“These businesses are nascent but the networks established, the brands are already meaningful, and if they grow to a large scale the could be very disruptive to us”

Archives of “Education” category

rss27 28 29

Did you say twenty-seven, twenty-eight, and twenty-nine? Brilliant! You’ve passed the second-hardest part of doing well in the market. Now for the hardest part. Look again at the numbers and say out loud the number that is the highest. Now say the lowest. Which number is between both numbers? Did you say that twenty-seven was the lowest and that twenty-nine was the highest? If you also said that twenty-eight was in the middle, then you’ve passed the test with flying colors! You are on your way to being very successful in the markets. You may be laughing, but I am dead serious. If it really is that simple to recognize what the market is saying at all times, why do you have to complicate it? The vision test that you have taken proves that you can recognize different numbers, and the I.Q. test demonstrates that you know the relationships among them. Believe me when I say that no other knowledge of the market is necessary. This exam determines that you are clearly capable of an egoless view of the market a Zen view, if you wish. A view that is free of personality needs. Twenty-nine is higher than twenty-seven. No one can dispute that. Not even your ego, no matter how hard it may try.

You’ve proven beyond a shadow of a doubt that you can tell when you’ve got a profit and when you’ve got a loss. There is no question about it. Absolutely none. When you buy something at 27 and it goes to 29, you know that you are showing a profit. Absolutely no doubt about it. Conversely, when you do the opposite, you know that you are sitting with a loser. If you bought at 29 and now the price is lower, you must recognize that you have a loss. Don’t rationalize and say that you don’t have a loss until you sell. And don’t say that you know it will come back. You don’t know that, either. And if you say it’s a long-term investment, you’re just kidding yourself. That’s just another way of not having to deal with a mistake. Your ego is just hoping, trying to shield itself from the pain of being wrong. You’ve proven that you know the difference between a profit and a loss. That’s the easy part. Doing something about it is where the difficulty lies.

Trading Expectations

There is a random distribution between wins and losses for any given set of variables that define an edge. In other words, based on the past performance of your edge, you may know that out of the next 20 trades, 12 will be winners and 8 will be losers. what you don’t know is the sequence of wins and losses or how much money the market is going to make available on the winning trades. This truth makes trading a probability or numbers game. when you really believe that trading is simply a probability game, concepts like ‘right’ and ‘wrong’ or ‘win’ and ‘lose’ no longer have the same significance. As a result, your expectations will be in harmony with the possibilities.

Traps and Pitfalls:

- Bad Markets – A good pattern won’t bail you out of a bad market, so move to the sidelines when conflict and indecision take hold of the tape. Your long-term survival depends on effective trade management. The bottom line: don’t trade when you can’t measure your risk, and stand aside when you can’t find your edge.

- Bad Timing – It’s easy to be right but still lose money. Financial instruments are forced to negotiate a minefield of conflicting trends, each dependent on different time frames. Your positions need to align with the majority of these cycles in order to capture the profits visualized in your trade analysis.

- Bad Trades – There are a lot of stinkers out there, vying for your attention, so look for perfect convergence before risking capital on a questionable play, and then get out at the first sign of danger. It’s easy to go brain dead and step into a weak-handed position that makes absolutely no sense, whether it moves in your favor or not. The bottom line: it’s never too late to get out of a stupid trade.

- Bad Stops – Poor stops will shake you out of good positions. Stops do their best work when placed outside the market noise, while keeping risk to a minimum. Many traders believe professionals hit their stops because they have inside knowledge, but the truth is less mysterious. Most of us stick them in the same old places.

- Bad Action – Modern markets try to burn everyone before they launch definable trends. These shakeouts occur because most traders play popular strategies that have been deconstructed by market professionals. In a sense, the buy and sell signals found in TA books are turned against the naïve folks using them.

Germany went off the gold-backed currency in 1914 to pay for the war. From “The Great Disorder” by Feldman

When the world turns the corners go the road not taken..

