeps you in the game.

Do not trade what you think should be….for in doing so your trading is based on egotism, a false sense of foresight, the desire for validation and approval, and the “win at all cost” mentality, which leads to confusion, anxiety, anger, and despair…not to mention the inability to trade another day.

SOMETIMES I JUST SITS

Sitting is ok when the markets are not set up for your trading edge…if you have one. If you do have a trading edge experience has taught you that there are certain times when it works, and works well, and other times when it doesn’t. The quicker you recognize the difference and make the necessary adjustments to suit market conditions, the quicker you can limit losses, thus leading to greater gains.

And right here let me say one thing: After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I’ve known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level, which should show the greatest profit. And their experience invariably matched mine –that is, they made no real money out of it. Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money. It is literally true that millions come easier to a trader after he knows how to trade than hundreds did in the days of his ignorance.

Jesse Livermore, Reminiscences of a Stock Operator

THE TRADER’S MINDSET: PROBLEMS AND SOLUTIONS

TRADERS AND THEIR IRRATIONAL BELIEFS

- What goes up must come down and vice versa. That’s Newton’s law, not the law of trading. And even if the market does eventually self-correct, you have no idea when it will happen. In short, there’s no point blowing up your account fighting the tape.

- You have to be smart to make money. No, what you have to be is disciplined. If you want to be smart, write a book or teach at a university. If you want to make money, listen to what the market is telling you and trade to make money — not to be “right.”

- Making money is hard. Nope. Sorry. Making money is actually easy. Statistically, you’re going to do it about half the time. Keeping it, now that’s the hard part.

- I have to have a high winning percentage to be profitable. Not true. How often you are right on a trade is only half of the equation. The other half is how much do you make when you’re right and how much you lose when you’re wrong. You can remember that with this formula: Probability (odds of it going up or down) x Magnitude (how much it goes up or down) = Profitability.

- To be successful, I have to trade without emotions. That is both wrong and impossible. You are human so you have emotions. Emotions can be a powerful motivator to your trading.

