Archives of “Economy” category

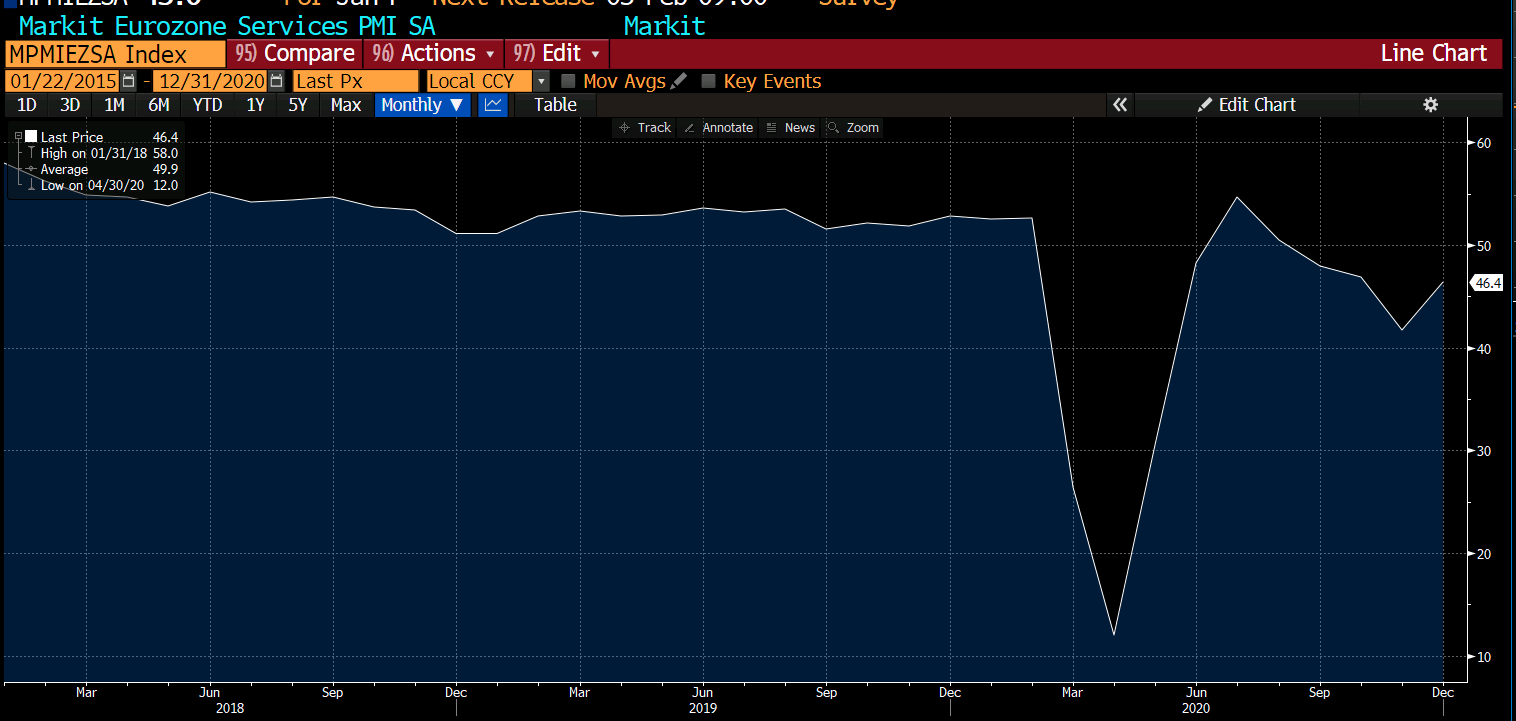

rssEurozone January final services PMI 45.4 vs 45.0 prelim

Latest data released by Markit – 3 February 2021

- Composite PMI 47.8 vs 47.5 prelim

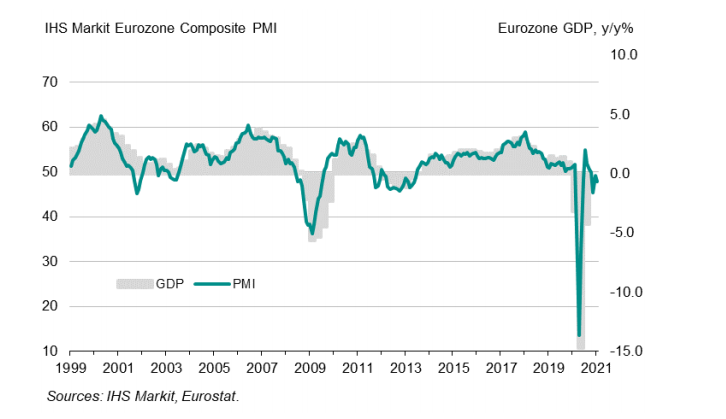

“The eurozone economy endured a predictably tough start to 2021 as ongoing efforts to contain the spread of COVID-19 continued to hit business activity, especially in the service sector. Manufacturing growth continued to help offset some of the weakness in the service sector, though even here factories saw output growth slow amid subdued demand and supply delays, often linked to the pandemic.

