Research via Goldman Sachs, in summary:

US GDP growth likely to peak in Q2 (citing maximum impact of fiscal stimulus and economic reopening then tailing)

- expect that core PCE inflation will temporarily surge above the Federal Reserve 2% target

- US growth to come in at 10.5% in Q2

- 7% GDP growth forecast for H2 thereafter

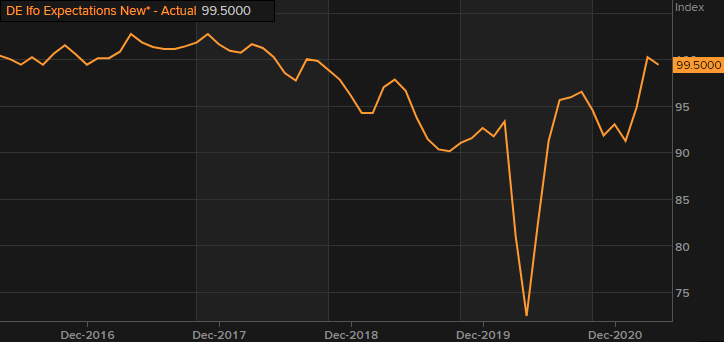

Non-US global growth will peak in 3Q 2021

- peak growth rates in Europe, Japan, and EM ex. China, among other economies

For the UK, GS see 7.8% growth for 2021, sees “UK economy is rebounding sharply from the Covid crisis”

—

In the olden days, comparative growth rates would have implications for monetary policy. Faster growing economies would tend to have higher interest rates, which would have implications for FX rates. Where we are right now is every central bank across DM doing the limbo dance … lower for longer is the mantra so the implications for FX are lesser.