Archives of “Economy” category

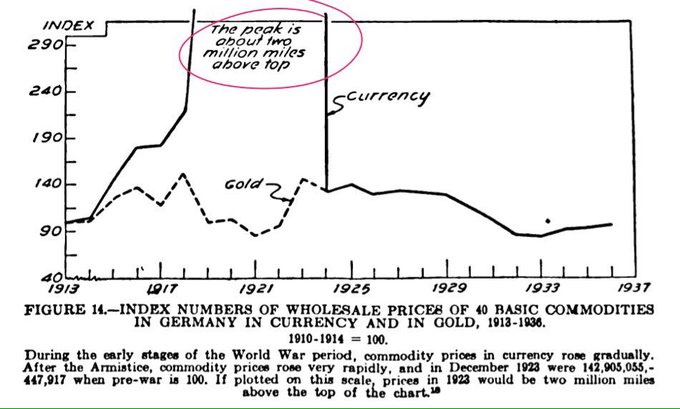

rssReminds me of this chart plotting Weimar hyperinflation where the analyst calculates wholesale prices would run 2 million miles above top.

literally off the chart..

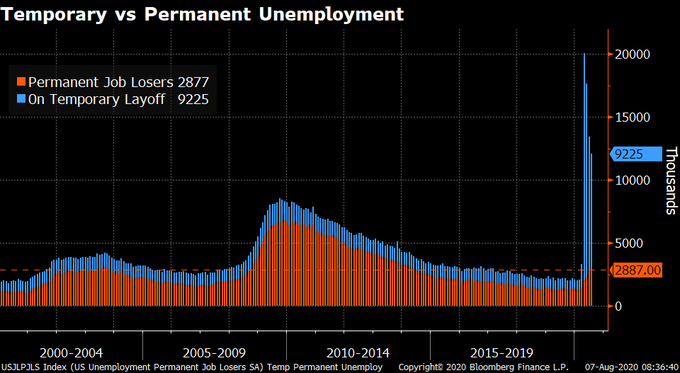

Temporary vs Permanent Unemployment:

BOE leaves bank rate unchanged at 0.10%

BOE announces its latest monetary policy decision – 6 August 2020

- Prior 0.10%

- Bank rate votes 0-0-9 vs 0-0-9 expected

- Asset purchase program total £745 billion

- Will continue to minor the situation closely

- Stands ready to adjust monetary policy accordingly

- UK GDP expected to have been over 20% lower in Q2 2020 than Q4 2019

- Higher frequency indicators imply that spending has recovered significantly

- Projections assume that direct impact of the virus will dissipate gradually

- Housing market activity appears to have returned to close to normal levels

- Doesn’t intend to tighten policy until there is clear evidence that significant progress is being made in eliminating spare capacity and 2% inflation is sustained

- Risks to the outlook are judged to be skewed to the downside

- Sees UK GDP at -9.5% in 2020 (previously -14%)

- Sees UK GDP at +9% in 2021 (previously +15%)

- Sees UK GDP at +3.5% in 2022 (previously +3%)

- Sees UK CPI at 0.25% in 2020 (previously 0.60%)

- Sees UK CPI at 1.75% in 2021 (previously 0.50%)

- Sees UK CPI at 2.00% in 2022 (previously 2.00%)

There are positives and negatives to take away but on the balance of things, it is more skewed to the former by the slightest bit. But in terms of key policy decisions, nothing has really changed as the BOE reaffirms their commitment to support the economic recovery.

In terms of positives, they are seeing that the economic downturn isn’t as severe – the language and current year projection show that – and that is something for bulls to chew on. In terms of negatives, it’s mostly on the inflation narrative over the next few months.

However, policymakers still see a modest recovery in inflation next year so that’s another positive takeaway but for now, it means more accommodative policy will stay for longer.

On the issue of negative rates, they side-stepped that by saying that they have other instruments to tweak such as asset purchases and forward guidance for now.

The pound is rising to fresh session highs against the dollar following the decision, with cable up to 1.3180 from around 1.3130 before the announcement.