“A contraction of GDP therefore looks likely in the first quarter, though on current trends this should be modest in comparison to the falls seen in the first half of 2020.

“However, with virus containment measures likely to constrain euro area economies in the coming months, and potentially well into the second quarter given the slow vaccine roll-out, the focus will be on the need to sustain supportive fiscal and monetary policymaking for some time to come, notably to prevent further intensifying job losses in the hardest hit sectors, such as hospitality, tourism, travel and retail.

“Rising costs have dealt a further blow to many companies, with input prices rising at the steepest rate for two years to squeeze margins. However, in many cases this reflects a short-term lack of capacity and shipping delays, which should ease in coming months, helping alleviate these price pressures.”

China Caixin manufacturing PMI for January 51.5 (prior 53.0)

his the privately conducted survey PMI for the month.

- expected 52.6

- December at 53.0

- China January PMIs: Manufacturing 51.3 (vs. expected 51.5) & Non-manufacturing 52.4 (expected 55.0)

China January PMIs: Manufacturing 51.3 (vs. expected 51.5) & Non-manufacturing 52.4 (expected 55.0)

China’s China’s National Bureau of Statistics (NBS) official survey PMIs

Manufacturing 51.3

- expected 51.5, prior 51.9

Non-manufacturing 52.4

- expected 55.0, prior 55.7

Composite 52.8

- prior 55.1

—

- manufacturing on 1 February at 0145 GMT

- Service & Composite on the 3rd at the same time.

Bank of Japan monetary policy meeting ‘Summary of Opinions’ of the January meeting

The minutes of this meeting will be out in around 7.5 weeks (March 24), the summary is a good guide to what was discusses.

- BoJ must strengthen easing stance as risk of deflation has heightened further

- One board member said the Bank should consider anew the cumulative effects of easy policy on matters such as financial intermediation, market functioning.

- must consider how to balance the effects and side-effects of its policy

US Q4 advance GDP +4.0% vs +4.2% expected

The first look at fourth quarter US GDP

- Q2 was +33.4% annualized

- Personal consumption +2.5% vs +3.1% expected

- GDP price index +1.5% vs +2.2% expected

- Core PCE +1.4% vs +1.2% expected

- Ex motor vehicles +4.5%

- Final sales +3.0%

- Inventories added 1.04 pp to GDP

- Business investment +13.8%

- Business investment in equipment +24.9%

- Exports +22.0%

- Imports +29.5%

BOJ December policy meeting minutes released

Bank of Japan Minutes of the Monetary Policy Meeting on December 17 and 18, 2020

- BOJ December monetary policy meeting Summary of Opinions

Headlines via Reuters:

- members shared view BOJ should ease without hesitation if needed with eye on pandemic development

- a few members said BOJ must analyse effect of its policies to see how it can achieve its inflation target

- most members said appropriate to examine BOJ’s policy measures on basis it will maintain current policy framework

- several members said BOJ must seek ways to make its ETF buying more flexible as ultra-easy policy is prolonged

- one member said BOJ’s ETF buying is already flexible but worth seeking more ideas

- several members said must be ready to effectively respond to possible changes to economic, price, financial developments

- one member said BOJ must control shape of yield curve more meticulously as desirable for curve to steepen moderately

- several members said boosting small, medium-sized firms’ profitability via digitalisation is crucial in strengthening japan’s growth potential

South Korea Q4 GDP was +1.1% q/q, beating the median estimate of +0.9%

The recovery in exports played a big role in the improvement.

- Construction too, +6.5% q/q

BOJ’s Kuroda: State of emergency measures may dampen Japan’s economic recovery

Remarks by BOJ governor, Haruhiko Kuroda

- Japan has been affected by the coronavirus significantly

- Virus resurgence, state of emergency may weaken economic recovery

- Most important policy is to avoid unemployment and corporate failures

- Both fiscal, monetary policies have been successful in preventing that

Eurozone Services PMI January 45.0 vs 44.5 expected

Markit 22 Jan

- Manufacturing PMI 54.7 vs 54.4 expected

- Composite PMI 47.5 vs 47.6 expected