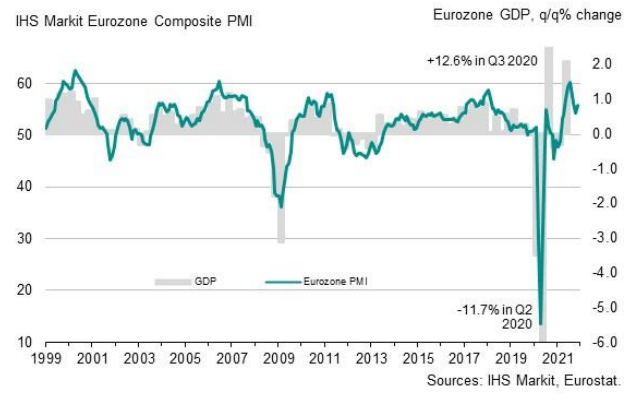

Latest data released by Markit – 1 December 2021

The preliminary report can be found here. A mixed picture in the manufacturing sector as there were improvements in France and Italy but heavyweight Germany and other peripheries like Spain, Austria and Netherlands saw activity declining last month.

“A strong headline PMI reading masks just how tough business conditions are for manufacturers at the moment. Although demand remains strong, as witnessed by a further solid improvement in new order inflows, supply chains continue to deteriorate at a worrying rate. Shortages of inputs have restricted production growth so far in the fourth quarter to the weakest seen over the past year and a half.

“Especially subdued production was again seen in Germany, France and Austria in November, albeit offset by strong performances seen in Italy, Ireland and the Netherlands, which helped lift the overall pace of production growth slightly during the month.

“A record rise in inventories meanwhile reflected increased efforts by manufacturers to build safety stocks, in turn driven by fears of ongoing shortages of inputs in coming months.

“With demand once again outstripping supply, November saw a continuing sellers’ market, pushing prices charged for manufactured goods higher at a rate surpassing anything previously recorded in almost two decades. Higher factory gate prices suggest consumer inflation has further to rise.

“Looking ahead, rising COVID-19 infection rates cast a darkening cloud over the near-term outlook, threatening to further disrupt supply chains while at the same time diverting spending from consumer services to consumer goods again, therefore worsening the imbalance of supply and demand.”

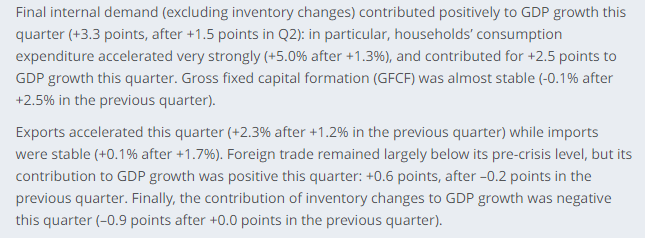

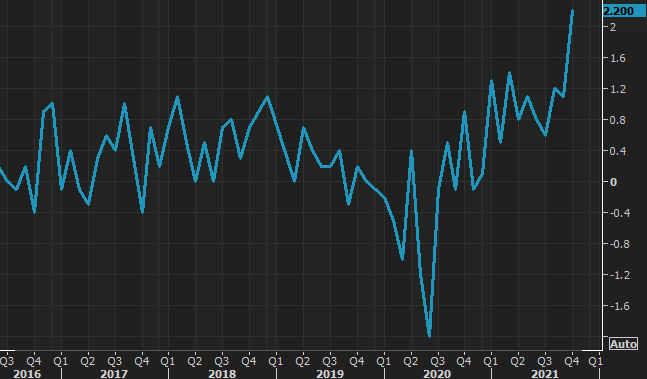

Latest data released by INSEE – 30 November 2021

Latest data released by INSEE – 30 November 2021