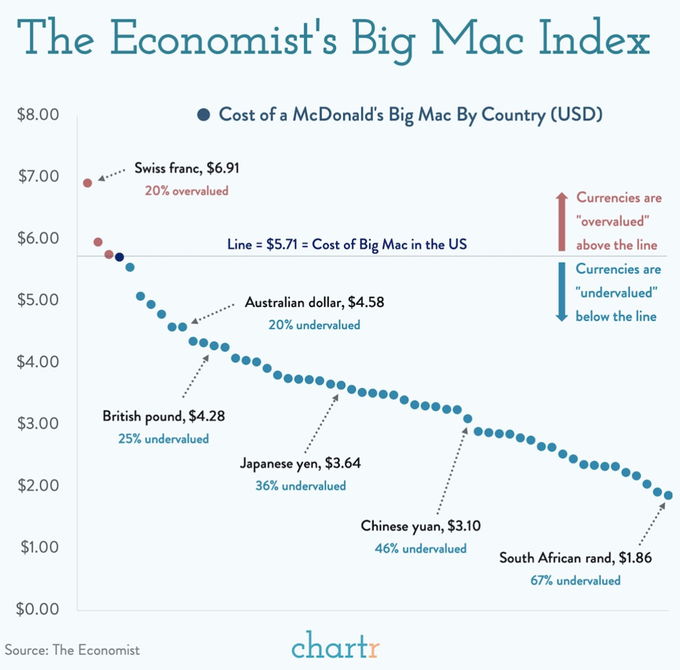

The Big Mac Index.

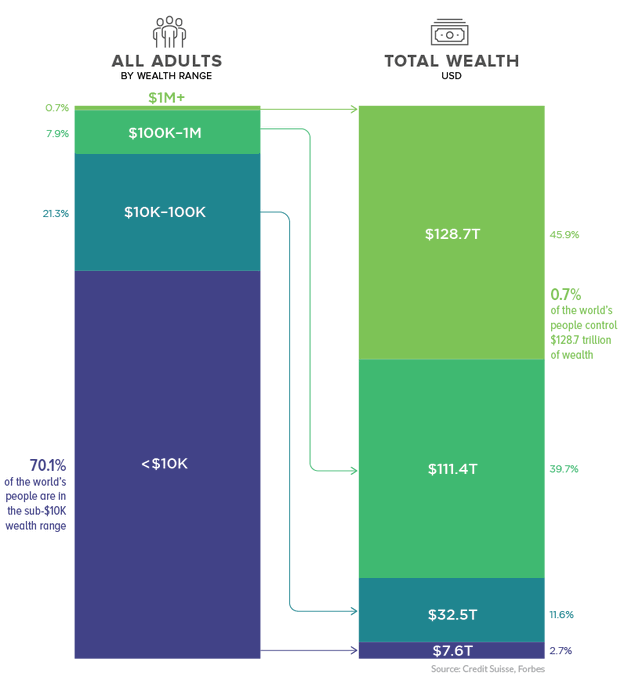

The distribution of wealth in the world.

“What Buffett wouldn’t do”

Investing:

- Don’t be too fixated on daily moves in the stock market (from Berkshire letter published in 2014)

- Don’t get excited about your investment gains when the market is climbing (1996)

- Don’t be distracted by macroeconomic forecasts (2004)

- Don’t limit yourself to just one industry (2008)

- Don’t get taken by formulas (2009)

- Don’t be short on cash when you need it most (2010)

- Don’t wager against the U.S. and its economic potential (2015)

Management:

- Don’t beat yourself up over wrong decisions; take responsibility for them (2001)

- Don’t have mandatory retirement ages (1992)

- “Don’t ask the barber whether you need a haircut” because the answer will be what’s best for the man with the scissors (1983)

- Don’t dawdle (2006)

- Don’t interfere with great managers (1994)

- Don’t succumb to the attitudes that undermine businesses (2015)

- Don’t be greedy about compensation, if you’re my successor (2015)

Last, Buffett advises “Don’t worry about my health” — because Berkshire’s future success is is tied to reinsurance lieutenant Ajit Jain. “Worry about his.” (2001)

