IEA comments on the oil market in its latest report

- Floating storage of crude oil in May fell by 6.4 mil barrels m/m to 165.8 mil barrels

- Global oil supply fell by 11.8 mil bpd in May

- Helped by OPEC+ countries reducing output by 9.4 mil bpd

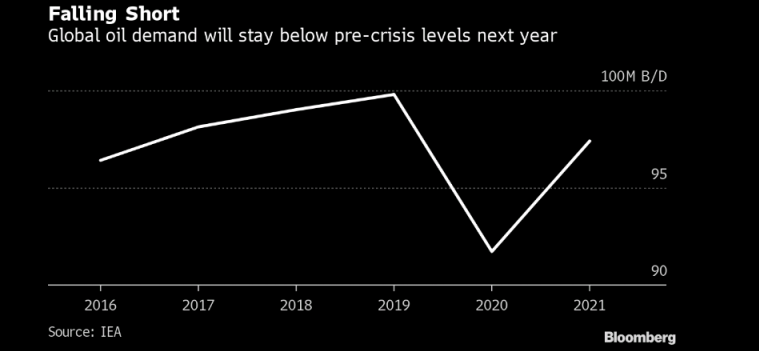

- Sees oil demand next year to rise by 5.7 mil bpd, but still lower than in 2019

- Oil demand next year to remain 2.4 mil bpd below 2019 levels

On OPEC+, IEA says that they made a “strong start” and delivered 89% of its pledge to cut output but warns that rising prices could pose a problem:

“The market may present producers with an opportunity to ramp up more quickly than dictated by current OPEC+ policy, or US and other non-OPEC production could recover more strongly than forecast.”

With oil prices having moved up back close to $40, nobody – even US shale drillers – will want to miss out on the party.