Latest data released by Markit – 1 October 2020

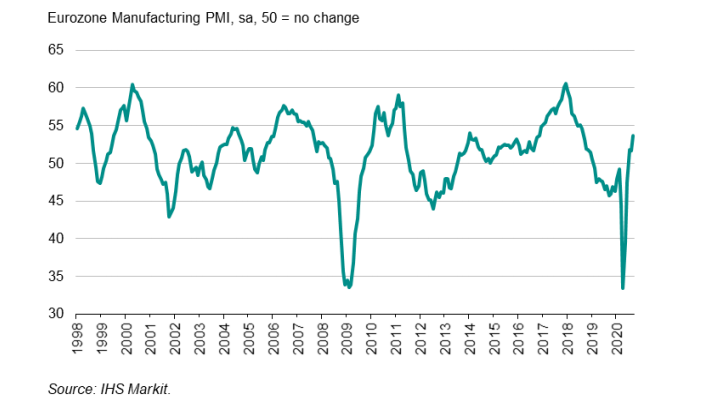

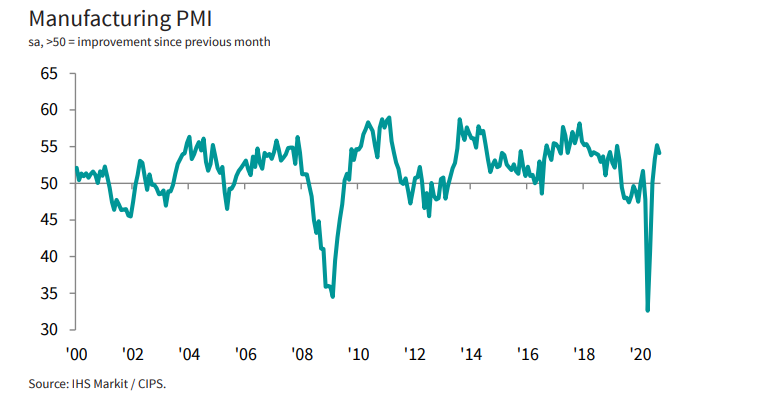

The preliminary report can be found here. Little change compared to the initial estimate, as factory activity expands for a fourth straight month but at a slower pace.

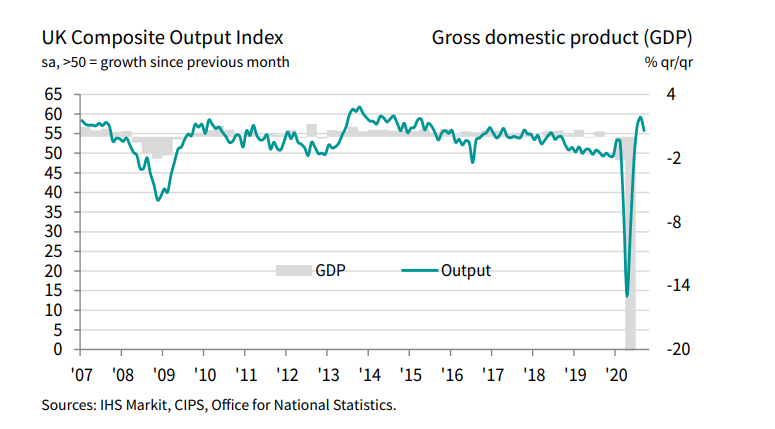

“September saw UK manufacturing continue its recovery from the steep COVID-19 induced downturn. Although rates of expansion in output and new orders lost some of the bounce experienced in August, they remained solid and above the survey’s long-run averages. Export demand is also picking up, as economies across the world restart operations and adjust to COVID-19 restrictions. Business sentiment remained positive as a result, with three-fifths of UK manufacturers forecasting a rise in output over the coming year.

“While the sector is still making positive strides, keep in mind that there remain considerable challenges ahead. This is especially true for the labour market, which saw further job losses and redundancies in September. The full economic cost incurred by 2020 will likely rise further as governments look to re-introduce some restrictions, job support schemes are tapered and rising numbers of firms start focussing on Brexit as a further cause of uncertainty and disruption during the remainder of the year.”