- Tendency to overvalue wagers involving a low probability of a high gain and to undervalue wagers involving a relatively high probability of low gain.

- Tendency to interpret the probability of successive independent events as additive rather than multiplicative.

- Belief that after a run of successes, a failure is mathematically inevitable, and vice versa (aka Monte Carlo fallacy).

- Perception that a favorable event has higher probability over an unfavorable event even though their mathematical probability is the same.

- Tendency to overestimate the frequency of occurrence of infrequent events and to underestimate that of comparatively frequent ones after observing a series of randomly generated events.

- Confuse the occurrence of “unusual” events with the occurrence of low-probability events (e.g. getting 13 spades is just as probable as getting any other hand).

Archives of “Education” category

rss15 Trading Lessons from the The Big Short

It’s possible to be right about a market move, but your timing can be too early.

It’s possible to be right about a market move, but your timing can be too early.- If you trade too big, you can lose all your capital before you have the time to be proven right.

- AAA agency ratings are more to make their clients who sell bonds happy than to protect investors.

- In markets that are not liquid, you can get in trouble by being right but your assets not reflecting it with a big move.

- When there is no risk of ruin to bankers and mortgage brokers they will risk the ruin of their companies and the world economy in pursuit of quick and easy money.

- When there is little ‘skin in the game’ bankers and mortgage brokers take risks that they are not held accountable for.

- Macro traders have to be able to take a lot of heat and losses on their positions before they are right.

- Hedge fund investors want consistent returns on their money and not drawdowns. They are quick to pull their money out during a losing streak.

- You want to have a large risk/reward ratio on your trades. Betting $1 for a chance to make $20 is a good trade.

- There is a lot of fraud in the financial world.

- Financial fraud is almost never prosecuted in the banking world.

- The SEC has little oversight in the banking industry.

- Bailouts can cause you to lose on a trade you would have made money on.

- You have to take your profits off the table while they are available.

- “Whenever you find yourself on the side of the majority, it is time to pause and reflect.” – Mark Twain

The time value of money formula is:

FV = PV x [ 1 + (i / n) ] (n x t)

