There has been plenty of discussion over whether or not China would set a target at all.

Citing info in the Hong Kong Economic Times

Here we go …. China’s Premier Li says >6% is the target for GDP this year

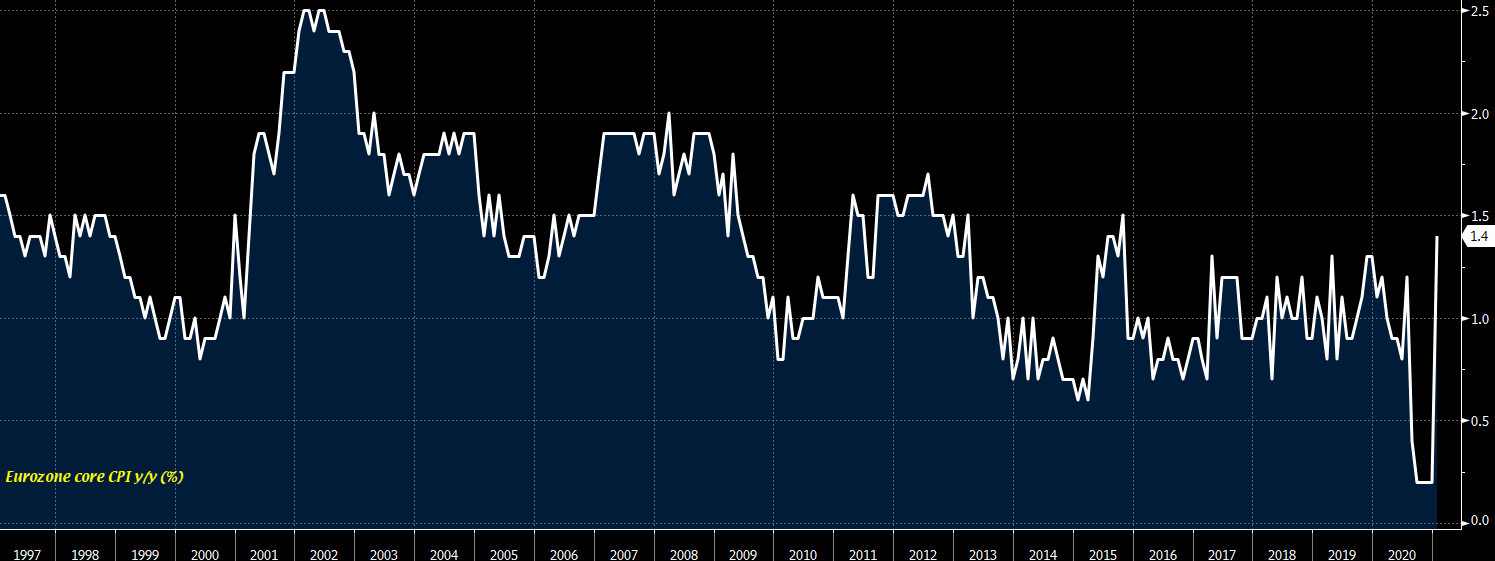

- 3% is the CPI target for 2021

Li is speaking at the National People’s Congress, delivering the ‘Work Report’

No change to the working on fiscal and monetary policy

- fiscal policy to be proactive

- monetary policy to be prudent