51.3 is a 3 month low

- 14th month straight in expmanison

- Export sales stagnated

- employment continued to rise

- easing cost pressures

From the report, summary comments:

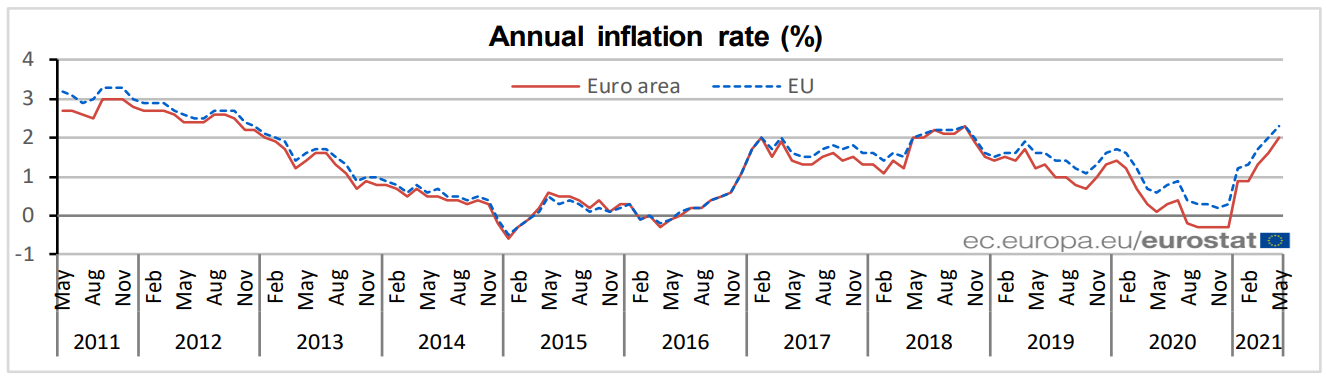

- Overall, the manufacturing sector continued to stably expand in June, despite the impact of the pandemic. Both demand and supply in the sector remained stable, as did external demand, showing the momentum of economic recovery still remained in the post-epidemic period. The job market continued to improve and businesses were highly optimistic, with the measure for future output expectations in June higher than the longterm average. Inflationary pressures eased somewhat, but manufacturing enterprises’ purchasing prices and factory-gate prices still rose. The shortage of raw materials continued in some regions. The manufacturing sector has gradually returned to normal. In the second half of this year, the low base effect from last year will weaken. Inflationary pressure, coupled with the economic slowdown, is still a serious challenge for China.