Understanding the factors influencing oil

Yesterday, I was speaking on CNBC Arabia about the factors influencing oil at the moment. Oil has been on a steady fall recently on demand concerns, but there are a number of factors influencing oil that it is good to be aware of. Here are five of the largest factors, so that you can get a handle on oil in a hurry.

- The first issue with oil is that the market is, or rather, can be easily oversupplied. OPEC+ have helped keep oil markets price supported through 2019 by agreeing to production cuts

- OPEC+ is waiting on Russia to see if they agree to the proposed 600K production cuts. Russia needs US crude to be at around $40 to balance their books, so they are not overly alarmed at current US crude prices around $50. However, Saudi need oil closer to the $80 mark, so they are incentivised to cut production. In fact production levels for January have been at historic low levels from OPEC suppliers

- Libya. The shutdown of ports in the East of Libya have really hit supply. Linya is producing around 180K barrels per day vs a normal production level of 1.2 million barrels per day. So, watch out. The Libyan crisis is currently supporting oil prices, so if the ports suddenly open then oil will fall sharply as they factor in the large inflows.

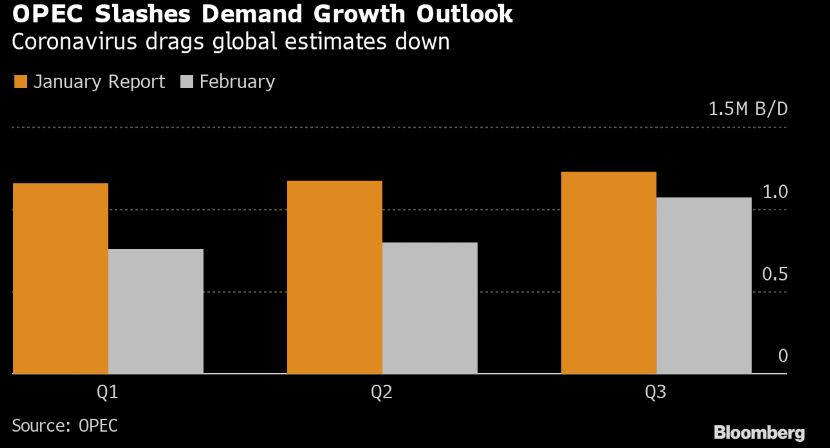

- Coronavirus demand issues. The longer and worse the coronavirus outbreak gets, the worse this is for oil prices. China is the world’s largest importer of oil at around 11 million barrels per day. The analysis that I have been reading puts China oil demand falling between 1-3 million barrels per day. So, that could be around a 20% fall in Chinese oil demand, possibly slightly more.

- The IEA and OPEC oil reports are both out this week. It will be interesting to see how they project oil demand being impacted by the coronavirus, so watch out for some potential oil wobbles as those headlines come out.

Ok folks, check the headlines as they come out, so that you can weigh them up against these factors. Trading oil is really like a puzzle at the moment, so just make sure you know how each piece is lining up before making your moves.

.jpg)