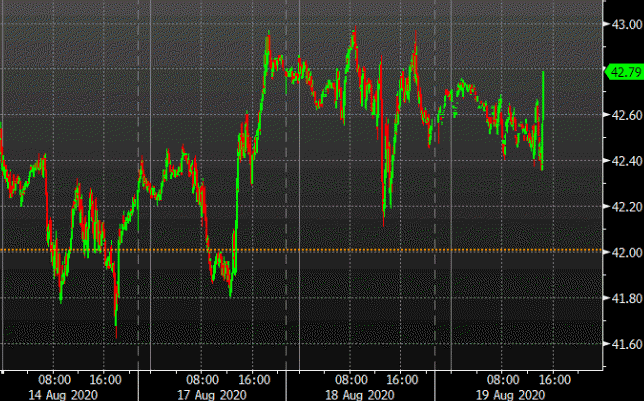

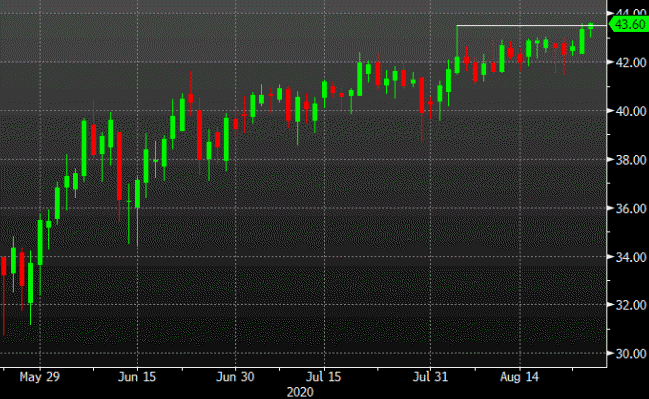

WTI crude breaks the August high

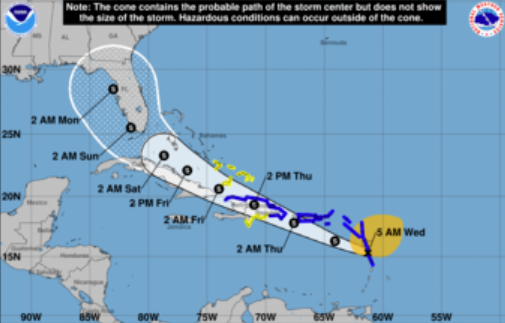

WTI crude closed yesterday at a post-pandemic closing high but today it has also broken the intraday high. Crude was near a session low until the latest weather observations showed Hurricane Laura as a Category 3 storm and likely to intensify further. It’s headed for the heart of US offshore oil production and refining.

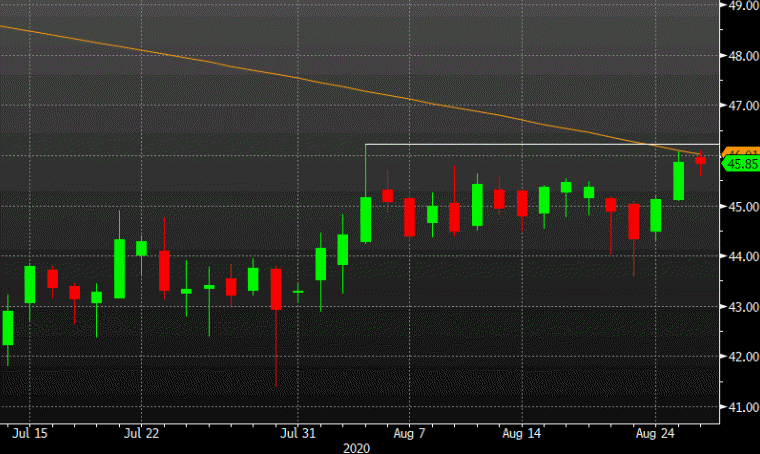

I’m skeptical of a storm-inspired breakout in oil because it’s not a fundamental change in the market. The chart to watch is Brent, as it also flirts with the August high and the 200-dma.

The next major update for Laura will be at 11 am ET. It’s expected to make landfall late tonight or early tomorrow.