Archives of “Economy” category

rssChina PMIs (August) Manufacturing 51.0 (expected 51.2) Non-manufacturing 55.2 (expected 54.2)

These are the official PMIs, the unofficial Caixin Markit PMIs will follow later ion the week.

For August:

Manufacturing 51.0

- expected 51.2, prior 51.1

Non-manufacturing 55.2

- expected 54.2, prior 54.2

Composite 54.5

- prior 54.1

While manufacturing is a touch softer services are gaining, a positive sign for the domestic economy.

Data from China’s National Bureau of Statistics and China Federation of Logistics and Purchasing.

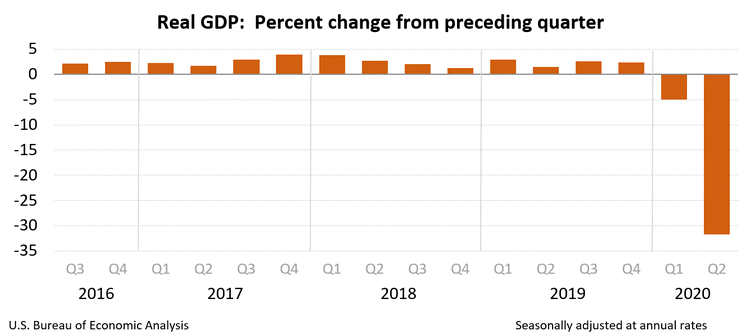

US Q2 GDP second reading -31.7% vs -32.5% expected

The second reading on Q2 gross domestic product

- The first estimate was -32.9%

- Q1 was -2.5%

- Final sales -28.5% vs -29.3% prelim

- Business investment -26.0% vs -27.0% prelim

- Consumer spending -34.1% vs -34.6% prelim

- Exports -63.2% vs -64.1% prelim

- Imports -54.0% vs -53.4% prelim

- Inventory change -$286.4B vs -$315.5B prelim

- GDP deflator -2.3% vs -2.0% expected

- Full release

Despite the headline, there’s more good news here than bad. The revision higher in inventories means that inventory rebuilding will be less of a tailwind in Q3 and Q4 than anticipated. The drop in inflation also added to real GDP.

“In the second estimate, real GDP decreased 31.7 percent in the second quarter, an upward revision of 1.2 percentage points from the previous estimate issued last month. The revision primarily reflected upward revisions to private inventory investment and PCE,” the BEA said in the release.

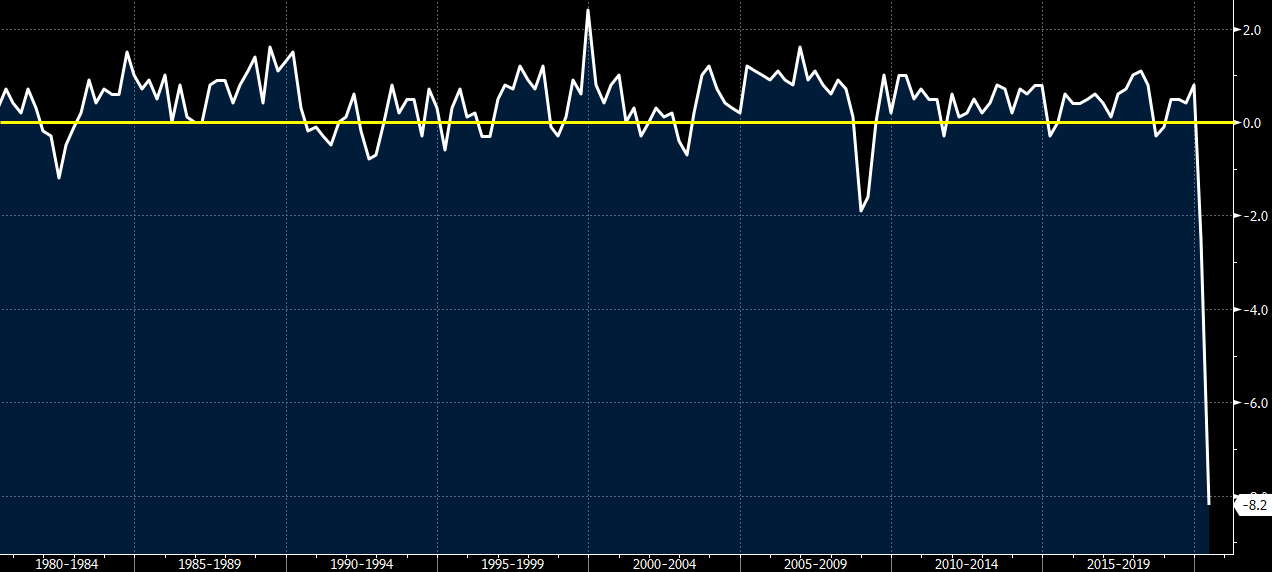

Switzerland Q2 GDP -8.2% vs -9.0% q/q expected

Latest data released by the Federal Statistics Office – 27 August 2020

- Prior (Q1) -2.6%; revised to -2.5%

- GDP -9.3% vs -10.4% y/y expected

- Prior -1.3%; revised to -0.7%

This just reaffirms the biggest quarterly contraction on record in the Swiss economy, which is reflective of global economic conditions in general during Q2. The recovery trajectory is still questionable, with price pressures a key concern for the SNB at this stage.

France to unveil economic recovery plan on 3 September

As confirmed by French prime minister, Jean Castex

The original unveiling date for the proposed plan was for 25 August but that has been pushed back since the weekend, with the government now confirming that they will present details of the €100 billion plan on 3 September instead.

Castex also adds that local authorities would do all they can to avoid another lockdown in efforts to limit the spread of the virus, as fears are growing over a second wave of infections starting to hit the country over the past few weeks.

Germany August Ifo business climate index 92.6 vs 92.1 expected

Latest data released by Ifo – 25 August 2020

- Prior 90.5

- Expectations 97.5 vs 98.0 expected

- Prior 97.0

- Current assessment 87.9 vs 86.2 expected

- Prior 84.5

Slight delay in the release by the source.

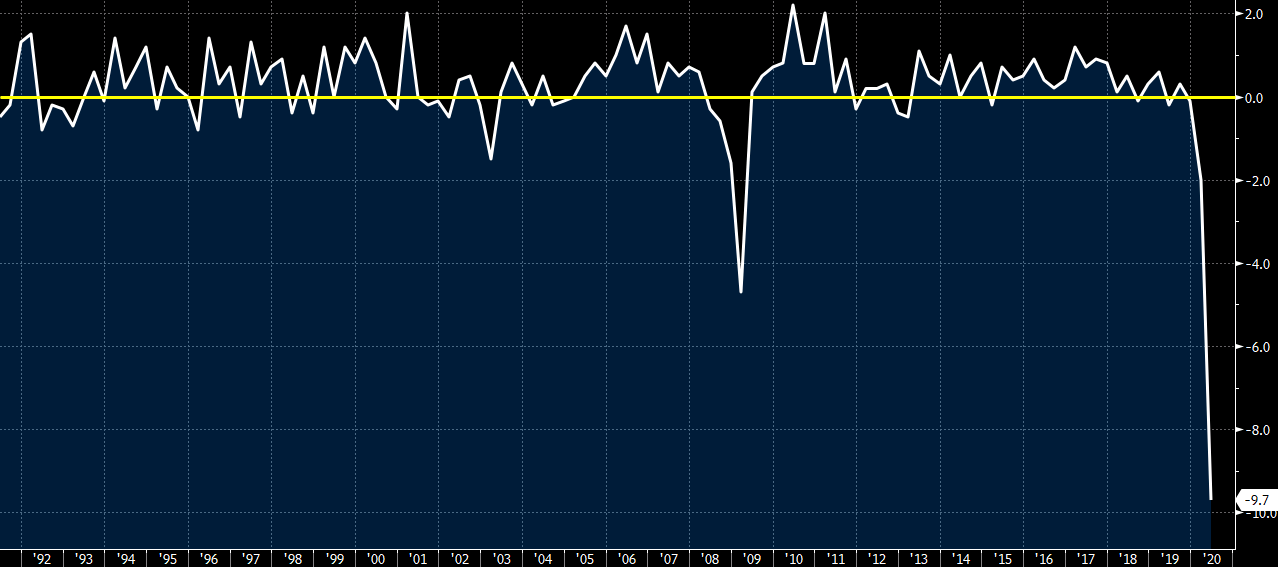

Germany Q2 final GDP -9.7% vs -10.1% q/q prelim

Latest data released by Destatis – 25 August 2020

- Non-seasonally adjusted GDP -11.3% vs -11.7% y/y prelim

- Working day adjusted GDP -11.3% vs -11.7% y/y prelim

- Private consumption -10.9% vs -9.8% q/q expected

- Prior -3.2%; revised to -2.5%

- Government spending +1.5% vs +1.5% q/q expected

- Prior +0.2%; revised to +0.6%

- Capital investment -7.9% vs -12.2% q/q expected

- Prior -0.2%; revised to -0.5%

Slight delay in the release by the source. The preliminary report can be found here.

The German economy shrank by slightly less than initially estimated, but it still is the biggest quarterly contraction on record amid the fallout from lockdown measures and the virus outbreak in general from April to June.

There was a heavy drag on consumption/spending but that is largely unsurprising and that contributed to the sharp decline in economic activity seen last quarter.

Headed for total disaster. A clear trend of worsening fiscal disorder since the break of the gold standard in 1971.

How does it all end? Colossal monetary dilution. None of us own enough gold.