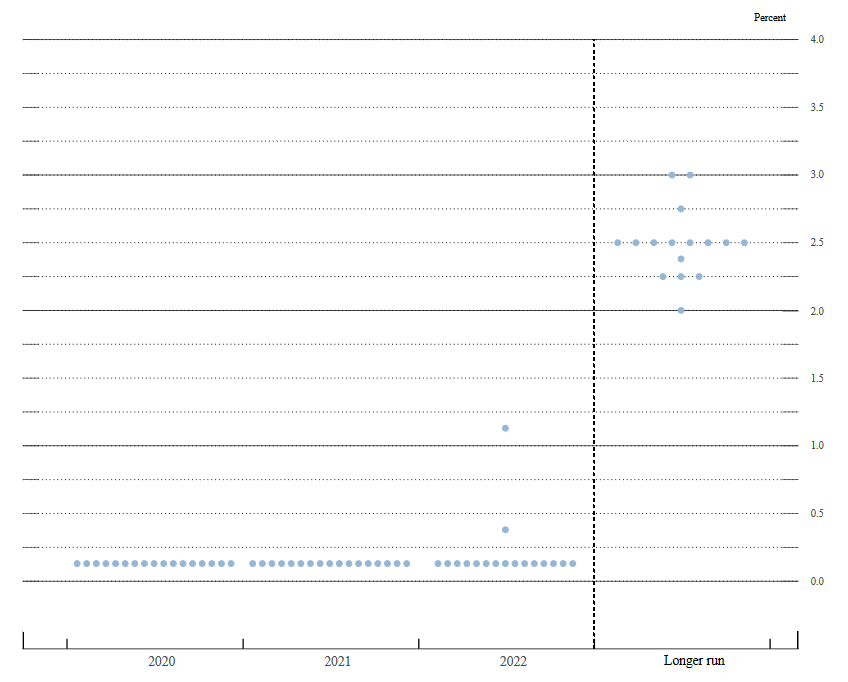

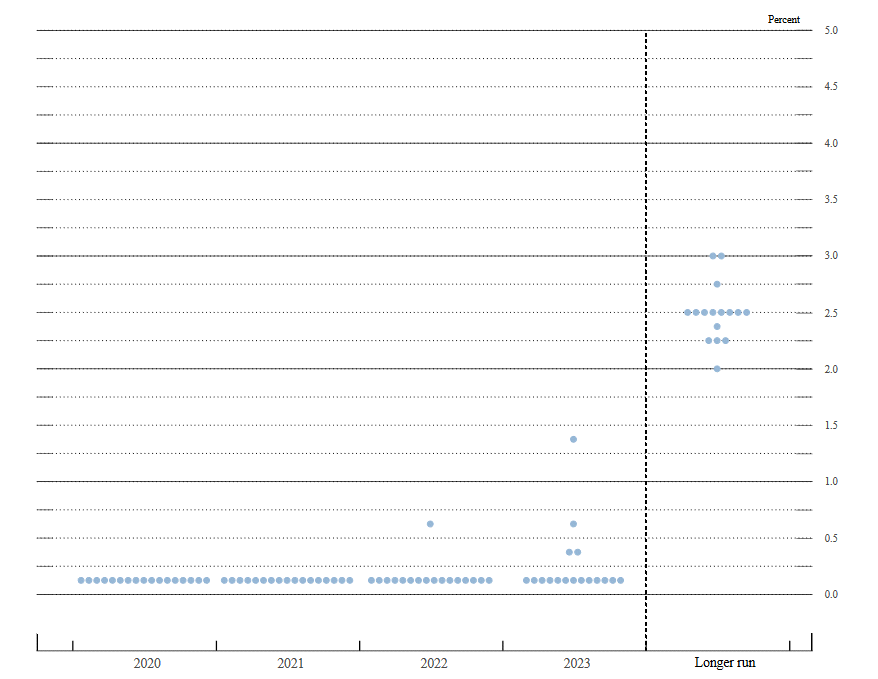

Changes in the dot plot for the Fed funds rate

- The June projections had two dots above zero in 2022.

