Archives of “Economy” category

rssIfo economist says 70% of industrial businesses complain about supply chain bottlenecks

Remarks by Ifo economist, Klaus Wohlrabe

- Trade index has also fallen, traders were less satisfied with their current business

- Export expectations have fallen but remain at a relatively good level

- 1/2 of companies in manufacturing, retail want higher prices to cover rising costs

As much as this is a hit to economic expectations as it will weigh on business sentiment, this is also part of the inflation debate as mentioned yesterday here.

This is going to be a major problem that will persist for many more months to come.

Bundesbank says virus resurgence may put unexpected strain on the economy in autumn

Bundesbank remarks in its latest monthly report

- Growth could undershoot projections this year

- Early weeks of the rebound were more timid than projected

- That will likely weigh on full-year figure growth as well

- Some restrictions could be introduced in autumn if infections continue to rise

- But unlikely to be as strict as in the past given vaccine progress

That pretty much sums up the view on the German and European economy at the moment, as overall growth momentum also looks to have peaked in early summer. The good news is that vaccinations have progressed well and that should keep some of the momentum flowing into Q4, though delta variant risks are something to keep an eye out for.

Japan July trade surplus 441B vs 202.3B expected

Japanese trade balance data for July 2021:

- Exports y/y 37.0% vs 39.0% expected

- Imports y/y 28.5% vs 35.1% expected

A trade surplus is generally good but when it comes on lower-than-expected exports combined with even-lower than expected imports, then it’s not a sign of underlying strength in the economy.

Seasonally adjusted imports were down 1.6% m/m and exports were flat.

US June machinery orders -1.5% m/m vs -2.8% expected

Japan June 2021 machinery orders:

- Prior was +7.8% m/m

- Machinery orders y/y 18.6% vs 15.8% expected

- Prior y/y machinery orders +12.2%

The previous reading fell well short of expectations despite a jump in exports to China.

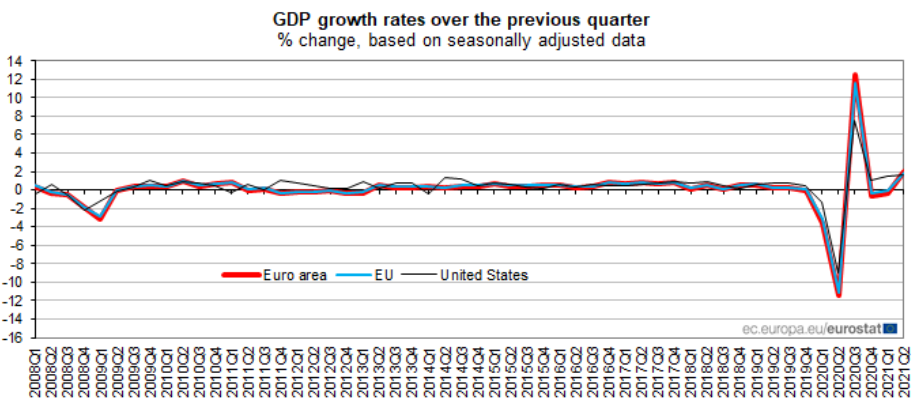

Eurozone Q2 GDP second estimate +2.0% vs +2.0% q/q prelim

Latest data released by Eurostat – 17 August 2021

- GDP +13.6% vs +13.7% y/y prelim

The preliminary report can be found here. No change to the quarterly reading as compared to the initial estimate so there isn’t much to extrapolate from the report today. This just reaffirms a modest bounce back in the economy in Q2 as restrictions ease.

Economists see ECB laying out plans to wind down PEPP programs in Q4

What’s the timeline for cutting pandemic emergency programs?

The ECB is likely to announce plans to reduce pandemic PEPP bond purchases in Q4 according to a Reuters poll of economists. Most also see the program to be wrapped up by the end of Q1.

The eurozone rebound, rising vaccination rates and the framing of the ‘pandemic emergency purchase program’ make ending it a priority, especially for the more-hawkish ECB members.

There is talk of announcing a phase out as early as September but new variants could push out that timeline. 12 of 29 economists see a September announcement while others said Q4 (15), December (10) or H1 2022 (22).

On the actual start of tapering, 18 of 29 said before year end with 11 saying in 2022. Meanwhile, 29 of 34 forecast the program would be wrapped up by the end of March.

Growth expectations are 2.1% in Q3 and 1.2% in Q4. For 2021 it’s seen at 4.6% and steady at 4.4% in 2022.

Japan Q2 prelim GDP +0.3% q/q vs +0.2% expected

Japanese second quarter growth data

- Q1 final reading was -1.0%

- Annualized sa +1.3% vs +0.7% expected

- Q1 final reading was -3.9% annualized

- Private consumption +0.8% vs -0.1% expected (-1.5% prior)

- External demand -0.3 pp vs -0.1 pp expected (-0.2 pp prior)

- Capital expenditures +1.7% q/qvs +1.7% expected (prior -1.2%)

- Exports +2.9% q/q

- Domestic demand contribution +0.6 pp

The domestic economy held up better in Q2 despite covid restrictions. It’s another data point that shows that the global consumer is holding up better to lockdowns than previously and increasingly learning to live with restrictions. Meanwhile, external demand is struggling with two quarters of declines.

Some background if you find useful:

- state of emergency curbs to combat the coronavirus pandemic are sapping GDP growth, weighing on consumption.

- Export growth is robust, which is a positive

- rising energy and commodities prices could worsen terms of trade (Japan is heavily reliant on raw material imports)

Singapore Q2 GDP -1.8% q/q and +14.7% y/y

ingapore Q2 GDP +14.7% y/y (Reuters poll +14.2%)

-1.8% q/q at seasonally adjusted rate

More:

- The Ministry of Trade and Industry upgrades 2021 GDP growth forecast to 6.0% to 7.0% (previous forecast 4.0% to 6.0%)

MTI says performance of Singapore economy in H1 2021 was stronger than expected

- says barring major setback in global economy, Singapore economy expected to continue gradual recovery in H2

- says easing curbs as vaccination ramps up to support recovery of consumer-facing sectors, alleviate labour shortages

2021 NODX forecast now +8% (from +7% previous forecast)

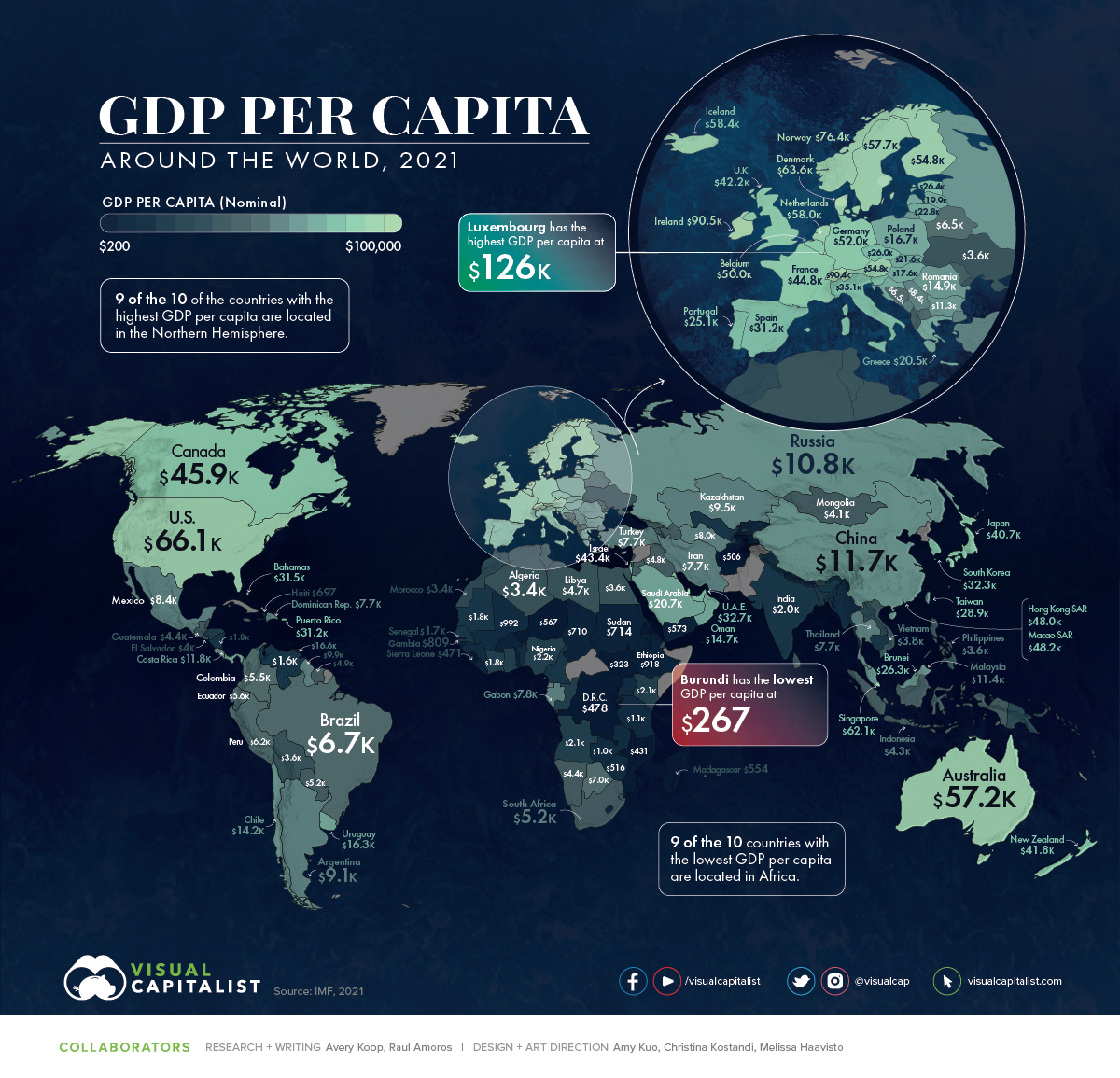

Worldwide per Capita GDP