Latest data released by ZEW – 11 May 2021

- Prior -48.8

- Expectations 84.4 vs 72.0 expected

- Prior 70.7

- Eurozone expectations 84.0

- Prior 66.3

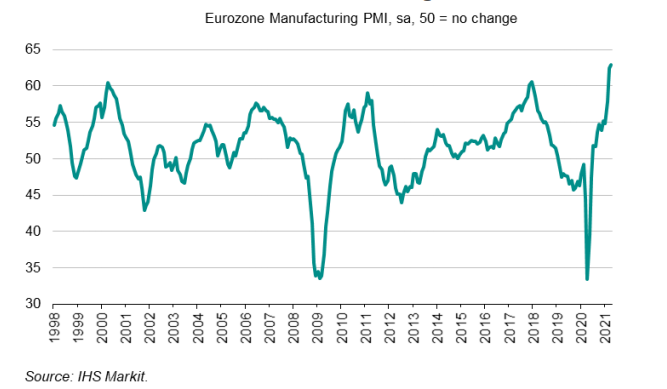

“Eurozone manufacturing is booming, with a new PMI record set for a second month running in April. The past two months have seen output and order books both improve at rates unsurpassed since the survey began in 1997, with surging demand boosted by economies opening up from COVID-19 lockdowns and brightening prospects for the year ahead.

“However, supply constraints are also running at unprecedented levels, leading to a record build-up of uncompleted orders at factories.

“The consequence of demand running ahead of supply is higher prices being charged by manufacturers, which are now also rising at the fastest rate ever recorded by the survey.

“The big uncertainty is how long these upward price pressures will persist for, and the extent to which these higher charges for goods and services will feed-though to consumers.

“Encouragement comes from the sharp increase in employment and investment in machinery and equipment signalled by the survey, which suggests firms are scaling up capacity to meet resurgent demand. This should help bring supply and demand more into line, taking some pressure off prices. But this will inevitably take time.”

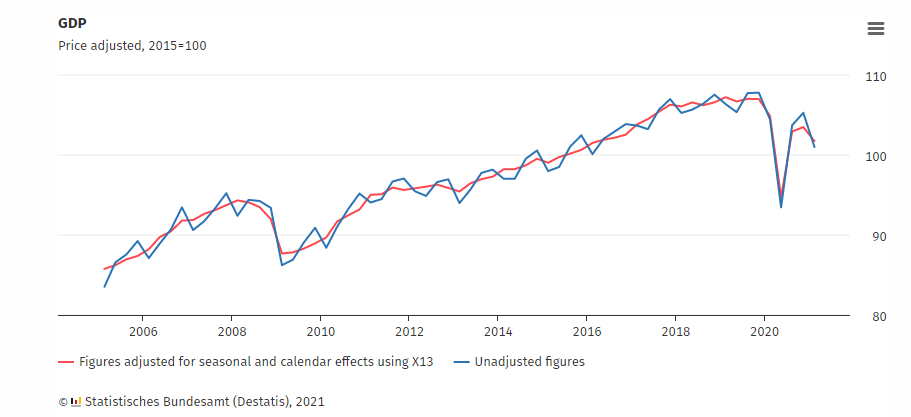

The readings are more or less within estimates as German economic activity contracted once again in Q1, though the resilience of the manufacturing sector has certainly helped to offset a chunk of the slump amid lockdown measures to start the year.

more to come

Note that there is no firmly scheduled time for the Bank of Japan announcement, expect it somewhere in the 0230 to 0330 GMT time window.