Archives of “Economy” category

rssJP Morgan has cut its China Q4 economic growth forecast again

JPM have downgraded their projections for Q4 GDP in China five times since August.

- Now expect 4% q/q from previously at 5%.

For the year as a whole. expect 7.8% and for 2022 are forecasting just 4.7%.

Citing:

- ongoing impact from the power shortages

- rekindling of coronavirus outbreaks

ps. This from late Friday.

China trade data over the weekend – exports beat expectations in October, and a record trade surplus

China’s exports +27.1% y/y in October

- expected was +22.7%, so a handy beat indeed.

- prior was +28.1%

- exports for January – October 2021 are already above all of 2020, the external sector has held in well to make up for softer domestic demand in the earlier months of this year

Imports in October +20.6% y/y

- expected +26.6%

- prior +17.6%

- coal imports were up nearly 100% y/y as the power sector trie to recover from shortages

The trade balance for the month was a surplus of US$84.54 bn, this is fresh record high surplus for a month.

- prior was a revised US$66.76 bn

China’s trade surplus with the United States was US$40.75 bn in October

- prior was US$42 bn

- For the first ten months of the year, the surplus was $320.67 bn.

JP Morgan slashes China Q4 GDP forecast to 4.0% from 5.0% q/q previously

Another cut to China growth forecasts

JP Morgan cites the lingering impact of the power crunch and resurgence of COVID-19 clusters as the main reasons, adding to further cuts in China forecasts as of late here.

Moody’s says headwinds to growth will dissipate in 2022, stable global growth by 2023

Ratings agency Moody’s with that upbeat headline, but there are potential hurdles, read on …

- says headwinds to growth will dissipate next year, allowing global economy to enter stable growth by 2023

- Covid-19 outbreaks, continued supply chain logjams and labour shortages to diminish in 2022

- expects G20 economies to grow 4.4% collectively in 2022 and then by 3.2% in 2023

- monetary and credit conditions will tighten as central banks look to remove pandemic-era liquidity and interest rate support

- another risk to global recovery is potential for more persistent supply chain disruptions, ratcheting up of inflation

South Korea October core inflation data the highest since December 2015

CPI data out of South Korea a few minutes ago.

Headline +3.2% y/y

- prior +2.6%

- highest since January 2012

- +0.1% m/m (prior 0.5%)

Core inflation +2.4% y/y

- prior +1.5%

- highest since December 2015

SK’s central bank has a 2% CPI target, October’s rate is the 7th consecutive month above target

- oil product prices, fresh foods and housing rentals continued to rise

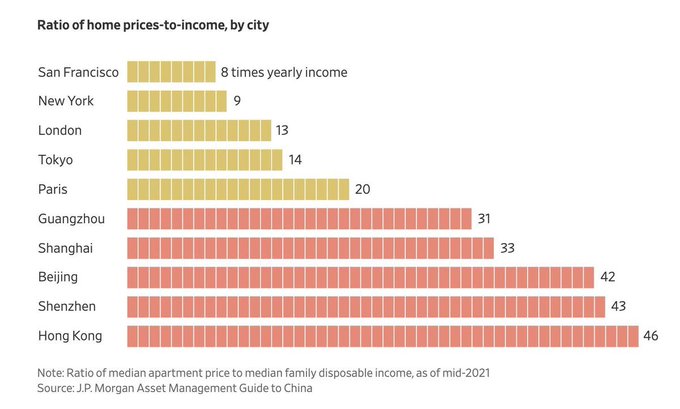

Two-thirds of the top 30 Chinese developers crossed at least one red line.-Bloomberg

The Chinese housing bubble.

China Industrial Profits for September +16.3% y/y (prior +10.1%)

China Industrial Profits for September

+16.3% y/y

- prior +10.1% y/y

+44.7% YTD y/y

- prior +49.5% YTD y/y

Resource related industries performing strongly, mining sector profits + 204% y/y

- profits higher in the coal industry, oil and gas sector

Eurozone October flash services PMI 54.7 vs 55.5 expected

Latest data released by Markit – 22 October 2021

- Prior 56.4

- Manufacturing PMI 58.5 vs 57.0 expected

- Prior 58.6

- Composite PMI 54.3 vs 55.2 expected

- Prior 56.2

Softer readings across the board, with overall business activity growth weakening to its slowest in six months. The details reveal that supply bottlenecks are a key issue, weighing on manufacturing output as it slumps to its weakest in 16 months.

Adding to that is a survey-record increase in prices, as firms reportedly sought to pass on the rise in costs on to customers. Markit notes that: