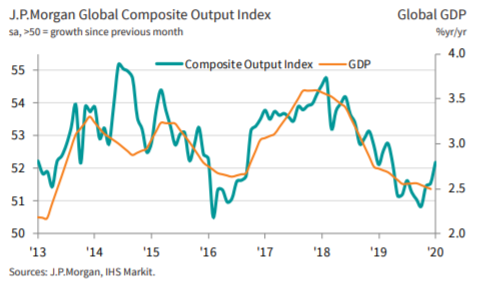

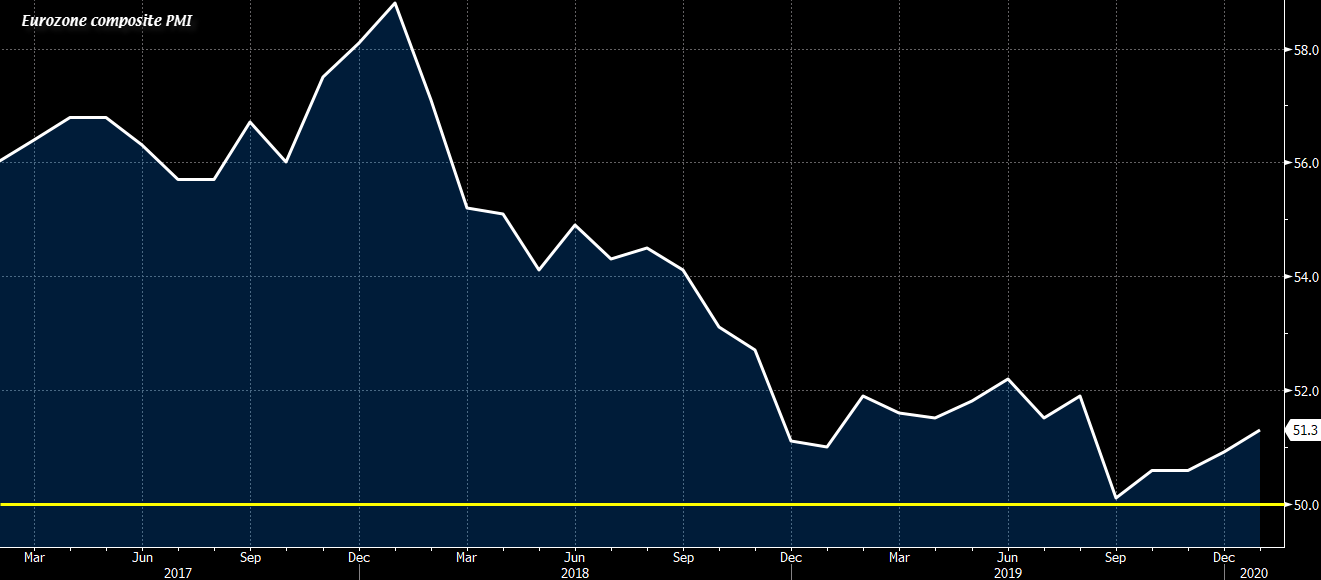

The widening coronavirus outbreak is expected to dampen world economic growth at least briefly, the head of the International Monetary Fund warns.

The impact of the disease, “in the short term, is likely to bring some slowdown,” IMF Managing Director Kristalina Georgieva told reporters here Friday. “In the long term, we don’t know. We have to assess how quickly action is being taken to contain the spread of coronavirus and how effective this action is.”

Effects are already manifesting, Georgieva reported. “We see some indirect impacts building up around manufacturing, value chains being impacted by the disruption caused by the virus,” she said. “We see impact on travel and on tourism.”

Severe acute respiratory syndrome ultimately had only a “relatively minor impact” on global growth, Georgieva said. SARS killed 774 people in 29 countries and regions by the time it ran its course in 2003, according to the World Health Organization.

Georgieva said that “there was a dip in growth in the months during and immediately after the containment” of the epidemic. But then came a rebound, and growth for the year “ended up being just 0.1% lower,” she added.

Yet China plays a much larger role in the international economy than it did 17 years ago.

“The Chinese economy at the time of SARS, in terms of share in the world economy, was smaller,” Georgieva said. It accounted for 4% of global gross domestic product then but contributes 18% now, “and therefore we are seeing a country with more significance globally,” she explained.

The repercussions of the coronavirus outbreak are already apparent in supply chains, according to Kristalina Georgieva, the IMF’s managing director. (Photo by Takeshi Kawanami)

(more…)