- FV = Future value of money

- PV = Present value of money

- i = interest rate

- n = number of compounding periods per year

- t = number of years

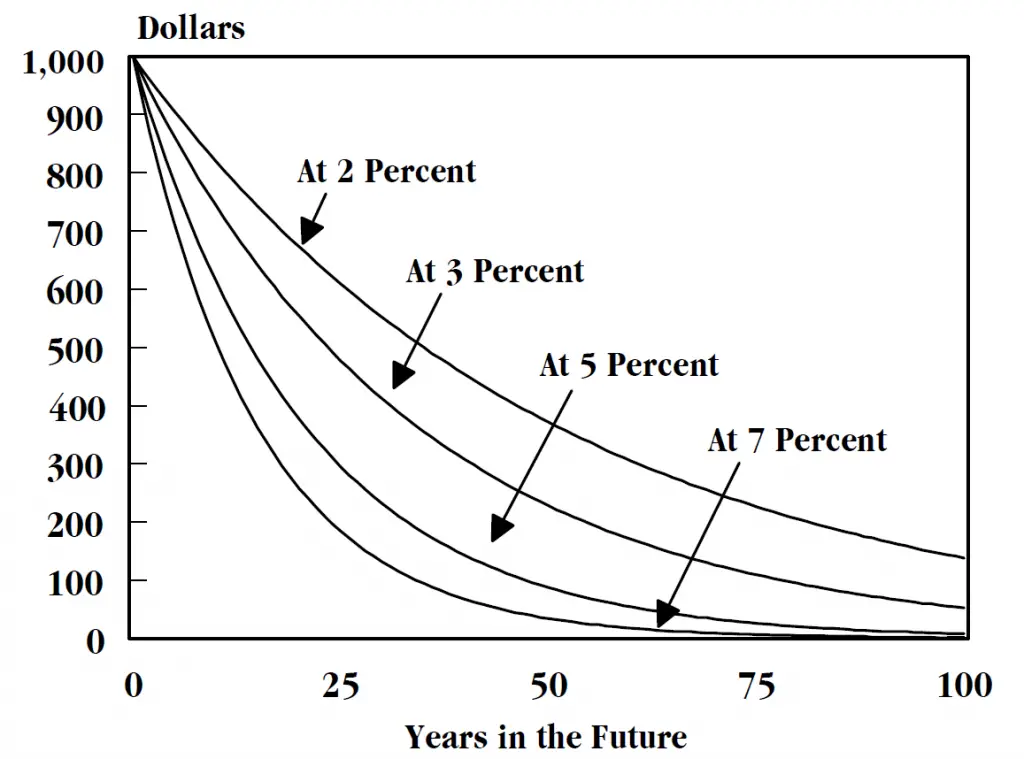

One of the biggest filters to calculate the destruction of the value of money into the future is the current rate of inflation on a currency.

“Discipline is choosing between what you want now and what you want most.” — Abraham Lincoln

1925 “Studies in Stock Speculation”

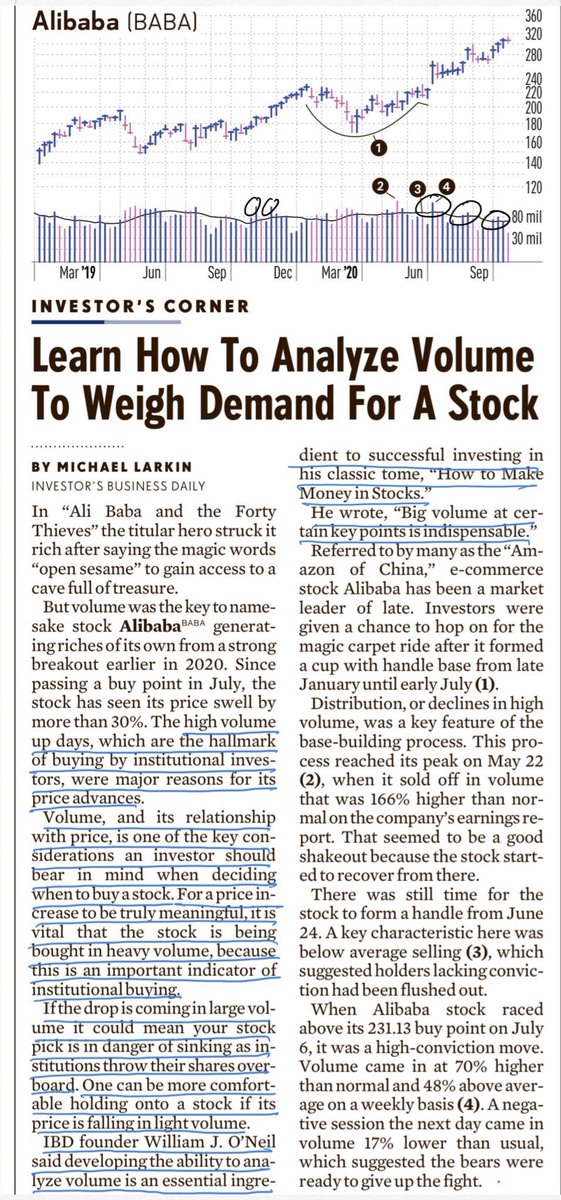

Nice reminder article on the importance of volume in relation to price performance in this weeks IBD.