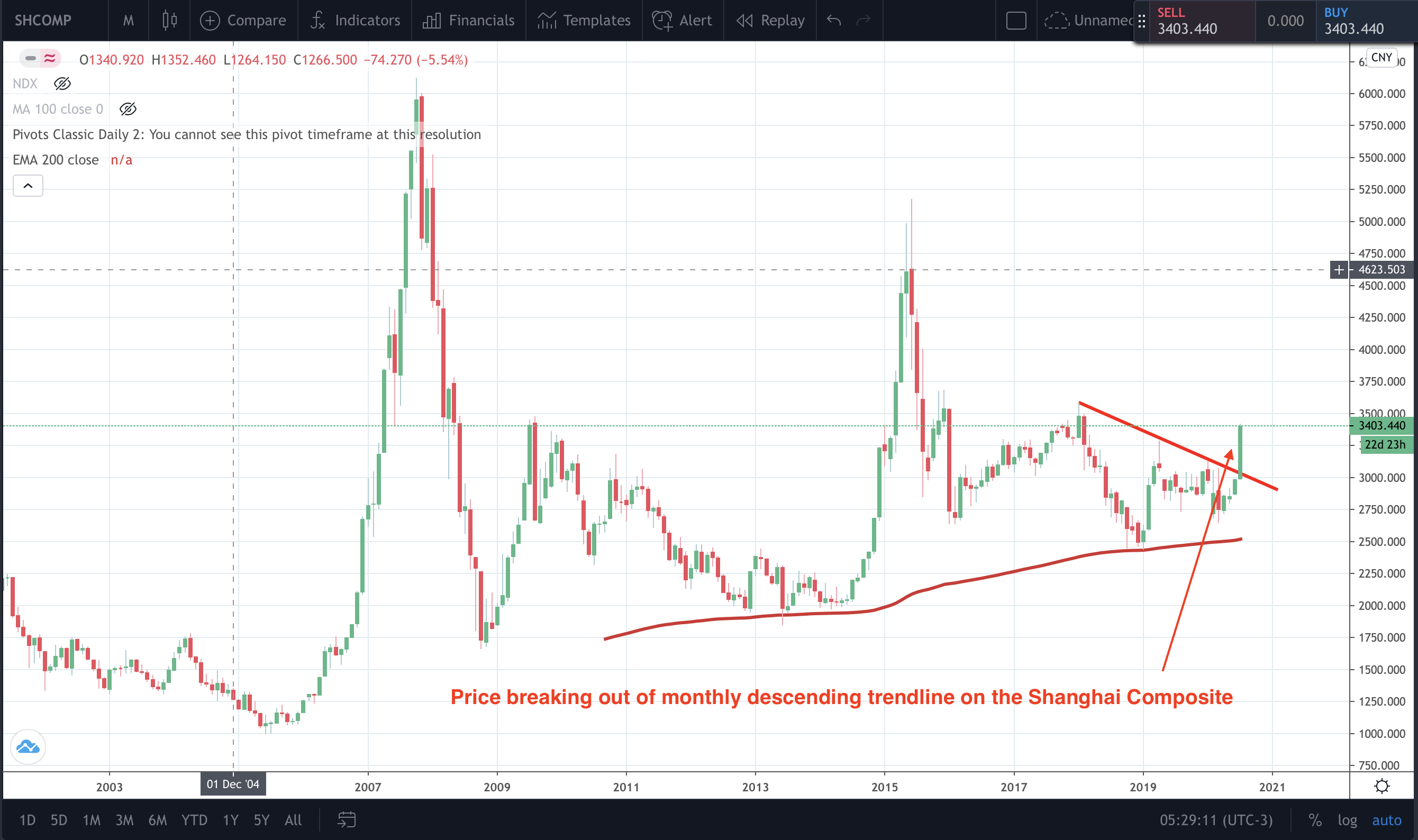

US stocks overvalued, China’s shares more reasonably priced?

Via Bloomberg

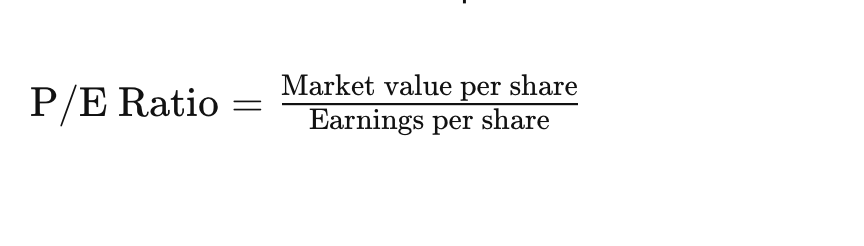

I came across an interesting piece on Bloomberg’s market live blog yesterday making a case for Chinese shares offering better value compared to US stocks This was based on the valuations based on a price to earnings ratio. The price to earnings ratio is a widely used metric for investors to decide on a stock prices valuation. It is calculated by measuring it share price vs its earnings per share. A high p/e ration can mean that a companies stock is over valued.

If you take a look at the chart below you can see that the Nasdaq has a high blended forward P/E ratio just around the 10 mark compared to the other major indices listed. The forward P/E ratio uses future earnings guidance rather than trailing figures. For a run down on the different types of P/E check out this article here.

If you take a look at the chart below you can see that the Nasdaq has a high blended forward P/E ratio just around the 10 mark compared to the other major indices listed. The forward P/E ratio uses future earnings guidance rather than trailing figures. For a run down on the different types of P/E check out this article here.

Now the reason for the Nasdaq’s high p/e ratio is that technological stocks have raced higher on the hopes of increased tech spending, Working from home, spending on software and hardware, and increased moves towards digitalisation are all expected to boost profit hopes of the Nasdaq.

The question going forward as we come into earnings season is whether or not the Nasdaq’s increased stock valuation can withstand an overall shrinkage in the US stock market as a whole. On a bargain p/e basis this means Chinese shares may offer a more stable path to ongoing gains given their low valuations.

1 year percentage change of the top 10 most valuable companies, vs Tesla

Psychological Risk Management

- If you’re out of balance, you’re going to make bad decisions, and trading the market is a decision game

- If you’re overtrading, you’re out of balance

- If you’re overcommited, you’re out of balance.

- If your dollar risk is too high, you’re out of balance.

- If you’re hung over, you’re out of balance.

- If you’re sick, you’re out of balance.

- If you need the money, you’re out of balance.

- If you make too much money, you’re out of balance.

- You’ve got to take time off. You can’t trade every day.

- If you’re overtrading, you’re out of balance

- Pay more attention when you account size gets bigger

- I’ve noticed over the years that when my account has been small for whatever reason, I have been really careful with it. I watch it like a hawk. When my account gets rich, I tend to fall into a habit of neglect. I’m making money. I have profits, and I’m more comfortable. I don’t keep as close an eye on it. That’s very foolish.

- Take profits out of your account

- You should spend some profits rather than letting the money stay in your account indefinitely. That’s been important to me over the years. I withdraw money from time to time and take a vacation or buy a new car. From a behaviorist’s standpoint, it gives a sense of reward. It provides conscious and subconscious motivation.