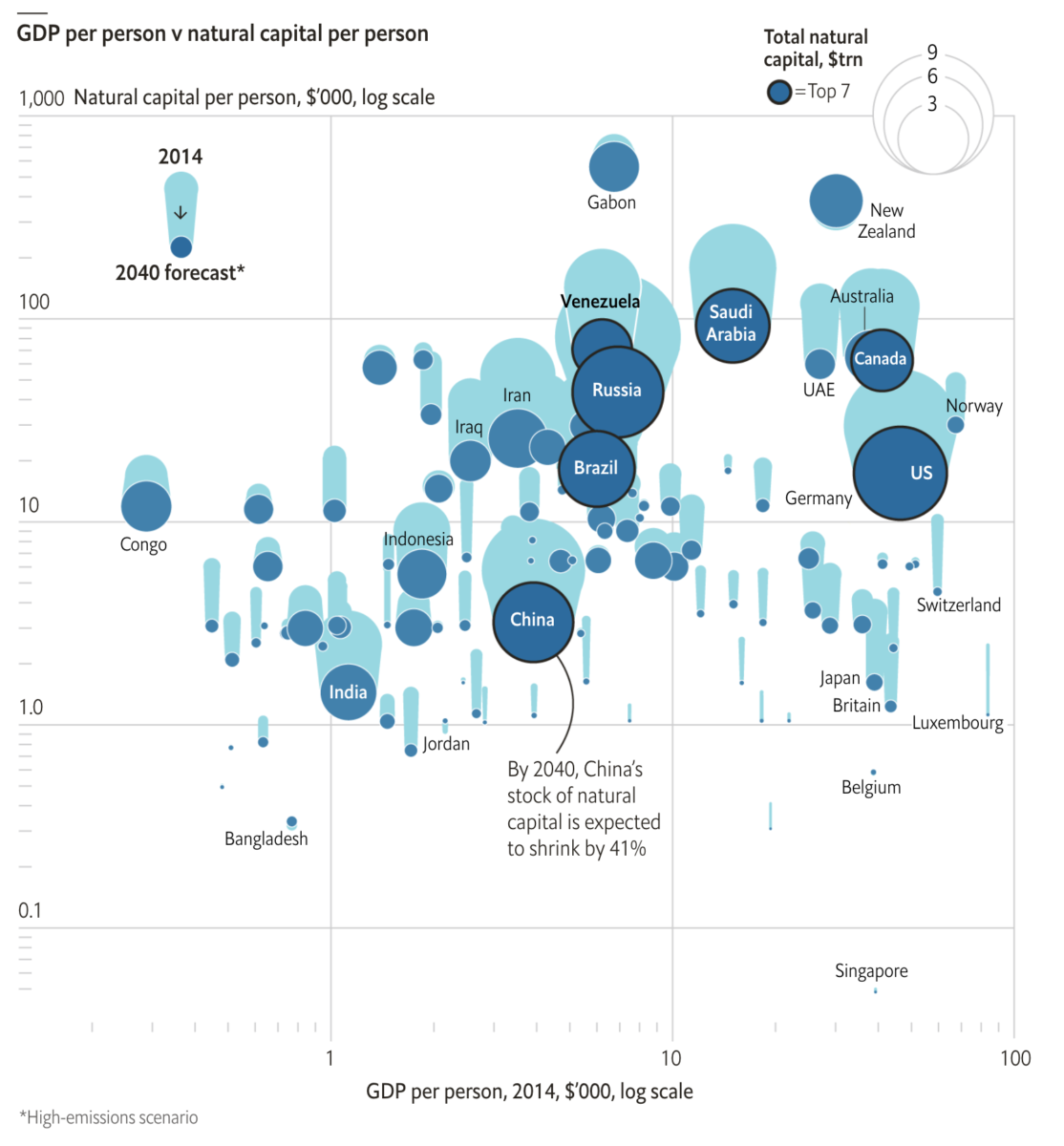

The world’s wealth is looking increasingly unnatural

Investing:

Investing: