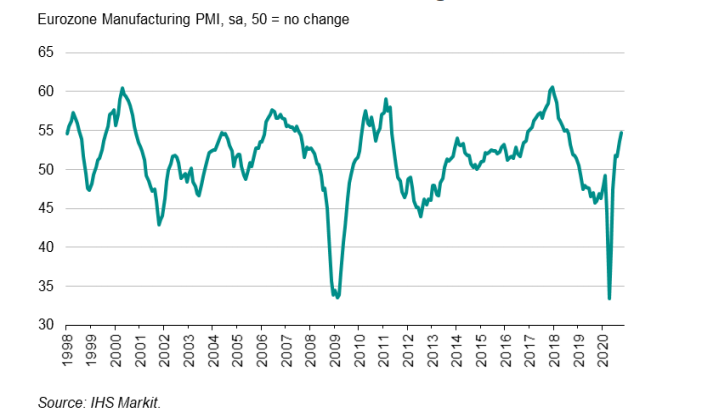

Latest data released by Markit – 2 November 2020

“Eurozone manufacturing boomed in October, with output and order books growing at rates rarely exceeded over the past two decades. However, while the data bode well for production during the fourth quarter, the expansion is worryingly uneven.

“By country, Germany was once again the star performer by a wide margin, as factories reported a surge in new orders that surpassed anything previously seen in the survey’s 25-year history. Italy, Spain and Austria also saw encouraging improvements in their recovery rates, but France, Ireland and the Netherlands all reported only modest growth and Greece has slipped back into contraction.

“Germany’s outperformance to a large extent reflects the recent pattern of demand growth. While orders for autos, business equipment and machinery have surged as the global economy has revived after lockdowns, benefitting German producers in particular, new orders for consumer goods came close to stalling in October, with exports even showing a renewed decline, blamed on rising COVID-19 infection rates, weakened labour markets and subdued consumer sentiment.

“The renewed weakness of consumer-facing businesses serves as a reminder that, while manufacturing as a whole may be booming for now, the sustainability of the recovery will depend on household behaviour returning to normal and labour markets strengthening. Given second waves of virus infections, this still looks some way off.“