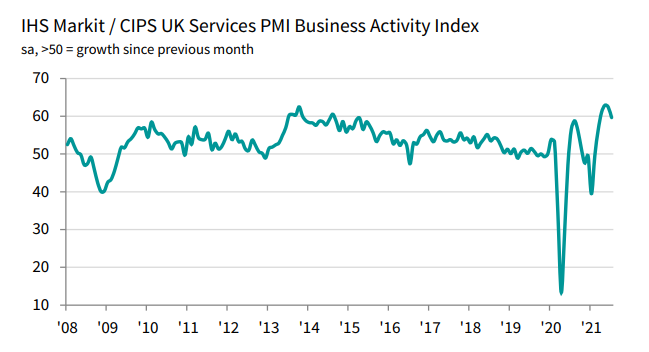

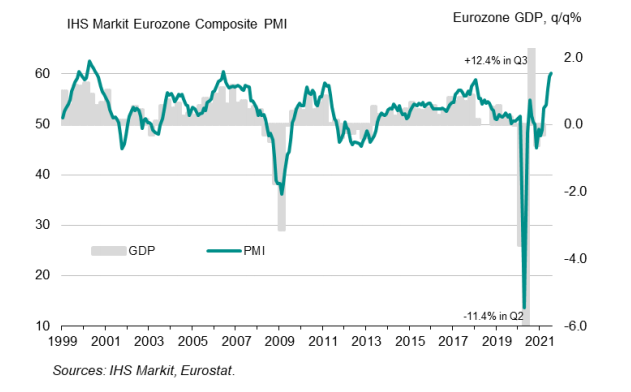

Latest data released by Markit – 4 August 2021

- Composite PMI 60.2 vs 60.6 prelim

The preliminary report can be found here. Slightly softer revisions but it still reflects the strongest growth in business activity in the Eurozone in just over 15 years.

The easing of virus restrictions have helped bolster sentiment in the services sector in the summer but concerns still persist amid the spread of the delta variant.

For now, the record surge in prices is still something that hasn’t quite put a major dent on demand conditions but we’ll see if that can stay the case in the months ahead once the supposed pent-up demand “honeymoon” period is over.

Markit notes that:

“Europe’s service sector is springing back into life. Easing virus restrictions and further vaccination progress are boosting demand for a wide variety of activities, especially in the tourism, travel and hospitality sector. It’s not just the consumer sector that is booming, however, with business and financial service providers also enjoying a growth spurt as broader economic recovery hopes build.

“Alongside the sustained elevated growth recorded in the manufacturing sector, the impressive strength of the service sector’s expansion in July means the eurozone should see GDP growth accelerate in the third quarter.

“Worries about the Delta variant have become more widespread, however, subduing activity in some instances and raising concerns about the possibility of virus restrictions being tightened again. Hence services growth in July was slightly less marked than the earlier flash estimate and future expectations cooled to the lowest since March, presenting a significant downside risk to the outlook and hinting that growth could begin to slow again as we head toward the autumn.

“Furthermore, up to now companies have generally seen little resistance from customers to higher prices, but this could change after the current rebound from lockdown restrictions has passed.”