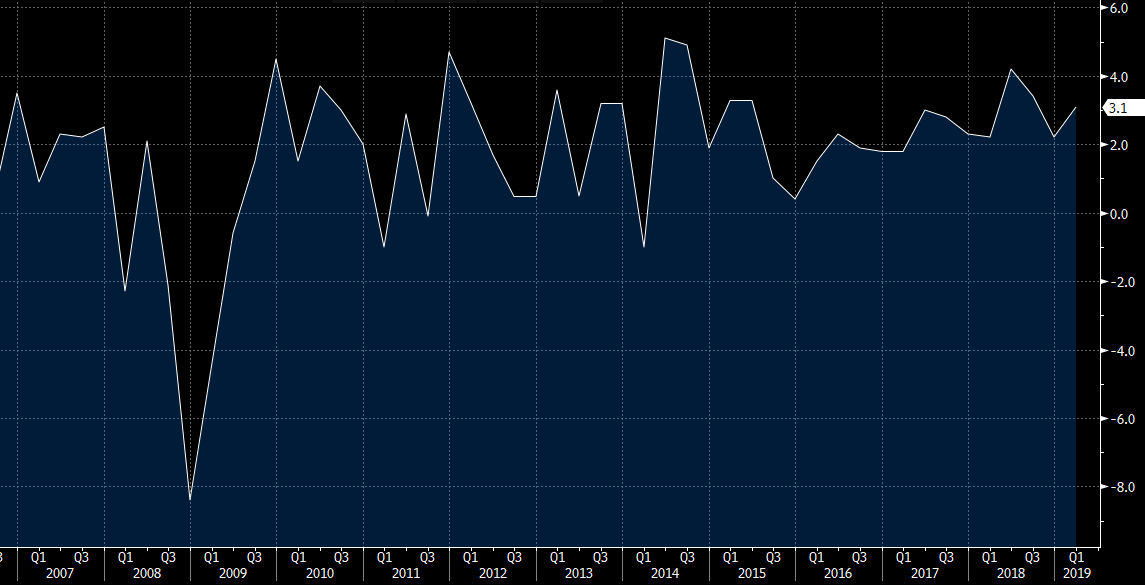

US GDP is $19.3T US Imports are $2.4T US imports from China $539B Goods subject to tariffs $200B Tariffs collected $20B We are taking about .1% of GDP max, and .002% of GDP with price elasticity

US GDP is $19.3T US Imports are $2.4T US imports from China $539B Goods subject to tariffs $200B Tariffs collected $20B We are taking about .1% of GDP max, and .002% of GDP with price elasticity

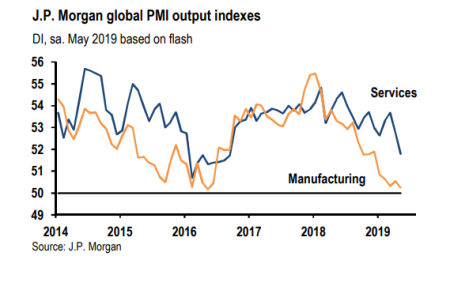

So much for a strong consumer & services resiliency in the face of manufacturing weakness

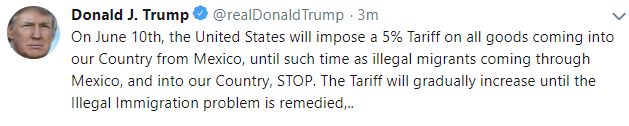

Adds in the next tweet:

Adds in the next tweet:Brazil’s economy shrank in the first quarter of this year, marking the first contraction since 2016 and underlining the challenge facing the government of Jair Bolsonaro.

Gross domestic product in Latin America’s largest economy fell 0.2 per cent in the March quarter compared to the previous quarter, according to the national statistics agency IBGE. The figure was in line with analysts’ forecasts and represented the first quarter-on-quarter contraction since the fourth quarter of 2016.

Compared to the first quarter of last year, the economy grew 0.5 per cent, also as expected.

“Despite hopes for a quick recovery after Jair Bolsonaro took over the presidency, the hard economic data have made for grim reading,” said analysts at Capital Economics ahead of the release of the GDP figures.

Mr Bolsonaro took power in January on an ambitious promise to revive an economy that is still reeling from a brutal two-year recession that was the worst in the country’s history.

But thus far, the rightwing president has failed to unleash the animal spirits that some had expected. The economy almost ground to a halt in the fourth quarter while monthly figures from the retail and services sectors suggest that growth slowed sharply. Consumer and business investment remain sluggish and the hoped-for fiscal reforms — particularly to the country’s bloated pensions system — have been delayed by political infighting.

The quarterly fall in output leaves the country at risk of a recession, typically defined as two consecutive quarters of contracting GDP.