Remarks by China premier, Li Keqiang

- Domestic and foreign situation still complex and severe

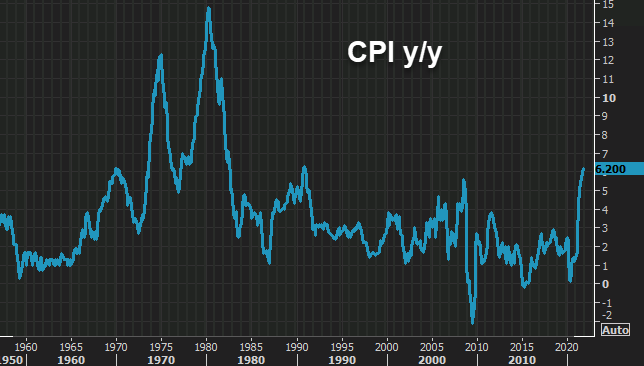

- Will take measures to reduce pressure of high commodity prices

- Will keep yuan exchange rate basically stable

He has been repeating the above comments for quite a while now, so there isn’t much of a big change to policy stance by local authorities in that respect.

They are recognising that the economy is facing challenges but they maintain that supportive measures will be undertaken if and when necessary.

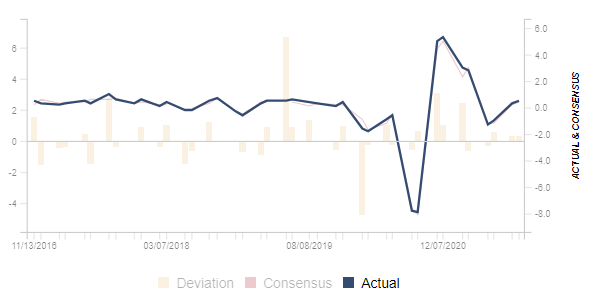

Comments from a Japanese data spokesman says declines in autos, household electronics consumption dragged down private demand. Auto, constructions, production were contributors to the capex decline.

Comments from a Japanese data spokesman says declines in autos, household electronics consumption dragged down private demand. Auto, constructions, production were contributors to the capex decline.