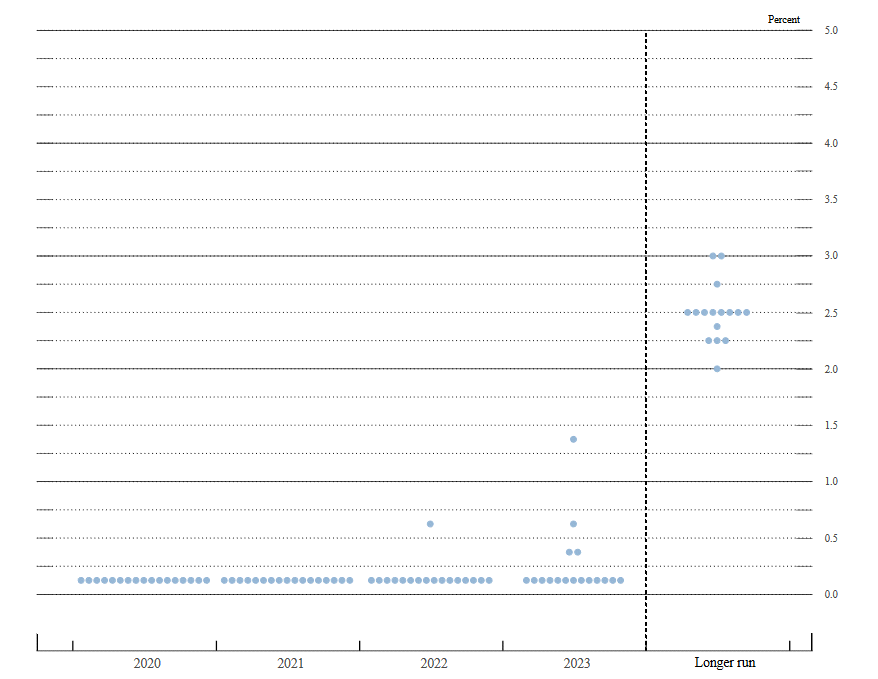

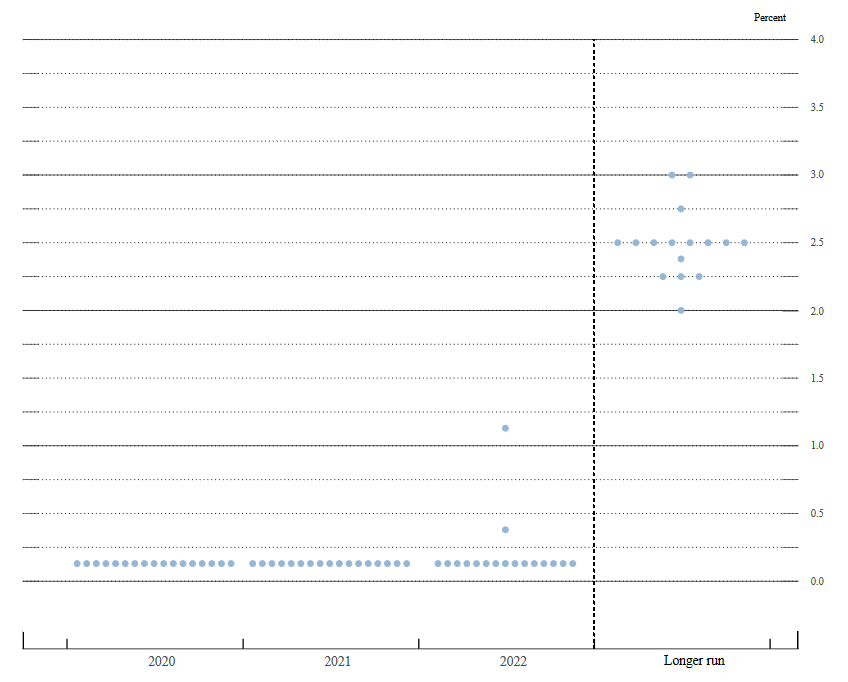

This is the first look at the dot plot for 2023.

This is the first look at the dot plot for 2023.

Note that one of the dots showing liftoff in 2022 is gone. There are four dots above zero in 2023.

This is the first look at the dot plot for 2023.

This is the first look at the dot plot for 2023.

Note that one of the dots showing liftoff in 2022 is gone. There are four dots above zero in 2023.

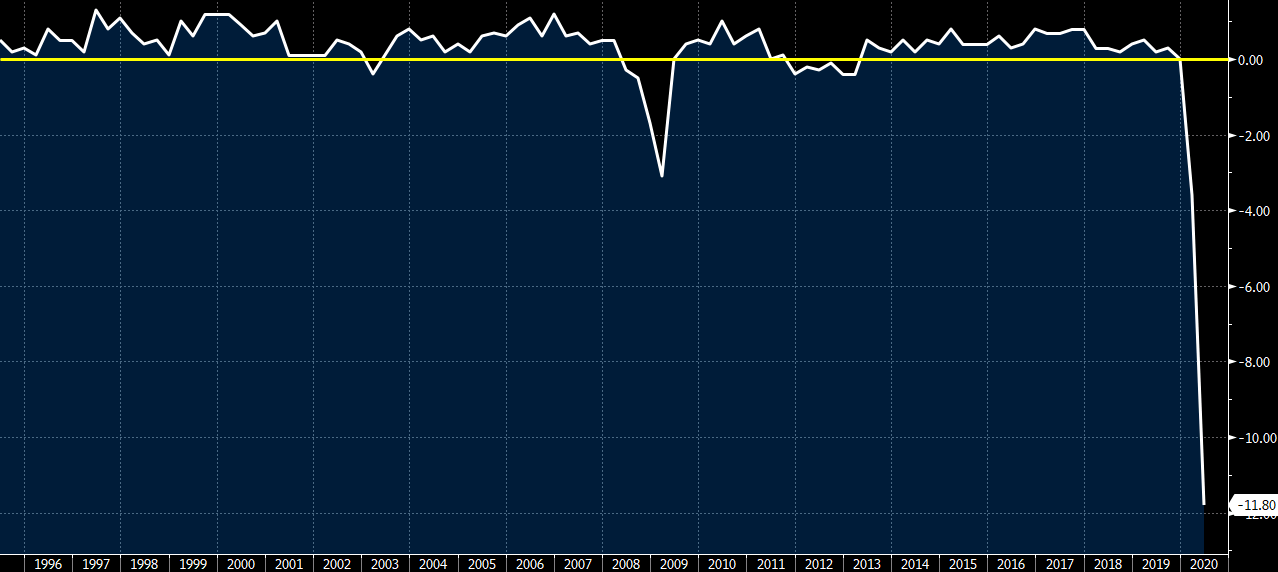

Trade balance adjusted Y 650.6bn

Exports -14.8% y/y

Imports -20.8% y/y

Exports fell but not by as much as expected. Imports fell by more than expected. Net result is a trade surplus, a deficit was expected.

and -16.2% y/y

The data is used as an indicator to capex in Japan for around 6 to 9 months ahead.

PPI % y/y