To read more enter password and Unlock more engaging content

Supply is already tight.

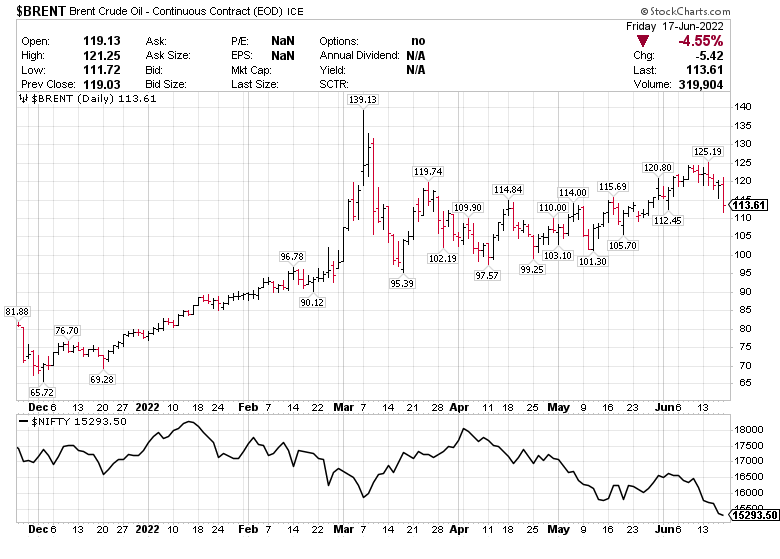

Brent update, hourly candles:

API data released late yesterday:

There is a bit of evidence of some loosening in the crude market here but it’s one week of data. Gasoline remains extremely tight with inventories 10% below the long-term average.

We’ve had oil prices surging and these numbers just highlight how difficult it is to bring on production. 10,000 barrels per day in nothing and even adding 1 million barrels next year won’t move the needle as the 1 mbpd release of the SPR runs off.

WTI crude is trading at $119.22 today, up 85-cents.

Reuters add:

Yep. I described the hike in output last week as a ‘drop in the bucket’.

CL update: