Highest level since September 24

The price of crude oil futures has moved up to a new session high at $58.28 and in the process is trading at the highest level since September 24 nearly 2 months ago.

The move today took the price above its November high at $58.09. Recall that the price of crude oil traded above and below its 200 day moving average at $57.39 for 11 consecutive days.

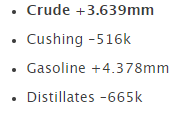

On Tuesday, the price tumbled lower falling below its 100 day moving average (and closing below that level). The move lower was helped by a much higher than expected API oil inventory data.

However yesterday, the inventory data from the DOE showed not nearly as strong a build, and the squeeze higher was on.

The price action today tried to stay below the 200 day moving average earlier in the session, but that level gave way, leading to increase momentum to the upside. Bullish.

Should momentum continue (stay above the 200 day MA), the 61.8% retracement of the move down from the September high comes in at $58.65. Get above that level and there is more room for further upside with the natural resistance level at $60 looming as a target to the upside.

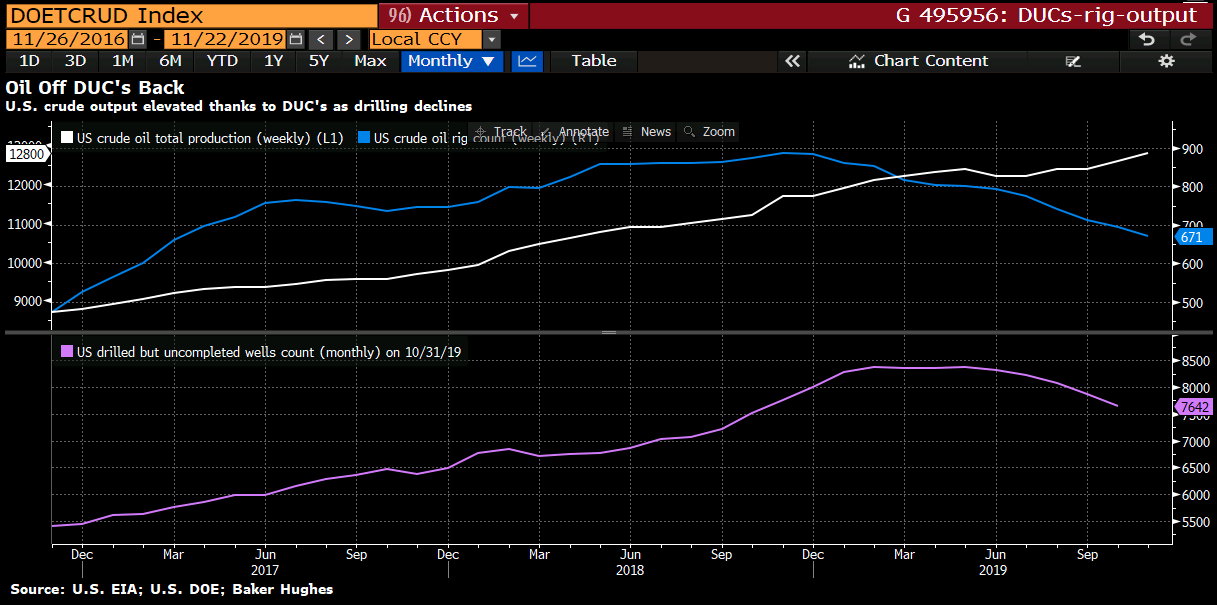

Bloomberg out with a piece citing that high US production levels are due to keep prices in check. The drilled- but- uncompleted (DUC) wells count had fallen for a fifth month in October as producers draw on the the DUC’s inventory to cut costs and capital outflows. This is how US crude production managed to hit a record high this month even as the rig count fell to its lowest level since March 2017. See chart below:

Bloomberg out with a piece citing that high US production levels are due to keep prices in check. The drilled- but- uncompleted (DUC) wells count had fallen for a fifth month in October as producers draw on the the DUC’s inventory to cut costs and capital outflows. This is how US crude production managed to hit a record high this month even as the rig count fell to its lowest level since March 2017. See chart below: