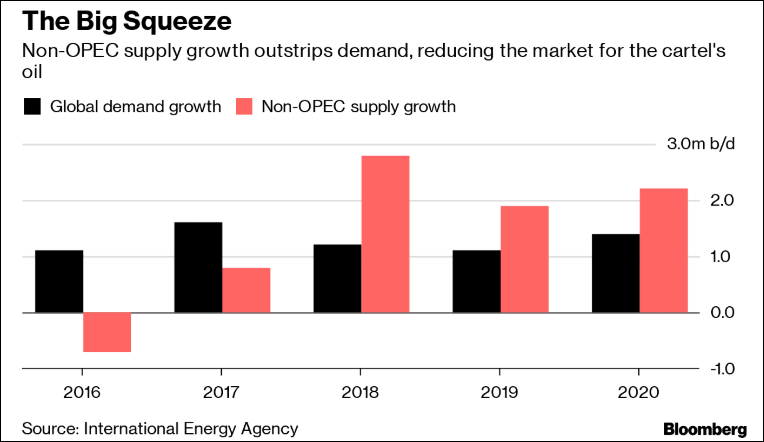

IEA comments in its latest monthly report on the oil market

- World oil demand to accelerate to 1.4 mil bpd in 2020

- But will be offset by production surge to 2.3 mil bpd at the same time

- Notes that ongoing US shale boom as main reason

- Says that despite OPEC efforts, they are still pumping much more oil than required

In short, global supply will still outpace global demand in the coming year and if OPEC wants to avoid prices from falling further then they have to step up their production cut quotas – which I don’t see happening.

Either way, that’s good news for consumers in general as this outlook would mean lower oil prices so that should alleviate some burden amid the global trade slowdown.