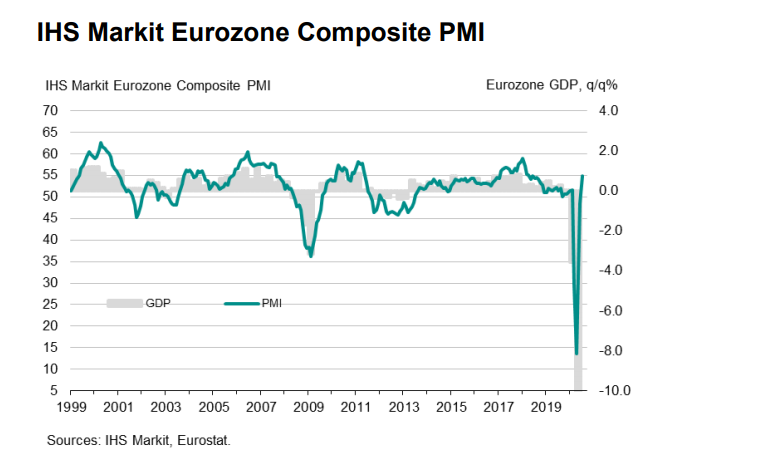

Eurozone July final services PMI 54.7 vs 55.1 prelim

Latest data released by Markit – 5 August 2020

- Composite PMI 54.9 vs 54.8 prelim

The preliminary release can be found here. That is more or less close to initial estimates as the final report reaffirms that the euro area economy observed a modest rebound in July, as domestic demand improves following the easing of virus restrictions.

That said, the outlook remains relatively uncertain still with labour market conditions a key area to focus on in the latter stages of Q3 and in Q4, with government stimulus measures to wear off. Not to mention, the potential for a secondary virus outbreak in the region.

Markit notes that:

“Eurozone service sector business activity rebounded in July to grow at a rate not exceeded for over two years. France and Germany enjoyed especially strong gains though renewed growth was also recorded in Spain and Italy as COVID-19 containment measures continued to be relaxed.

“Combined with a surge in manufacturing production, the renewed expansion of the service sector bodes well for the economy to rebound in the third quarter after the unprecedented slump seen in the second quarter.

“Whether the recovery can be sustained will be determined first and foremost by virus case numbers, and the recent signs of a resurgence pose a particular risk to many parts of the service sector, such as travel, tourism and hospitality. However, even without a significant increase in infections, social distancing measures will need to be in place until an effective treatment or vaccine is available, dampening the ability of many firms to operate at anything like pre-pandemic capacity, and representing a major constraint on longer-run economic recovery prospects.

German Ifo institute says auto industry shows initial signs of recovery

Ifo says automakers expect their exports to increase

This is based on a survey published by the institute today, with auto industry business expectations rising from 26.9 in June to 43.7 in July. Adding that demand and order books also improved in the past month.

That said, the indicator for the current business situation was still negative.

Despite the optimism, the fact that global trade continues to stay extremely subdued and the virus situation getting worse around the world won’t help with that.

Foreign demand conditions should improve over time but to expect a return to pre-virus levels any time soon will be mistaken. Even a swift recovery may not be anticipated and whatever we have seen from May to July/August may be as good as it gets for now.

Japan final Q1 GDP -0.6% q/q

January to March economic growth data from Japan. Old, old news by now.

- GDP sa q/q -0.6%, prior -0.6%

- GDP annualised sa q/q -2.2%, prior -2.2%

- GDP nominal q/q -0.5%, prior %

- Private consumption -0.8% q/q, prior -0.8%

- Business spending +1.7%, prior +1.9%

Yen unchanged.

U.S. GDP Growth 1946 – Current:

Japan to release several growth forecasts for fiscal year 2020, 2021 – report

Reuters reports, citing four government sources familiar with the matter

The multiple forecasts are due to the uncertainty over how long the coronavirus pandemic will last, with the government planning to release several scenarios for both fiscal year 2020 and also fiscal year 2021.

It is reported that the government will give projections for GDP based on two assumptions i.e. either the pandemic would end quickly or be prolonged.

As unusual as it may be for policymakers to do so, it is only prudent given the current situation. But as mentioned before, take forecasts during this period with a pinch of salt.

It is an evolving process and view, depending on how the virus situation plays out globally.

As for Japan itself, the country recorded another 981 new virus cases yesterday – a new daily record – with ~8,300 active infections seen currently. For some context, there was “only” ~1,000 active cases on 30 June.