Reuters reports, citing sources familiar with the situation

Just be wary that when China issues such statements, they are usually to preempt the market that there might be possible decisions on said matter on the way.

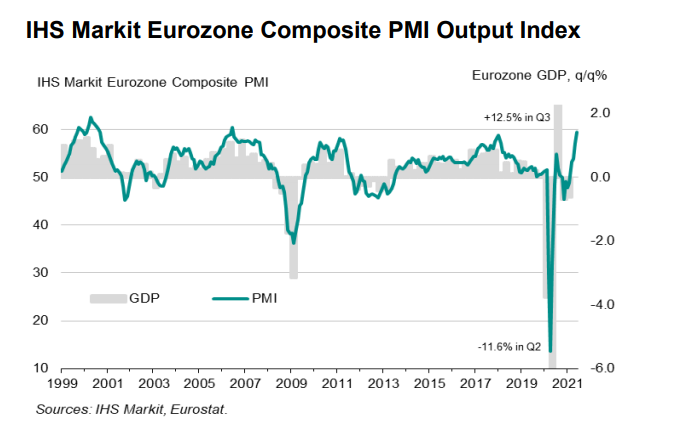

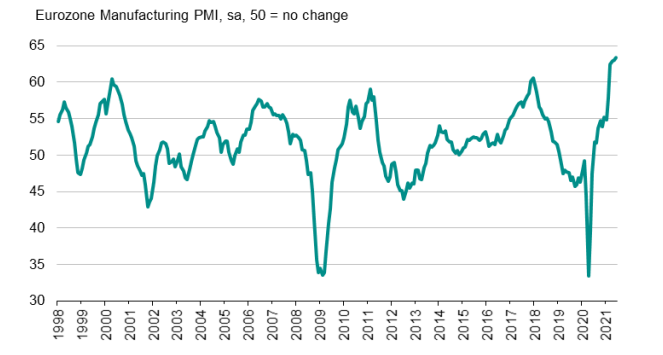

A slight revision higher on the balance of things and that marks the quickest growth in Eurozone activity in 15 years, with both the manufacturing and services sectors showing marked improvement as virus restrictions are loosened.

“Europe’s economic recovery stepped up a gear in June, but inflationary pressures have also ratcheted higher.

“Business is booming in the eurozone’s service sector, with output growing at a rate unsurpassed over the past 15 years. Added to the impressive growth seen in the manufacturing sector, the PMI surveys suggest the region’s economy is firing on all cylinders as it heads into the summer.

“Service sector growth has picked up across the board among the countries surveyed, with hard-hit sectors such as hospitality and tourism now coming back to life to join the recovery as economies and travel are opened up from virus-related restrictions.

“A wave of optimism that the worst of the pandemic is behind us has meanwhile propelled firms’ expectations of growth to the highest for 21 years, boding well for the upturn to gain further strength in coming months.

“Firms are increasingly struggling to meet surging demand, however, in part due to labour supply shortages, meaning greater pricing power and underscoring how the recent rise in inflationary pressures is by no means confined to the manufacturing sector. Service sector companies are hiking their prices at the steepest pace for over 20 years as costs spike higher, accompanying a similar jump in manufacturing prices to signal a broad-based increase in inflationary pressures.”

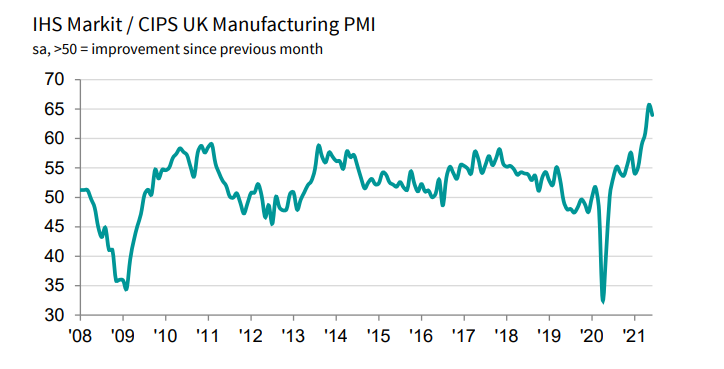

“UK manufacturing maintained a near survey-record pace of expansion at the end of the second quarter, as the reopening of economies at home and overseas supported increased production, new orders and employment. Solid business confidence and rising backlogs of work also suggest that the current upturn has further to run.

“The sector is still beset by rising cost inflationary pressures, however, as Brexit-related trade issues exacerbated global supply chain delays. The resulting widespread raw material shortages drove purchase prices up to the greatest extent on record, leading to an unprecedented steep rise in selling prices. There are also widespread reports of supply issues causing disruptions to production schedules and impeding the re-building of buffer stocks.

“The continued inflationary impact of capacity issues at both manufacturers and their suppliers will be a further factor keeping headline inflation above the Bank of England’s 2% target in coming months.”

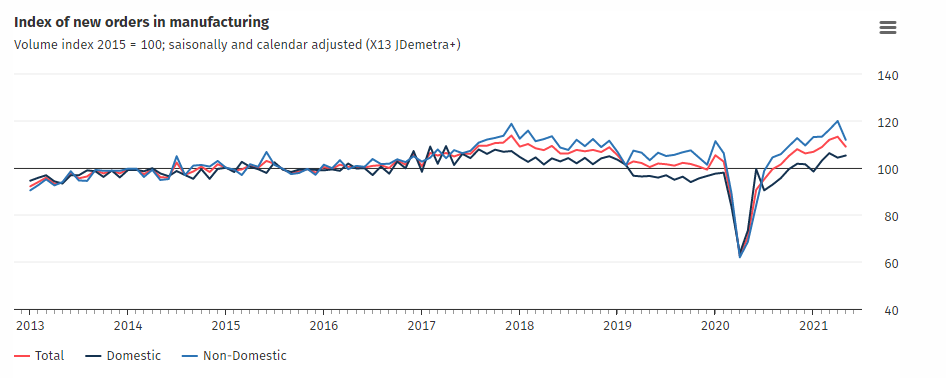

A slight revision higher with the headline being yet another fresh record for a fourth consecutive month now as manufacturing conditions in the region keep more solid as virus restrictions are loosened, with output coming in strong.

“Eurozone manufacturing continued to grow at a rate unbeaten in almost 24 years of survey history in June as demand surged with the further relaxation of COVID-19 containment measures and vaccination progress drove renewed optimism about the future.

“However, the sheer speed of the recent upsurge in demand has led to a sellers’ market as capacity and transportation constraints limit the availability of inputs to factories, which have in turn driven industrial prices higher at a rate not previously witnessed by the survey. Manufacturers are clearly willing to pay more to ensure sufficient supplies of key inputs.

“Encouragingly, there are several survey indicators which add to hopes that the current spike in prices will prove transitory.

“Widespread issues such as port congestion and a lack of shipping containers should soon fade as the initial rebound from the pandemic passes. Similarly, recent months have seen safety stock building as companies seek to protect themselves against potential future supply-chain disruptions, which has exacerbated the imbalance of demand and supply in the short-term. Once sufficient stocks are built, this effect should likewise fade.

“Finally, we have also seen the expansion of capacity via record employment growth and greater capital expenditure on business equipment and machinery. This expansion should raise output in sectors that are currently straining to meet demand, and hence remove some of the upward pressure on prices for these goods.”