Remarks by China premier, Li Keqiang, after the NPC meeting

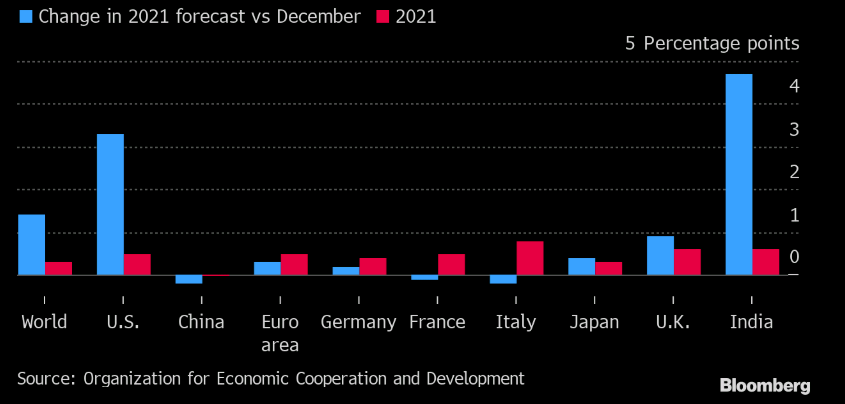

- China is obviously optimistic about economy, but also realistic

- China doesn’t want big fluctuations in GDP growth

- 2021 GDP growth target should match that in the next year to avoid big swings

- Growth target is aimed to guide expectations

Historically speaking, it is low but one also has to consider the current predicament of the global economy I guess. Nonetheless, when China sets the target as such, expect that to be hit one way or another regardless of how the economic figures turn out to be.