Archives of “Education” category

rssDon’t over leverage

Leverage can be a killer

The use of leverage is almost certainly the most important aspect of risk management. In turn proper risk management is the top priority for all traders. Or at least it ought to be.

This is the case whether you are trading for a fund, your family or even a personal account. Furthermore, whether people realise it or not, managing risk is going to be one of the single most important factors in your success or otherwise as a forex trader.

You can’t trade if you have no capital left. Many traders have over leveraged, lost all their capital and then never traded again. In contrast, the proper use of leverage will prevent you from destroying your account and preserve your capital as a trader.

Sometimes people say it is just about greed or fear. However, often times it is simply ignorance as to how leverage works.

Ray Dalio gets the rebound right but trades it wrong

Rough year for Bridgewater

Bloomberg today writes about Bridgewater and note that its Pure Alpha II fund is down 18.6% year-to-date after a flat year last year.

The story details internal turmoil at the firm managing $148 billion. They also highlight a issue that every trader has faced; getting the strategy right and the execution wrong:

This year’s inability to turn big ideas into big returns may be the last straw for some investors after nearly a decade of low-single-digit gains coupled with high fees.The problem, according to those with inside knowledge who asked not to be identified without permission to speak publicly about the firm, is that Bridgewater cut risk in March as the market crashed and was slow to ramp up again — even as the Federal Reserve unleashed an unprecedented support effort. So even though it correctly touted trades such as going long equities, buying gold and betting on the yen against the dollar, it failed to benefit from its own foresight.

Bill Gates, Jeff Bezos, Andre Agassi & Pete Sampras play tennis (2001)

4 levels of competence

“Don’t marry a position.”

Marriage is for couples that want to be emotionally and materially bonded and is simply not appropriate for a trader’s relationship to a trading position. Remember, the market is open every day with an endless amount of opportunity for those with heads clear and objective enough to discern it.

Marrying positions generally occurs to traders with losing trades because winners generally cash out, while losers can take a longer time to divorce emotionally.

Also, giving into your emotions while trading is a common sign that you may be trading without a plan or perhaps disregarding the plan you do have. Emotional trading is the first step in losing discipline.

Remember, trading is a highly competitive business that does not take prisoners. Much like a casino, the market will not let you have your money back once lost!

Trade Management

- Only exit when stopped at the point where trend reverses.

- When you sell because you think that it has gone far enough, or the opposing forces are becoming stronger, you are essentially predicting the short-term movement of the price. Nobody can do that successfully. Let the fighting take place and resolve itself.

- Ignore the immediate momentum, only the structure matters. The

- Immediate momentum can be clearly down but it is just a temporary rock, it cannot alter the structure / shape of the stream.

- Let the stream flow its natural course, there will be rocks along the way that attempt to impede the flow, but the flow will continue.

- If you get stopped out when your stop is at a logical spot and price quickly went back to your entry price, re-enter immediately

- The re-entry does not require your fresh entry criteria to be satisfied.

- This is for the situation where there is a shake out that is quickly repelled.

- The stop for the re-entry would be your original stop. In the case of a long, the first violation of your stop made a lower low. After you re-enter, if price hits your original stop again, it would have meant that price went up, made a lower high, came back down and hit your stop. So you would have a lower low and a lower high — a trend reversal, so you should not be holding your long position. Reverse for a short. By right it would also mean that after you re-entered, and you see a lower high forming, it is also time to get out of the position even before the initial stop gets hit.

- If you get stopped out when your stop is at a breakeven level, you re-enter immediately if the logical spot level holds

- In this case the re-entry price need not be the same price as the stopped out price, since the stopped out price was at the same level as the previous entry. Just apply the usual entry rules.

- Re-enter immediately if you get shaken out (i.e. you manually exited your position because you fear the position going against you) by immediate momentum

- If you are shaken out by immediate momentum, you have just made a trading mistake. Get back in immediately.

- Support and resistance still needs to be obeyed (including major levels such as VWAP, day high, day low, prior day close). If a level is acting as it should, follow it.

- E.g. if trend is down, you get to an area near a support level, tighten your stop to a momentum stop. Once your stop gets hit, place a re-entry stop order at the spot where it shows your countertrend exit is wrong.

- A support is not a reason for going long in a downtrend. In a downtrend, a support means you should get flat, and wait for the support to be broken to get back in.

- A resistance is not a reason for going short in an uptrend. In an uptrend, a resistance means you should get flat, and wait for the resistance to be broken to get back in.

- If you end up getting out too early, stop chasing, wait for the pullback, be satisfied with the bit that you got because it is too risky to chase further.

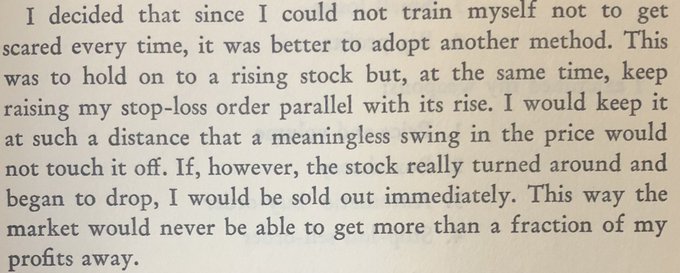

Risk control money mgmt is the key – from Darvas

Meanwhile Covid Era Investors

Ray Dalio on Focus

- You can have virtually anything you want, but you can’t have everything you want.

- Life is like a giant smorgasbord of more delicious alternatives than you can ever hope to taste. So you have to reject having some things you want in order to get other things you want more.

- Some people fail at this point, afraid to reject a good alternative for fear that the loss will deprive them of some essential ingredient to their personal happiness. As a result, they pursue too many goals at the same time, achieving few or none of them.

- In other words, you can have an enormous amount: much, much more than what you need to have for a happy life. So don’t get discouraged by not being able to have everything you want, and for God’s sake, don’t be paralyzed by the choices. That’s nonsensical and unproductive. Get on with making your choices.