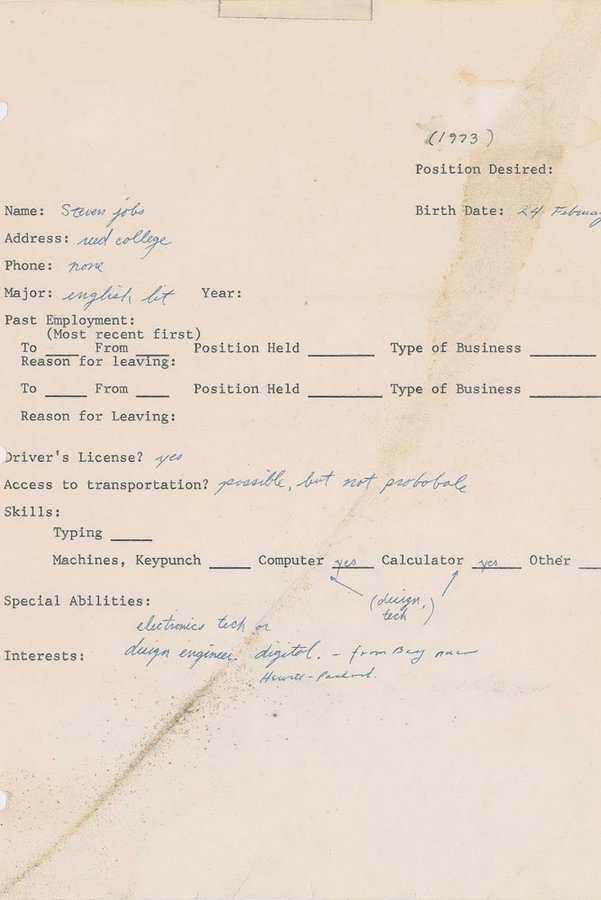

1973 job application, Steve Jobs Skills: (computer, calculator, design, tech)

The 7 fears you must overcome to be successful.

Fear of Criticism People often fear the thoughts of others and how it will impact their life. However, your thoughts are more important and making decisions for yourself regardless of potential criticism is how you truly become successful.

Fear of Poverty Most people think their current life is as good as it gets and are scared of taking any risks to potentially lose what they have. But you will never know how much you can achieve or how far you can go in life if you never take risks.

Fear of Old Age Benjamin Franklin said “Many people die at 25 but are buried at 75.” People often give up on their dreams before even getting started. They wait for the perfect opportunity before taking chances instead of creating chances for themselves.

Fear of Failure Focusing on failure instead of succeeding is the wrong mindset to live with. Mistakes are fin, bad decisions are fine, quitting is not fine. Typically failure is part of success so view it as an opportunity and push forward through failure.

Fear of Offending Others Being afraid of offending anyone is living in fear. You should be proud of who you are, proud of your decisions and never be afraid to be yourself. Show the world who you are, take chances and see how far you can go.

Fear of Being Ridiculed You need to live your life with blinders on. Focusing on only what you want and what you need to do to achieve that. Being ridiculed can be used as fuel to push you forward when you are in fear. Use it as fuel.

Fear of Success Sadly, people are afraid of their own potential. Most people assume being successful is unattainable and develop fears for even attempting to be successful. But success is attainable to all who work for it. It may not come easy, but it is achievable for anyone.

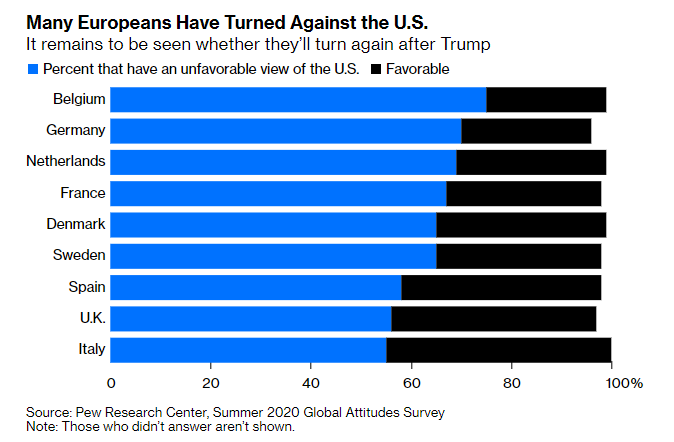

Two in three Europeans have a negative view of the U.S.

It’s possible to be right about a market move, but your timing can be too early.

It’s possible to be right about a market move, but your timing can be too early.